Go to Source

Author: Bradley Keoun

Go to Source

Author: Ian Allison

A group of XRP investors has filed a petition in the Rhode Island District Court seeking a writ of mandamus in the U.S. Securities and Exchange Commission (SEC) vs. Ripple case filed last month.

A writ of mandamus is a court order compelling someone to execute a duty that they are legally obligated to complete. In this case, the petition filed on Friday by the group is against Elad Roisman, acting chairman of the SEC. The petitioners seek an amendment of the SEC’s complaint against Ripple so that their XRP holdings aren’t considered securities.

The SEC views XRP as a security and sued Ripple and two of its executives — CEO Brad Garlinghouse and co-founder Chris Larsen — on December 22, alleging that they have raised more than $1.3 billion via an ongoing, unregistered securities sale of XRP.

The petitioners argue that “today’s XRP” is not a security. They say the SEC could have targeted specific distributions of XRP, especially in the early days of 2013 through 2015. “Any colorable claim or argument that XRP constitutes an unregistered security could only be made in those very early days and distributions. The SEC could have targeted those early Ripple distributions and any individual sales by its executives without attempting absurdity by calling the XRP in the Petitioners’ wallets unregistered securities,” the petitioners say.

They claim that the former chairman of SEC, Jay Clayton, “knowingly and intentionally caused multibillion-dollar losses to innocent investors who have purchased, exchanged, received and/or acquired the Digital Asset XRP, including the named Petitioners, and all others similarly situated” by suing Ripple. The named petitioners are John Deaton, Jordan Deaton, James Lamonte, Tyler Lamonte, Mitchell McKenna, and Kristiana Warner — all residents of the U.S.

They further say that Clayton went after Ripple and the executives seven years after XRP was introduced to the public for sale and just one day before leaving the SEC. They go on to say that Clayton never clarified whether XRP is a security when asked by media on a few occasions.

“Clayton chose to file, quite possibly, the most significant SEC enforcement action in 76 years as he was walking out the door after allowing the Digital Asset XRP be sold for SEVEN years, leaving a new administration to deal with the aftermath,” they say. “A different political party is assuming control and it is quite possible, if not likely, that they withdraw and/or amend and limit the Complaint’s scope and allegations related to XRP.”

The petitioners also noted that all major U.S. crypto exchanges are set to either delist or suspend all XRP trading and after that, the XPR owned by them will become “untradeable and thus lose all value and become useless.”

It remains to be seen whether the court will grant the petitioners a writ of mandamus. The SEC and Ripple, on their part, are set to begin legal proceedings on February 22.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Tanzeel Akhtar

Quick Take

- SBI Holdings is a Japanese-Internet financial services conglomerate with three core businesses that extend to Financial Services, Asset Management, and Biotechnology

- SBI is creating an ecosystem based on digital assets as one of its growth strategies and has been an active investor in blockchain technology as far back as 2014

- In total, the firm has deployed capital to at least 22 startups and protocols across nine verticals, which The Block has mapped out

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: John Dantoni

SafePal represents a new generation of innovative crypto asset storage solutions that offers not only safety, security, and affordability but interoperability as well as convenience. SafePal’s innovative hardware wallet and software wallet app allows users to store crypto assets from the likes of Bitcoin, Ethereum, Binance BNB, and 17 other mainnet coins as well as 10,000+ tokens.

As the crypto industry continues to grow, accessibility to high-level crypto security needs to be affordable for not only developed countries but also developing markets. SafePal aims to assist the emerging markets by offering a high-value product at an affordable price. SafePal is backed and invested by Binance, complimenting each other in driving greater crypto adoption. SafePal has integrated the Binance Dex as well as Binance Spot Trading directly into the SafePal App allowing hardware wallet users to

conveniently trade their crypto assets.

“The security of user assets always remains top priority throughout our product and business activities. Lowering the hurdle for users to own and use a safe hardware wallet in an easy and user friendly way is one of the unique values we identified when we looked into SafePal products.” Binance’s VP of Mergers & Acquisitions, Ling Zhang

Innovative Features

DeFi

As a light, portable air-gapped hardware wallet, SafePal S1 is the perfect device for users on the go. The solutions offered by SafePal not only opens the way for users to have an affordable hardware wallet solution but also access to the latest crypto industry offerings. SafePal is fully compatible with more than 1,000 DeFi solutions like Uniswap, Sushiswap, Aave, Curve and Compound. DeFi represents a decentralized solution to finance therefore many of the participants want access to decentralized wallet solutions to protect their assets while being able to securely participate.

NFT

The innovative NFT segment of the crypto industry has recently experienced rising asset prices, causing artists and collectors to search for a safe decentralized haven for their NFT assets. As one of the most NFT compatible hardware wallets in the industry, supporting NFT platforms like Openseas, Rarible, and Sandbox, SafePal wallet can store ERC721, ERC1155 and BSC NFTs. SafePal will strategically offer NFT integration

for the industry to continue serving this segment of the industry with secure and convenient storage solutions.

Acting as a gateway for crypto adoption, SafePal aims to do this by providing a truly innovative ecosystem with its service and product offerings. As the first tokenized hardware wallet in the industry, it is important for SafePal to create unique and innovative utilities for crypto users. The recent introduction of SFP token will assist SafePal in achieving its mission of rapidly educating, and onboarding a new generation

of users into the crypto industry through innovative incentives.

Download the App

https://www.safepal.io/download

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Mike McCaffrey

Go to Source

Author: Tanzeel Akhtar

The price of bitcoin briefly fell below $30,000 from nearly $34,000 within a couple of hours, as derivatives positions worth more than a billion-dollar get force liquidated by crypto exchanges.

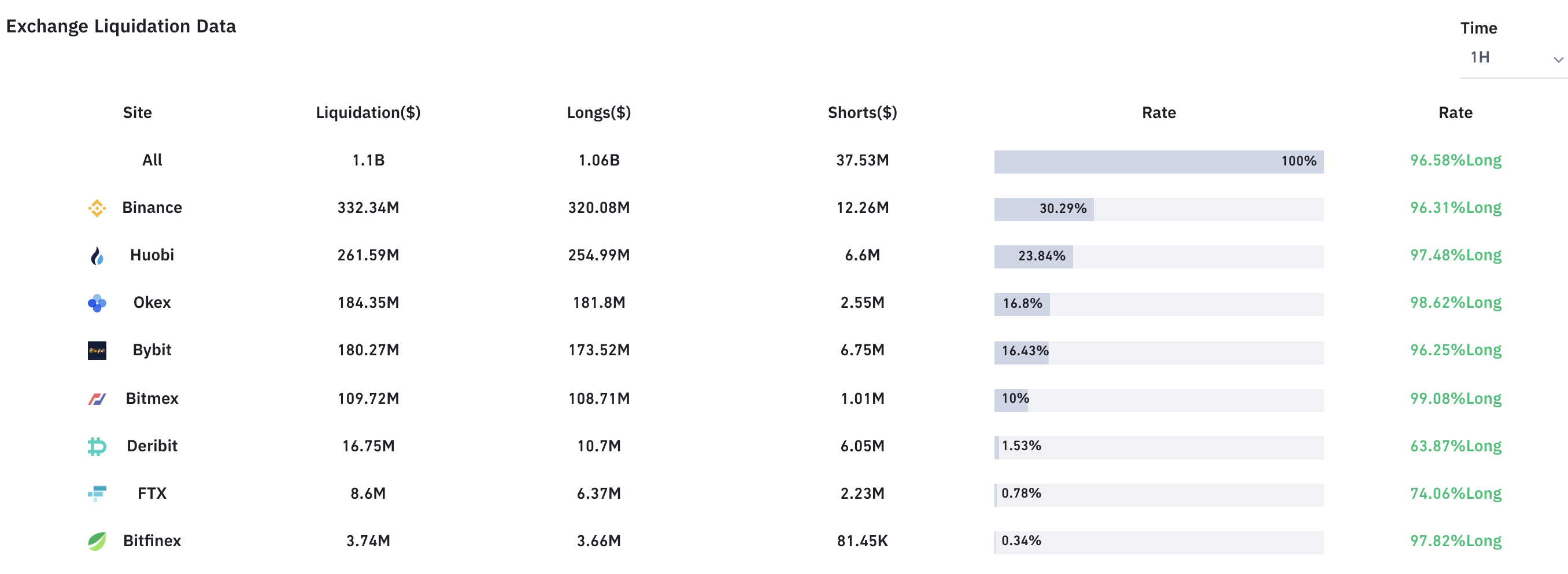

About $1.1 billion worth of open interest was liquidated by crypto exchanges in the last one hour, according to tracker Bybt.com. In other words, exchanges liquidated traders’ overleveraged positions.

Traders overleverage, or trade on margin, thinking that bitcoin’s price would go up and they would benefit more. But when bitcoin’s price goes below the liquidation price of their positions, exchanges force liquidate or close their positions because traders are unable to fulfill margin requirements of their leveraged positions.

Source: Bybt.com

Source: Bybt.com

Of all the liquidations, most of it occurred on Binance, followed by Huobi and OKEx. While in terms of crypto assets, bitcoin positions formed most of the liquidations, followed by ether (ETH) and litecoin (LTC). Source: Bybt.com

Source: Bybt.com

At the time of writing, bitcoin is trading down at around $30,200 and ether down at about $960, according to TradingView.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Omkar Godbole

Ethereum’s Layer 2 scaling solution developer Optimism has said that it expects to release its preliminary mainnet on January 15.

The first trial run will be with decentralized exchange protocol Synthetix, which will experience Optimism’s full mainnet. This includes converting Ethereum smart contracts to Optimistic Virtual Machine (OVM) and deploying them onto mainnet. OVM is almost fully compatible with the Ethereum Virtual Machine, meaning Synthetix won’t have to change its code to deploy its smart contracts onto OVM.

Since the mainnet release is preliminary, Optimism cautioned that it could result in outages and bugs. Therefore, the project team will hold upgrade keys for at least the first six months to ensure user funds’ safety. “Until we relinquish those keys, please do not consider this the full and final system,” said Optimism.

The public or community version of the mainnet is expected to release on March 15. Overall, with its solution, Optimism aims to resolve Ethereum’s scaling problem, i.e., improving its transaction processing capacity at a reasonable cost. The current capacity of Ethereum is about 1.2 million transactions per day, and the average fee per transaction is around $15.

Other projects that have announced to trial Optimism’s solution are Uniswap and Chainlink.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri