Go to Source

Author: Danny Nelson

Go to Source

Author: Colin Harper

Go to Source

Author: Pete Howson

Go to Source

Author: Daniel Cawrey

Digital asset investment firm Grayscale is moving to dissolve the XRP Trust — a move that comes days after it announced the liquidation of XRP positions from its Digital Large Cap Fund.

In a press statement circulated Wednesday, Grayscale cited the decision by the Securities and Exchange Commission to file suit against Ripple last month, in which it argued that the digital asset XRP is a security under U.S. law.

“In response to the SEC’s action, certain significant market participants have announced measures, including the delisting of XRP from major digital asset trading platforms, resulting in the Sponsor’s conclusion that it is likely to be increasingly difficult for U.S. investors, including the Trust, to convert XRP into U.S. dollars, and therefore continue the Trust’s operations,” Grayscale said Wednesday, adding:

“In connection with the dissolution, the Sponsor has liquidated the Trust’s XRP and intends to distribute the net cash proceeds to Trust shareholders, after deducting expenses and providing appropriate reserves and subject to any applicable withholding. The Trust will terminate following distribution of the net cash proceeds.”

As previously reported, numerous market-facing crypto firms have moved to draw distance between themselves and XRP. The looming SEC dispute sparked an investor lawsuit from Tetragon Financial Group, which invested in Ripple’s Series C funding round.

Still, as The Block reported earlier Wednesday, regulators in non-U.S. countries have thus far taken a different tack in their determinations about the status of XRP. Japan, for example, considers it to be a cryptocurrency under its payments services-related laws.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Michael McSweeney

Go to Source

Author: Kevin Reynolds

Japan’s Financial Services Agency (FSA), the country’s securities regulator, has confirmed to The Block that it views XRP as a cryptocurrency and not as a security.

The question has become relevant recently in light of the U.S. Securities and Exchange Commission’s allegation that by selling XRP the firm engaged in sales of unregistered securities — and because just about one month ago Ripple CEO Brad Garlinghouse said that the firm might leave the U.S. in search of a more friendly regulatory environment.

“FSA regards XRP as a cryptocurrency based on definitions of the Payment Services Act,” the Japanese regulator told The Block in an email Tuesday. “FSA refrains from making comments about other authorities’ response.”

The statement represents the first time the FSA has commented directly on the legal status of XRP. Last month, Nomura Research Institute published a report, saying that according to the Act, a “widely accepted interpretation” is that XRP is a crypto asset and not a security.

Shortly after, citing that report, Ripple’s investor and business partner SBI Holdings published a press release saying that XRP is not a security in Japan. It did not cite any direct comments from the FSA.

SBI Holdings did not respond to The Block’s requests for comments when reached. Ripple also cited the Nomura report when reached for comments. The firm did not provide any further comments by press time.

Crypto definitions

According to Japan’s Payment Services Act, a digital asset is a cryptocurrency or “virtual currency” when it is used as a payment method to an unspecified person and when it is not denominated in fiat currency.

“The term ‘Virtual Currency’ as used in this Act means any of the following,” the FSA told The Block:

“(i) property value (limited to that which is recorded on an electronic device or any other object by electronic means, and excluding the Japanese currency, foreign currencies, and Currency-Denominated Assets; the same applies in the following item) which can be used in relation to unspecified persons for the purpose of paying consideration for the purchase or leasing of goods or the receipt of provision of services and can also be purchased from and sold to unspecified persons acting as counterparties, and which can be transferred by means of an electronic data processing system;

and (ii) property value which can be mutually exchanged with what is set forth in the preceding item with unspecified persons acting as counterparties, and which can be transferred by means of an electronic data processing system.”

Currency-denominated assets mean any assets that are denominated in Japanese yen or a foreign currency, per the Act.

The U.K.’s finance ministry also considers XRP as a non-security. It considers the digital asset as an “exchange token.”

“Tokens that are primarily used as a means of exchange – this includes widely known cryptoassets such as Bitcoin, Ether and XRP,” the finance ministry said in a regulatory consultation document published last week.

The U.K. was also previously shortlisted by Ripple for its new headquarters, among other countries, if it leaves the U.S.

Of course, the FSA determination doesn’t mean much for Ripple’s looming fight with the SEC. But it does reflect how governments around the world take divergent viewpoints on regulating digital assets such as XRP.

Under pressure

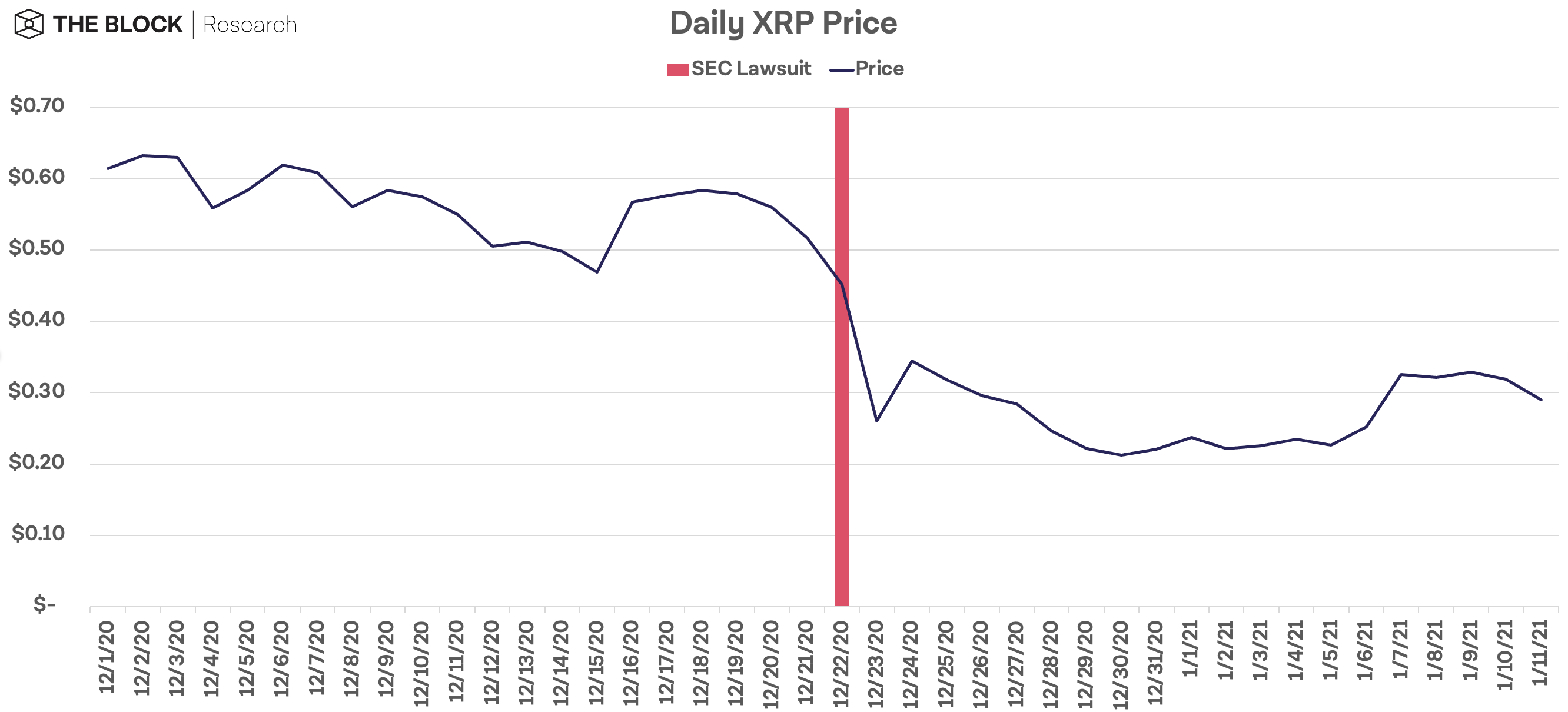

Within less than a month since the SEC filed its lawsuit against Ripple, Garlinghouse, and co-founder Chris Larsen, crypto firms around the world have come under pressure to drop XRP from their offerings. XRP’s price is down by about 35% since the lawsuit. It is currently trading at around $0.30 per token.

Source: CoinGecko, The Block Research

But in Japan, it appears that XRP trading will be allowed to continue for the foreseeable future — and that might be enough to lure Ripple there, too.

Ripple has maintained that XRP is not a security and has vowed to fight the SEC charges. Ripple is expected to submit its initial response to the SEC’s charges in the coming weeks.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Nathaniel Whittemore

Go to Source

Author: Marta Belcher

Anchorage has won the race to become the first federally chartered digital asset bank by obtaining a national bank charter from the Office of the Comptroller of the Currency (OCC).

The institutional crypto custodian is now on even firmer footing with its designation as a “Qualified Custodian” under the Securities and Exchange Commission’s (SEC) requirements. Investment advisers have to keep client funds and securities with those that meet the qualified custodian standard, usually banks or registered broker-dealers.

In a statement, the OCC highlighted the “conditional approval” of Anchorage’s banking bid.

“The OCC granted a national trust bank charter to Anchorage after thorough review of the company and its current operations. As an enforceable condition of approval, the company entered into an operating agreement which sets forth, among other things, capital and liquidity requirements and the OCC’s risk management expectations,” the regulator said.

With a banking charter, the Anchorage Digital Bank National Association can provide sub-custody services — like holding assets for a main custodian — for any financial institution, according to Anchorage.

“Before now, there have existed fintech companies with the technical sophistication to securely handle digital assets under a piecemeal, state-by-state regulatory structure, and there have existed federally chartered banks with a robust regulatory framework that lack the true technological savvy it takes to operate in the blockchain space at its breakneck pace of innovation,” said Nathan McCauley and Diogo Mónica in a joint statement.

Anchorage Digital Bank, they say, can now provide the tech and regulatory clarity that “serious institutional participation” requires.

Other players are also looking to obtain banking charters in the near future. BitPay and Paxos both applied for federal charters from the OCC in December. Avanti remains a state-regulated bank under Wyoming’s charter.

Anchorage’s approval comes days before Acting Comptroller Brian Brooks is slated to end his tenure with the bank regulator, according to a report from Politico.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely