Go to Source

Author: Tanzeel Akhtar

Go to Source

Author: William Foxley

Decentralized derivatives exchange dYdX has raised $10 million in Series B funding.

Announcing the news on Tuesday, dYdX said the round was led by Three Arrows Capital and DeFiance Capital, with participation from Wintermute, GSR, Scalar Capital, and others. Existing investors, including a16z and Polychain Capital, also backed the round.

With fresh capital at hand, dYdX looks to expand its platform and team, as well as its footprint in Asia, with a particular focus on China.

“China is a very important market for dYdX, DeFi, and the global cryptocurrency industry,” dYdX founder Antonio Juliano told The Block. “dYdX is committed to long-term success in China and is investing heavily in growth.”

dYdX recently hired its first international employee, Yiran Tao, to focus on driving growth in China, Juliano told The Block, adding that the exchange is also focused on expanding in Korea, Japan, and Singapore.

Founded in 2017, dYdX offers three different types of products — perpetual contracts with up to 10x leverage, spot trading, and margin trading with up to 5x leverage.

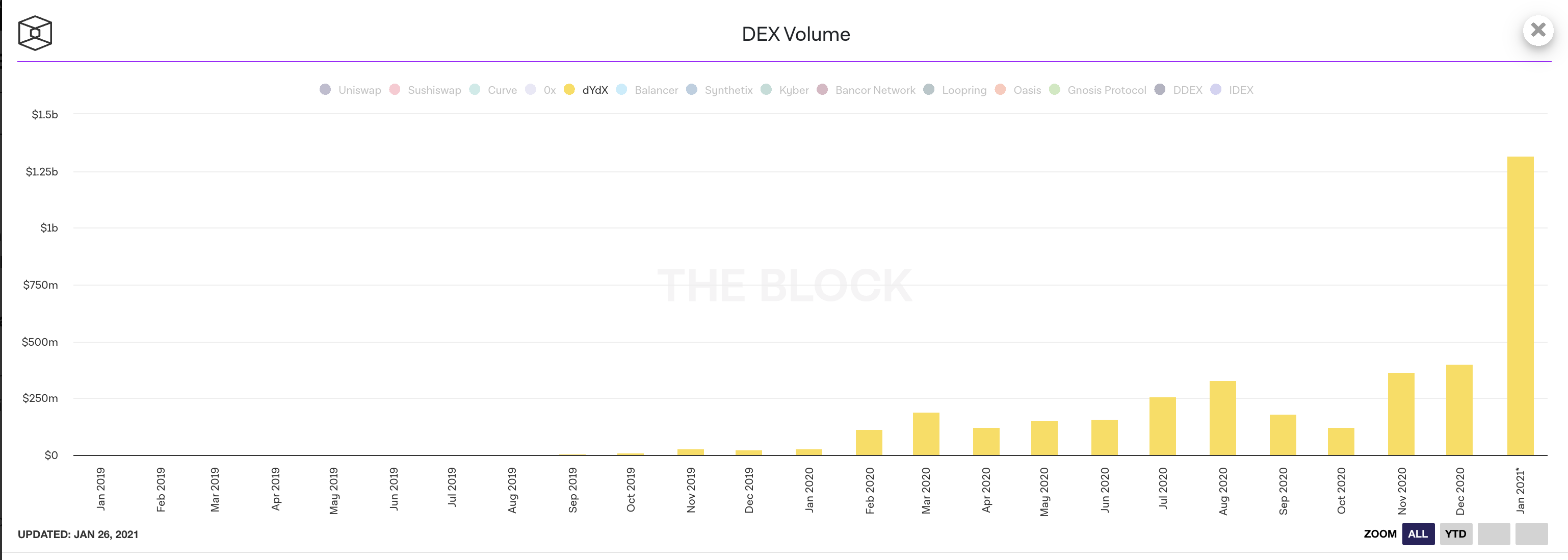

The exchange achieved record trading volume across all three products in 2020, reaching a total cumulative trade volume of $2.5 billion — up 40 times from $63 million in 2019.

This year so far, dYdX’s total cumulative trade volume has already crossed $1.3 billion within just one month.

“We believe dYdX will continue to gain market share in relation to CEXs [centralized exchanges] due to decreased switching costs, simple onboarding, better UI & UX, increased security guarantees, and more attractive trading products,” Juliano told The Block. “Over 2021, we aim to launch a variety of crypto markets, with the goal of ultimately becoming on par with major CEXs in the space.”

To that end, dYdX is looking to enhance its platform further and expand its current team of 14 (it doubled its headcount last year). One of the major features that dYdX is launching soon is an Ethereum Layer-2 scaling solution that utilizes ZK-Rollups.

dYdX is built on Ethereum, and given the blockchain network’s limited transaction capacity and high transaction costs, several DeFi projects, including dYdX, are looking to implement rollups. The core philosophy of rollups is that transaction data is on-chain, while transaction computation is done off-chain to scale Ethereum’s capacity.

There are two main types of rollups: ZK-Rollups and Optimistic Rollups. The former guarantees that transactions are valid with zero-knowledge proofs, while the latter allows transaction validity to be challenged on the Ethereum blockchain. Optimistic Rollups are currently the more flexible solution because it is easier to build smart contracts on them, while ZK-Rollups are technically more secure.

When asked why dYdX chose StarkWare’s ZK-Rollups, Juliano told The Block that the exchange wanted a scaling solution that could be on mainnet “within a few months, not within some undefined timeline.” For that reason, “we ruled out Eth2 and Optimism, which had not yet been on mainnet.”

Juliano said rollups offer 100x+ scaling benefits without Eth2. dYdX is set to launch its StarkWare Layer 2 solution next month for cross-margined perpetual contracts.

Looking ahead, dYdX is also planning to decentralize its platform further and could even launch its own token.

“Our team has actively been researching how best to decentralize the protocol over time. Decentralization will be a gradual process that could ultimately result in a DAO [decentralized autonomous organization] to govern the community,” Juliano told The Block.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Brady Dale

Bitmain’s co-founder Jihan Wu has officially announced that he is stepping down from the bitcoin miner maker giant in an effort to settle down a year-long internal power struggle with rival co-founder Micree Zhan.

In a coded letter dated on Tuesday and decrypted by The Block’s Igor Igamberdiev, Wu said the disagreement between Zhan and him has been “finally” settled in an “amicable” and “constructive” manner.

Part of the agreement is that Zhan purchased almost half of the Bitmain shares owned by Wu and a group of founding shareholders for a value of $600 million. In return, Wu said he has resigned as CEO and chairman of Bitmain as of Tuesday.

“In order to complete the share purchase, Micree obtained a loan of $400 million from Bitmain while he committed to raising another $200m from outside of the group,” Wu wrote in the encrypted letter.

According to Wu, as of January 24, Bitmain had $327 million in fiat cash holdings, “which was twice higher than what is required by the preferred shareholders in order to close this settlement.”

The settlement is also in line with previous reports that Bitmain is set to spin off its mining pool and cloud mining businesses.

“Also pursuant to the settlment, Bitdeer is spun off from Bitmain today together with the mining farm operations in the U.S. and Norway. I will be the chairman of Bitdeer. Matt Kong will be the CEO of Bitdeer. Antpool will soon be spun off into an independent company to be led by Micree,” Wu wrote.

The purpose of the spinoff is to streamline Bitmain’s business model to make pursuing a public offering easier.

As part of the settlement deal, Bitmain’s B and B+ round investors, who poured in more than $700 million into the firm in 2018, got their number of shares tripled as compensation of valuation adjustments.

“Upon the closing of the settlement today, Bitmain has turned over a new page with great opportunities ahead. As the co-founder of Bitmain, I enjoyed the 2,815 days of journey working for it with numerous help and support from lots of customers, colleagues, friends and investors, and I give my most sincere blessing to Bitmain and its leadership of Micree,” Wu wrote.

The full letter can be read below:

Regarding the Settlement Between Bitmain’s Two Co-founders by MichaelPatrickMcSweeney on Scribd

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Wolfie Zhao

The Financial Crimes Enforcement Network (FinCEN) has extended the comment period for its recent proposed rule on virtual currency transactions.

The comment period will last 60 days after the extension notice hits the Federal Register, which is planned for Jan. 28.

The proposed rule plans to impose higher know-your-customer standards and reporting to crypto transactions, including those performed with self-hosted wallets. Initially, FinCEN released the notice in late December and left only 15 days over the holiday period to submit comments. This shorter-than-normal comment period set off a race to submit, with many stakeholders and even members of Congress expressing dissatisfaction with the shortened comment period.

There was also confusion over when the deadline would take effect, since many industry players believed the deadline to be Jan. 4, counting 15 days from the release of the proposed rule rather than the date it hit the register. The rule itself stated the deadline as Jan. 4 and FinCEN did not update the text of the notice, although it did update the deadline on the portal for submission on Jan. 4.

The regulator did not publicize the change or respond to requests for comment on the date change. Still, industry players managed to lodge over 7,500 comments in the shortened period. After, FinCEN reopened the comment period on Jan. 14, giving stakeholders an additional 15 days to submit.

With the new extension, stakeholders should have until March 29 to lodge additional comments.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

Go to Source

Author: Bradley Keoun

Go to Source

Author: Nikhilesh De

Go to Source

Author: Nathan DiCamillo

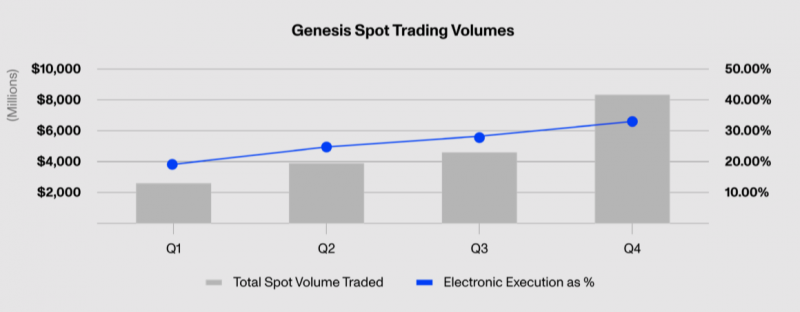

Business boomed for one of the largest trading and lending firms in the crypto market during the final quarter of 2020.

According to Genesis Global Trading’s most recent quarterly report, the New York-based firm saw “a new wave” of institutional players — spanning banks, private equity firms, and investors — drive growth, with the firm originating more than $7 billion in loans during Q4 2020. In 2020, the firm clocked in $19 billion in cumulative originations.

Source: Genesis

“In addition to structuring a new facility with one of our banking partners, we saw a significant uptick in lending volumes with ultra-high-net-worth individuals, corporations, traditional hedge funds, and family offices who wanted to dip their toes in the market for the first time,” Genesis wrote.

“Relentless” demand for cash drove growth in new loan originations, according to the firm. Investors borrowed cash en masse to generate returns through the popular basis trade—which represents the spread between bitcoin futures and spot markets. In Q4, the average loan size in US dollars increased to $4 million from $2 million Q3 — a 100% increase.

“Take a closer look at the spread/basis between futures and spot markets, we still need to see a lot more cash inflows before spreads normalize,” Genesis wrote.

Source: Genesis

The firm told The Block that the basis trade will narrow as more spot buyers enter the market. “We expect that as more spot buyers (institutional-size capital inflows) materialize, the amount of USD circulating within the crypto ecosystem (which includes stablecoins and bank balances at Silvergate, Signature, etc.) will increase and, in turn, narrow the basis trade.”

$20 billion in traded volumes

As for the firm’s trading operation, Genesis traded $8.1 billion in spot crypto during the fourth quarter, up 80% from Q3.

The firm — which launched a prime brokerage offering this past spring — said that it executed about a third of its orders via its smart-order routing engine. In total, Genesis traded $20 billion worth of spot crypto in 2020.

Underpinning the spike in volumes was a shift in the volatility of bitcoin, which soared towards $30,000 at the end of the year.

“With BTC/USD and most of the crypto complex reaching new highs at the end of Q4, it became apparent we were entering into a new volatility regime, unlike the range bound trading we had seen over the past few years,” the report noted. “Spot BTC entered price-discovery mode to find new equilibrium where supply would meet surging demand.”

Genesis, which has been expanding beyond its roots as an over-the-counter trading shop, anticipates more and more of its volumes will be electronic as it introduces new algorithmic strategies via its upcoming agency trading desk.

“Electronification is a natural conclusion in any asset class,” the firm said. “Crypto, true to form, is accelerating through decades of market structure development in a matter of 1-2 years. If anything, crypto lends itself more to electronification than other financial assets due to its digitally-native nature.”

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro