Go to Source

Author: Sebastian Sinclair

Decentralized finance (DeFi) protocol Balancer Labs has raised a seven-figure sum via the sale of its native governance token BAL.

The backers are Pantera Capital and Alameda Research. While Balancer did not disclose the investment amount, Alameda founder Sam Bankman-Fried told The Block that his firm invested a seven-figure sum, i.e., a minimum of $1 million. Pantera did not immediately respond to a request for comment.

With fresh capital at hand, Balancer plans to expand its team ahead of the protocol’s V2 launch. The second version will introduce “significant improvements” to transaction costs and improve user experience, said Balancer.

Balancer operates as an automated market maker protocol and can be seen as a rival to decentralized exchange protocol Uniswap. According to data compiled by The Block Research, Uniswap is ranked first and Balancer fifth in terms of trading volumes. Uniswap had $11.2 billion worth of volume in October, while Balancer got $0.35 billion, i.e., 32 times less.

Today’s funding comes in addition to a $3 million seed round Balancer raised in March of this year. That round was led by Accomplice and Placeholder, with participation from CoinFund and Inflection.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Sebastian Sinclair

The total storage power on Filecoin has grown over 40% since a Chinese miners’ standoff in mid-October, which resulted in an upgrade to the network’s block rewards and a surge in FIL lending.

Data shows the decentralized storage blockchain, which went live on October 15, has now nearly 850 pebibyte (PiB) of effective storage, compared to 600 PiB seen around October 19 when a majority of Chinese Filecoin miners had halted their growth plan.

The Block reported at the time that the shortage of Filecoin’s native cryptocurrency FIL in the market caused miners to stop growing their effective mining power – since they needed FIL to pledge as collateral.

As such, Filecoin’s total network storage power had nearly zero growth rate in the days following the mainnet launch and was steadily around 600 PiB.

To resolve the issue, Protocol Labs, the foundation behind Filecoin, decided to activate a proposal on October 22 that would release 25% of Filecoin miners’ block rewards immediately without vesting.

In addition, several crypto exchanges have also launched financial products for users to deposit FIL to earn lucrative interest as well as for miners to borrow FIL with collateral in order to fulfill their growth appetite.

Binance rolled out a FIL time deposit product with an annualized interest of 156% and a 7-day maturity term on October 26. Currently, it is still offering a nearly 1% daily interest for FIL savings.

Gate.io also said last week that the lending demand for FIL has been surging with an annualized interest over 100% as miners are looking for more resources to boost their mining growth.

Since the miners’ standoff around October 19, Filecoin’s total network storage has increased by 250 PiB over the past 22 days with a daily average growth of about 11 PiB.

To seal and grow every 32 gibibyte of storage, a miner needs to pledge 0.2 FIL as collateral. Hence, a daily growth of 11 PiB equates to miners having pledged around 70,000 FIL every 24 hours.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Wolfie Zhao

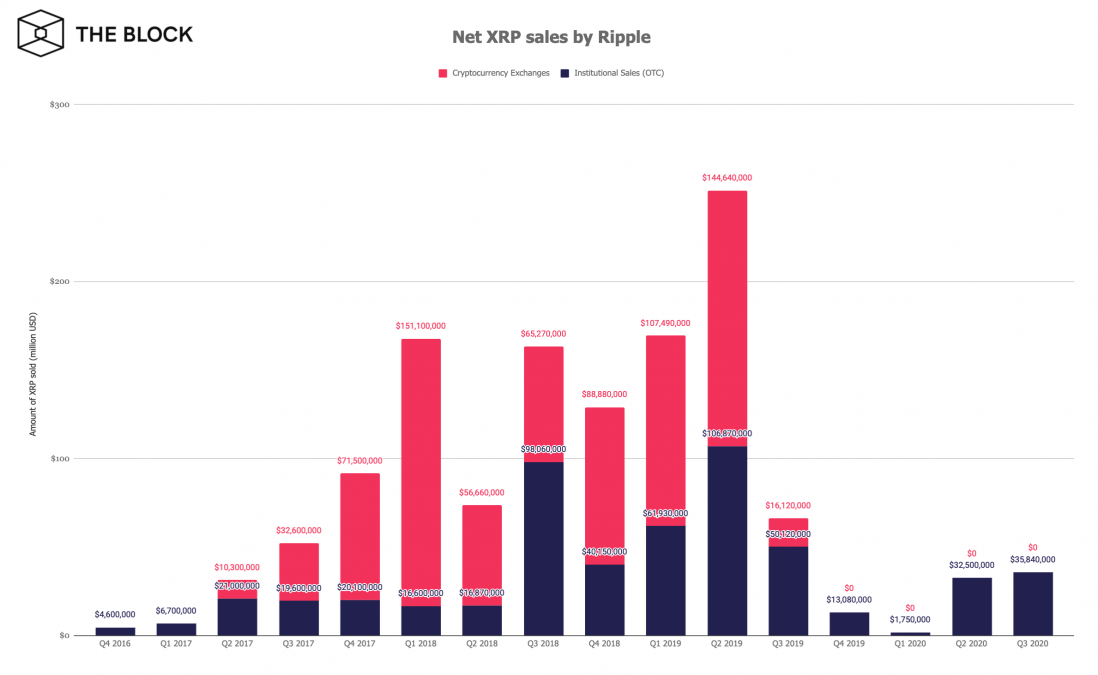

Ripple for the first time bought $46 million worth of XRP in the third quarter of 2020, despite already owning nearly half of the digital asset’s supply.

Ripple said the purchase was made to support “healthy markets,” possibly referring to creating interest around XRP and thereby raising its price.

A Ripple spokesperson told The Block that the company may continue to purchase XRP to also support its newly launched product — Line of Credit beta — which allows On-Demand Liquidity (ODL) customers to buy XRP on credit from Ripple. The ODL solution leverages XRP for fund transfers.

“Long-term, Ripple is building new ODL capabilities to dynamically source XRP liquidity from the open market, not just Ripple,” said the spokesperson.

Ripple’s Q3 sales were also related to its ODL solution. “ODL-related sales include XRP sales to support ODL (including Line of Credit) and key infrastructure,” said the spokesperson.

Ripple sold $81.39 million worth of XRP to ODL customers in Q3, compared to $32.55 million worth of XRP to direct institutions in Q2. There were no programmatic sales, i.e., XRP sales to cryptocurrency exchanges, in Q3. In other news, Ripple has also opened a new regional headquarters office in Dubai International Financial Centre, which has its own independent judicial system and regulatory framework.

In other news, Ripple has also opened a new regional headquarters office in Dubai International Financial Centre, which has its own independent judicial system and regulatory framework.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Ian Allison

Go to Source

Author: Zack Voell

Researchers from the U.S. Federal Reserve published a deep-dive into the past literature on central bank digital currencies on Monday — while also laying out critical considerations for the future of such initiatives.

With a wholly digital dollar — whether from a private entity, the Fed itself or a mix of the two — potentially on the horizon, the Fed’s researchers say the most important consideration is whether a central bank digital currency (CBDC) would substitute fiat for currency, deposits or both.

In sum, the report leans on the work of a variety of works that offer theories on the impact of CBDCs, including productions from individual researchers and other central banks like the Bank of England. The Fed says it’s looking to past theoretical CBDC research to answer questions about the possible effects on commercial banks and monetary policy. Indeed, the Fed is far from alone in pursuing research in this area, as The Block outlined in its past report on CBDC initiatives.

While the Fed said some research points to the value of CBDCs in creating greater financial inclusion by lowering the number of unbanked citizens, it could also mean a change in deposits and volume at commercial banks.

“In this respect, this strand of the literature can speak to the concern of some policymakers that the introduction of CBDC may replace banks’ main source of funding and cause disintermediation of commercial banks, which in turn may lead to a decrease in their lending,” the report’s authors said.

However, the U.S. central bank is exploring a variety of thinking on the topic. The report recognized a digital dollar as an opportunity to serve as a monetary policy tool. The bank said it’s taking a closer look at possible implications on household portfolio choices and the interplay with bank runs.

“Crucial to these mechanisms is the flexibility provided by CBDC in responding to macroeconomic shocks,” said the report’s authors, who went on to write:

“We believe the most crucial question is which intrinsic features of CBDC as a means of payment and a store of value are important for households’ portfolio choices as to which monies to use.”

You can read the Fed’s full literature review here.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

Go to Source

Author: Nikhilesh De

Go to Source

Author: Colin Harper