Go to Source

Author: Benjamin Powers

Anthony Scaramucci’s Skybridge Capital has already invested as much as $182 million to bitcoin on behalf of its investment funds, according to an investor deck obtained by The Block.

The fund of funds, which has a planned public debut for a new Bitcoin fund slated for next month, has partnered with a number of crypto firms including Fidelity Digital Assets and Silvergate. The deck says Skybridge “has invested $182 million in bitcoin on behalf of its investment funds.”

In another section of the deck, the firm said it had invested $25.3 million for the new fund, which opened to the public in December. It’s not clear if there is overlap between these two invested amounts.

Scaramucci is the latest financial services titan to be drawn to the digital asset world, following in the footsteps of Paul Tudor Jones’ Tudor Investment Corp and Renaissance Technologies, which have made similar allocations.

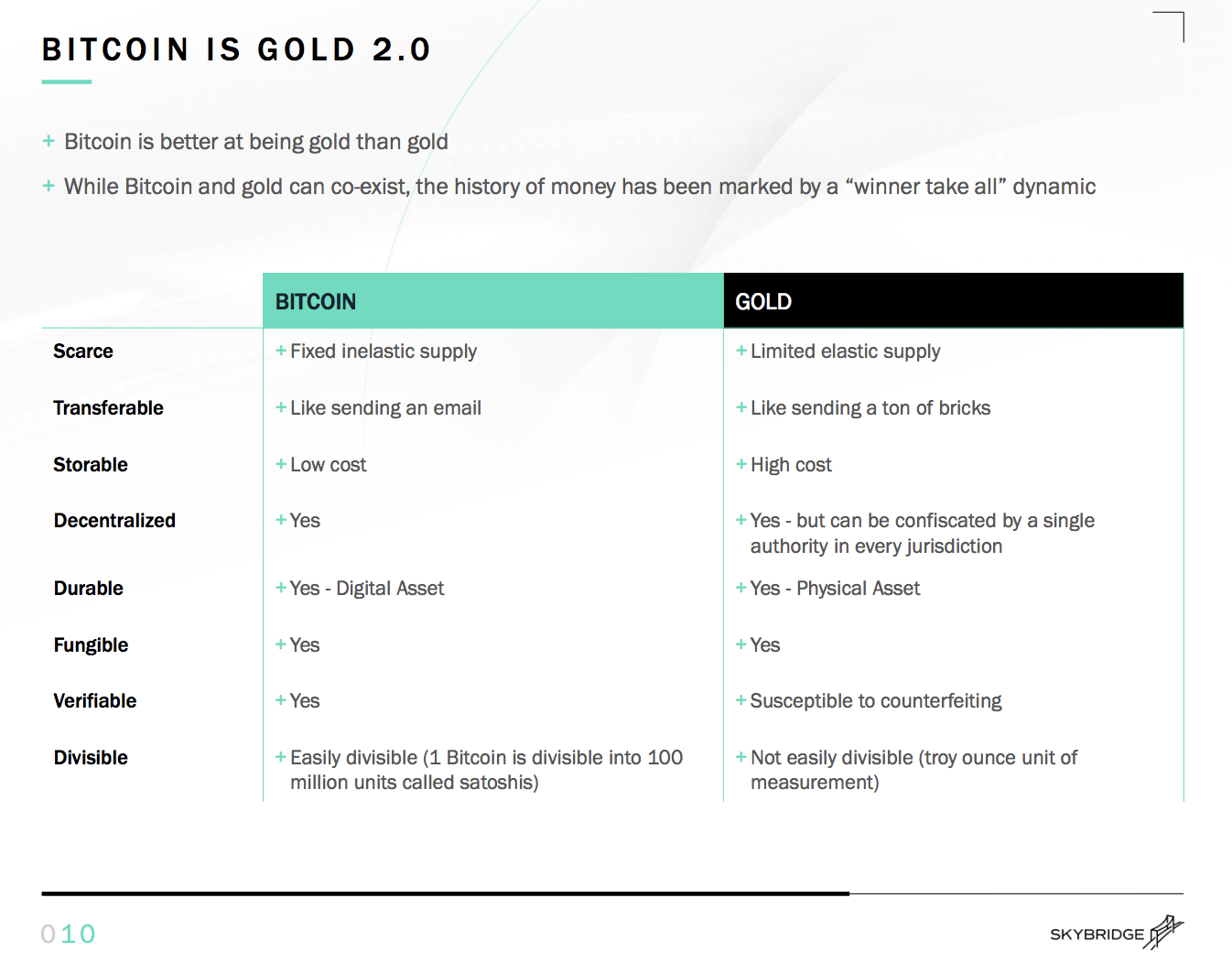

As for Skybridge, the firm expects the institutional push into the crypto market to continue. Bitcoin’s properties as a superior version of gold as well as the market’s maturation “and numerous discussions with large asset allocators” will result in more hedge funds, RIAs and insurance funds allocating capital to the digital asset, according to Skybridge.

The firm also expects a shake-up in the traditional 60/40 portfolio ratio of stocks and bonds will serve as a tailwind for bitcoin as investors look for new investment opportunities. This shift, according to Skybridge, is tied to the actions of the Federal Reserve and negative interest rates.

“Negative interest rates represent an existential risk to pension funds, insurance companies, and endowments that need to achieve targeted rates of return to meet financial obligations,” the deck says.

A re-allocation of funds by such institutions from the fixed-income market to bitcoin would “produce a substantial increase in the price of bitcoin.”

A message to Scaramucci seeking comment was not returned by the time of publication.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

Go to Source

Author: Kevin Reynolds

A week after the Securities and Exchange Commission filed charges against Ripple, alleging the company sold $1.3 billion worth of unregistered securities, Ripple has released a statement pushing back against the charges.

According to the firm, the SEC’s lawsuit has already harmed “countless innocent XRP retail holders with no connection to Ripple,” adding that the charges “needlessly muddied” the regulatory environment for the whole crypto industry.

Ripple said it would continue to support “all products and customers” both domestically and abroad. “The majority of our customers aren’t in the U.S. and overall XRP volume is largely traded outside of the U.S.,” it said, adding: “There are clear rules of the road for using XRP in the UK, Japan, Switzerland and Singapore, for example.”

“For eight years, we’ve built products that help hundreds of customers solve pain points around global payments — we will defend our company and look forward to settling this matter in court to finally get clarity for the U.S. crypto industry,” Ripple said in the statement.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: MK Manoylov

Noted Bitcoin enthusiast and Carolina Panthers offensive lineman Russell Okung will be the first player from any major sports league to publicly use a new service that converts a traditional paycheck into bitcoin.

According to a Coindesk report, half of Okung’s salary — about $6.5 million — will be paid through crypto payment startup Zap’s Strike product, which will turn it directly into bitcoin. The arrangement had to receive approval from the NFL and NFL Players Association.

Today’s announcement comes more than a year after Okung over a year after he posted a tweet saying that he’d like to be paid in bitcoin. In recent years he has become an outspoken advocate of the cryptocurrency.

A number of other professional athletes, including several unnamed players from the Brooklyn Nets basketball team and New York Yankees baseball team, are also joining the Strike bitcoin payment arrangement, Zap founder Jack Mallers told Coindesk.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Saniya More

Go to Source

Author: Jaspreet Kalra

Go to Source

Author: Nathaniel Whittemore

Ahead of its hotly anticipated initial public offering, crypto exchange operator Coinbase has hired an investor relations executive from Facebook to serve as its face to Wall Street.

Anil Gupta, previously a director of investor relations at the social media giant, announced Monday on LinkedIn that he is joining the crypto exchange to “lead their Investor Relations efforts.”

“Today is my last day at Facebook. The past 8+ years (that’s 33 earnings calls!) have been nothing short of spectacular. I have learned, grown, and accomplished more than I could have ever imagined,” Gupta wrote in a LinkedIn status.

Gupta joined Facebook in 2012 — the year the company had its own market debut. He previously held positions in equity research at Imperial Capital and Oppenheimer.

In his new role at Coinbase, Gupta will likely be tasked with engaging with the sell-side and shaping the way Coinbase is pitched as a public investment to big pension funds and asset managers. When Coinbase goes public, he will likely lead a team that works hand-in-hand with the CFO on presenting quarterly results.

Coinbase, which is in a quiet period, declined to comment. The firm filed a confidential S1 ahead of its IPO and is expecting to tap the public markets in the first quarter of the new year. The firm has already enlisted Goldman Sachs as an investment banking adviser for its IPO.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

Our Panelists:

Itay Malinger – Co-founder and CEO at Curv

Stani Kulechov – Founder and CEO at Aave

Phil Kelly – Head of Business Development at ConsenSys

Vance Spencer – Co-founder at Framework Ventures

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Andreas Nicolos

Another publicly traded company wants to invest in bitcoin. Greenpro Capital (NASDAQ:GRNQ) said it intends to set up a Bitcoin Fund for investment in an announcement Monday.

Greenpro, which calls itself a “business incubator,” provides cross-border financial services for businesses and high net-worth individuals.

Its portfolio already spans banking, health, technology, wellness and art. Now Greenpro will use its subsidiary, exchange CryptoSX, to acquire bitcoin. CEO CK Lee said he’s instructed Greenpro investment bankers to raise debt in Q1 up to $100 million for BTC investment, and also plans to invest Greenpro’s cash in BTC.

The firm’s stock, GRNQ, saw a considerable bump after the announcement broke last night, moving from $1.38 to $2.39. It has since fallen to $1.68, according to TradingView.

Publicly traded IT company Microstrategy made similar moves in 2020, purchasing millions of BTC with funds raised through convertible debt.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely