This research report is part of a new series produced by The Block Research to provide insights and due diligence on some of the leading companies in the digital asset ecosystem. This debut Company Intelligence report on BlockFi is free to read. Information included in this work comes from previous The Block Research work, The Block news coverage, and internal BlockFi documents reviewed by the author of this report.

To learn more about The Block Research, check out our full service offerings here.

DISCLAIMER

This report has been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. The Block will not be liable whatsoever for any direct or consequential loss arising from the use of this publication/communication or its contents.

Company Overview — BlockFi

One month into 2021 and it already has been a year of firsts for crypto.

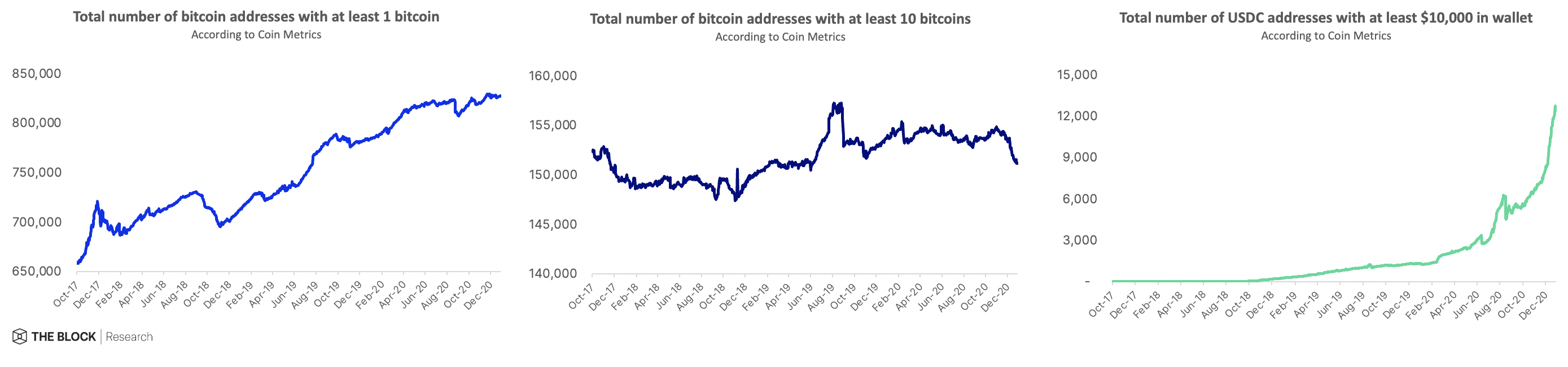

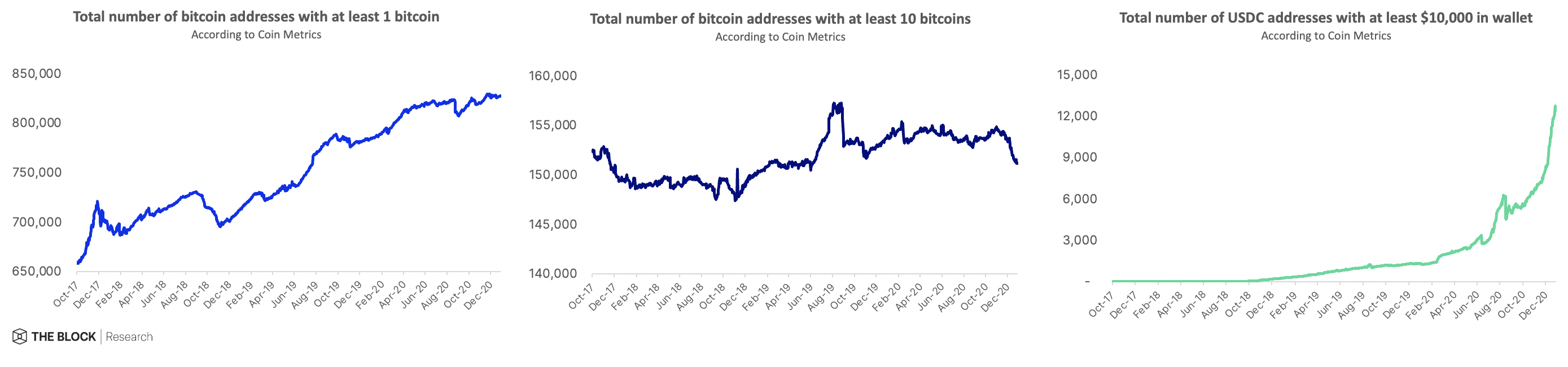

Headlined by the total market value of all outstanding digital assets surpassing more than a trillion dollars for the first time ever, several crypto metrics are now (again) measured in the trillions — including annual on-chain transaction volumes of stablecoins, annual spot volumes at major crypto exchanges, and quarterly derivative volumes in 4Q’20. Nearly 900,000 unique addresses now hold at least 1 bitcoin, with roughly 150,000 addresses holding at least 10 BTC.

Naturally, as the industry has reflated and grown to new highs in terms of users, volumes, and overall market valuations, there exists a growing need from market participants (both retail and institutional) to receive financial services and product offerings built specifically for the digital asset ecosystem.

Recognizing this opportunity, many large financial institutions, banks, and payment companies have now publicly accelerated their strategic efforts to expand capabilities and services in 2021. However, they do so — ironically, perhaps — as companies emerge to challenge a group of well-funded digital asset financial services companies that boast several years of first-mover advantages.

One such company is BlockFi.

Source: Coin Metrics, The Block Research

Source: Coin Metrics, The Block Research

From one perspective, BlockFi can be viewed as one of the world’s largest crypto-native neobanks: part non-bank crypto-secured (collateral) lender, part digital asset depository institution. But even that framing provides an incomplete picture.

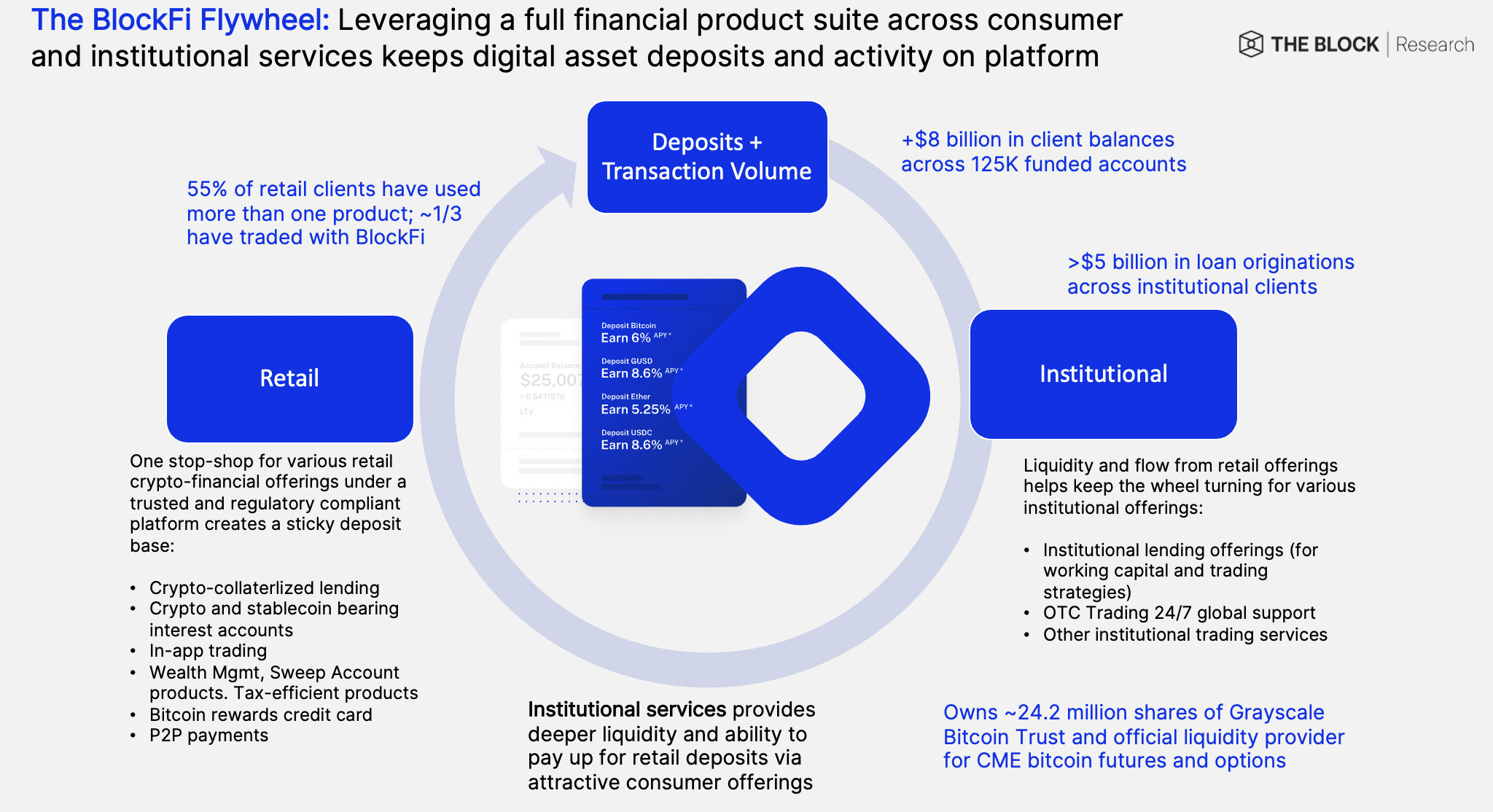

At its core, BlockFi provides liquidity and unlocks utility for digital assets by creating financial products and services that meet the needs of both retail and institutional clients. Headquartered in the U.S., it serves clients in more than 140 countries. Originally going to market in late 2017 by offering USD loans secured by either BTC or ETH as underlying collateral, BlockFi, in just three years’ time, is now in the process of evolving into a diversified financial services company centered around the digital asset ecosystem.

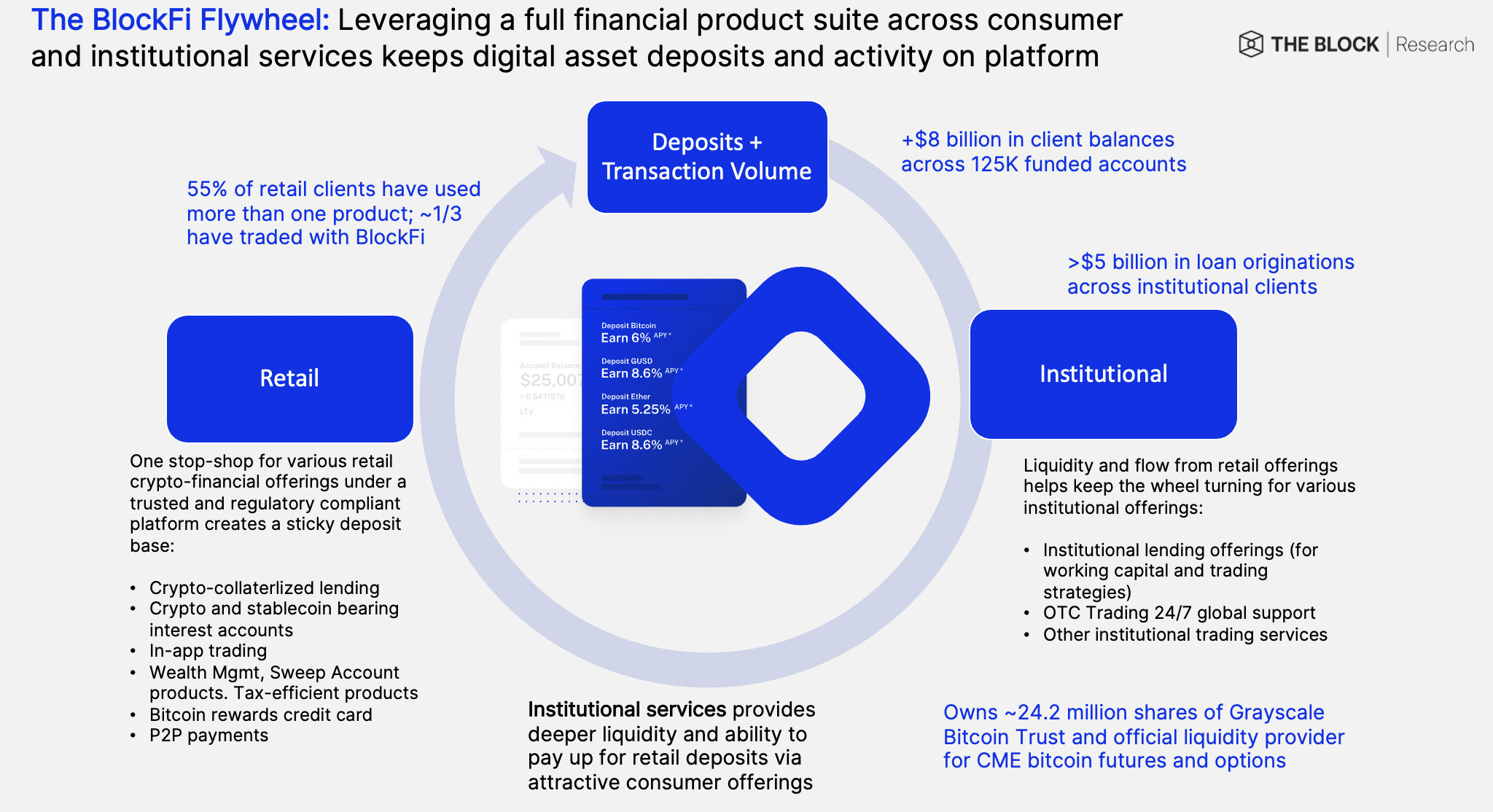

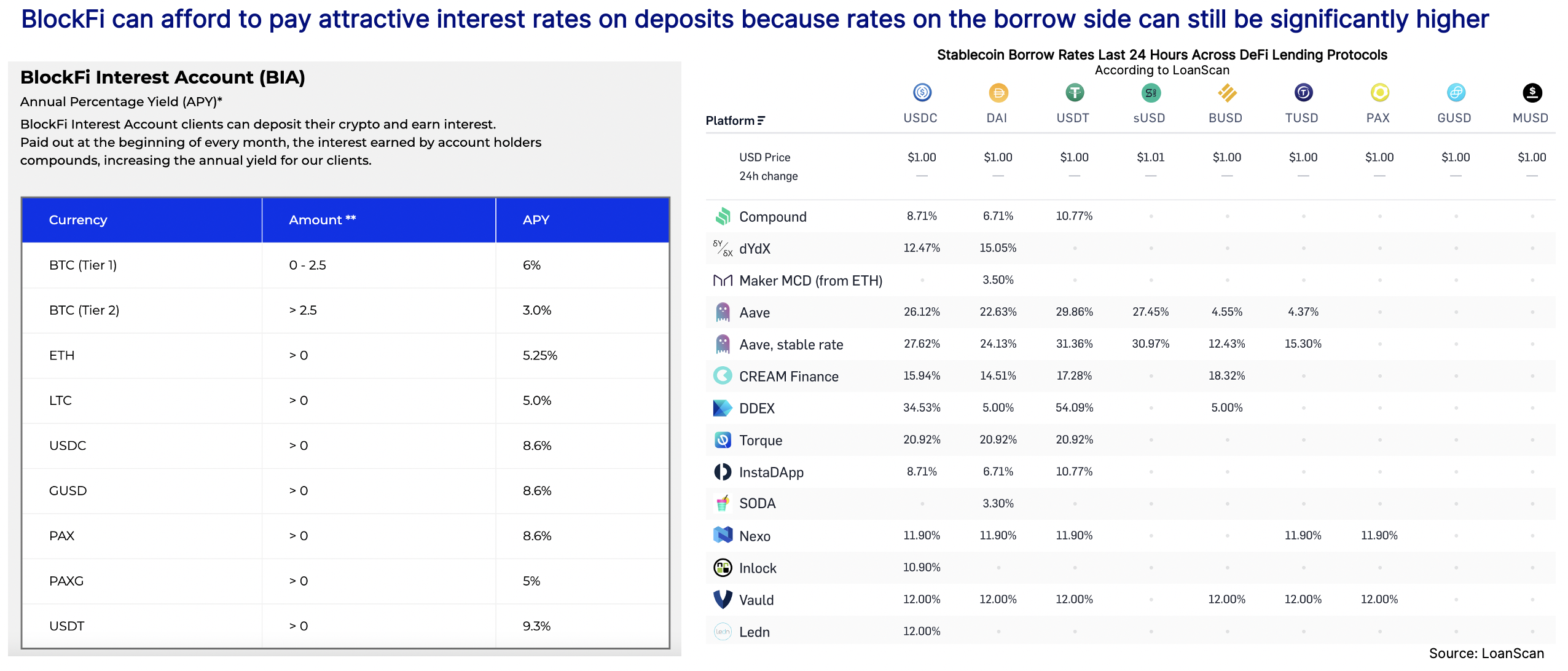

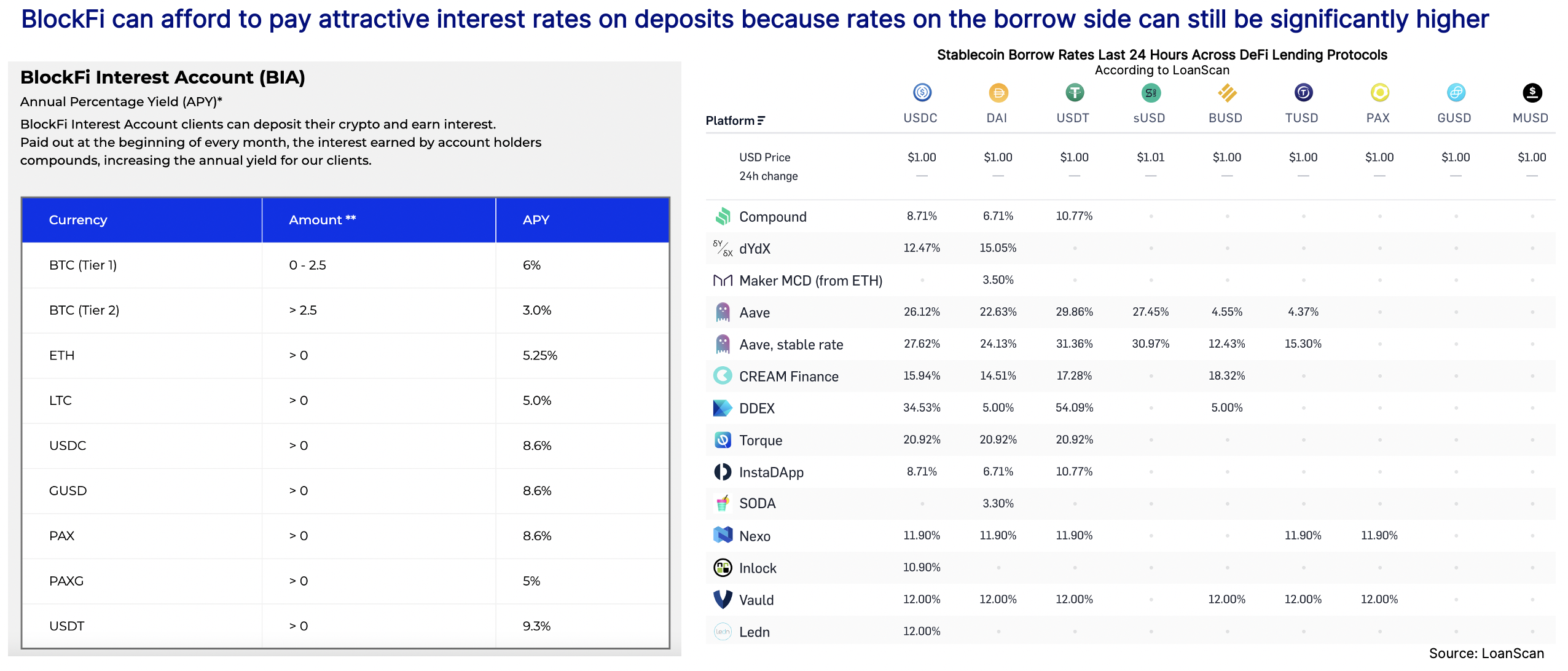

Its current retail product suite lets users earn crypto-denominated yield on deposited crypto at up to 8.6% APY rates, trade assets on its platform and mobile app, and borrow against crypto pledged as collateral. On the institutional side, BlockFi offers custom credit and structured products for a number of institutions including hedge funds/family offices, market makers/OTC desks, crypto companies, and high-net-worth individuals.

BlockFi also has launched dedicated OTC desks in both the U.S. and Asia to provide global 24/7 support for institutional and high net worth clients.

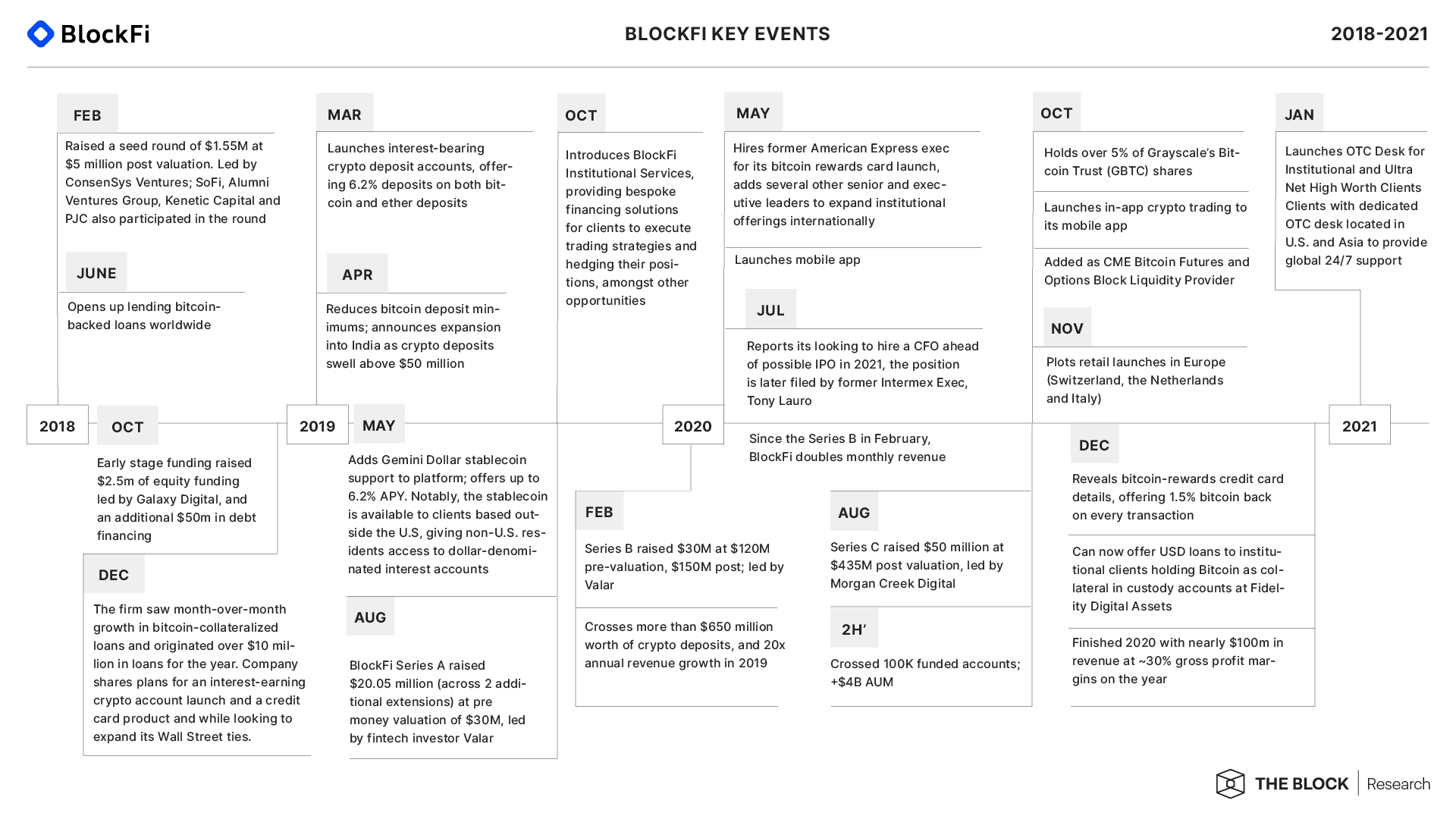

Source: BlockFi

Looking ahead, BlockFi now has its sights set on delivering new offerings that can reach a wider customer base that may not currently hold crypto and digital assets. On the retail side, that approach includes a 1H 2021 launch of the first bitcoin rewards credit card which is set to pay back 1.5% in bitcoin on every purchase (and runs on Visa). BlockFi also has plans to roll out a dedicated institutional trading platform in 2021 which will feature spot and derivative margin products on crypto, stablecoins, and USD, along with a richer order-management system.

On a previous episode of The Scoop Podcast (aired July 2019), CEO Zac Prince has said that he views BlockFi not as a bank but as a diversified financial-services company in the same mold of a SoFi. SoFi is a U.S.-based digital consumer finance company which first built its business around student loans and has now become a one-stop shop for mortgage, personal loans, checking and cash management products, and even an investing platform that offers crypto trading.

Like SoFi, BlockFi now has several revenue-generating lines of business.

In terms of its retail and institutional lending business, BlockFi generates margin on the spread between the cost to fund the loans (the cost of deposits and the cost of capital) and the rate of interest earned on its loan portfolio. BlockFi’s retail loan portfolio is currently running at a ~10% weighted average APR, with no credit losses to date. Meanwhile, the institutional lending book has originated more than $5 billion worth of loans across +150 clients (split 60% U.S., 25% APAC, 15% Europe).

BlockFi launched in-app crypto trading in October 2020, and acting as principal on all transactions allows for small spreads to be taken on those volumes. The company also makes money by opportunistically deploying capital and providing strategic market activity, similar to how traditional banks generate returns from interest-earnings assets. It currently is one of the largest shareholders of the Grayscale Bitcoin Trust (holding ~24.2 million shares) and is also an official liquidity provider for the CME Group bitcoin futures and options products.

By year-end 2021, BlockFi should also drive revenue from both its credit card product ($200 annual fee + gross interchange fees) as well as its expanded institutional trading activities.

According to company documents reviewed by The Block Research, BlockFi now has over $8 billion in total client balances (more than 30x assets on platform in 4Q’19) with more than 125,000 funded accounts (12.5x funded accounts in 4Q’19).

Taken together, BlockFi generated nearly $100 million worth of revenue in 2020 (+22x FY’19 revenue) at nearly ~30% gross profit margins. The company is profitable entering 2021.

Funding and Organization Overview

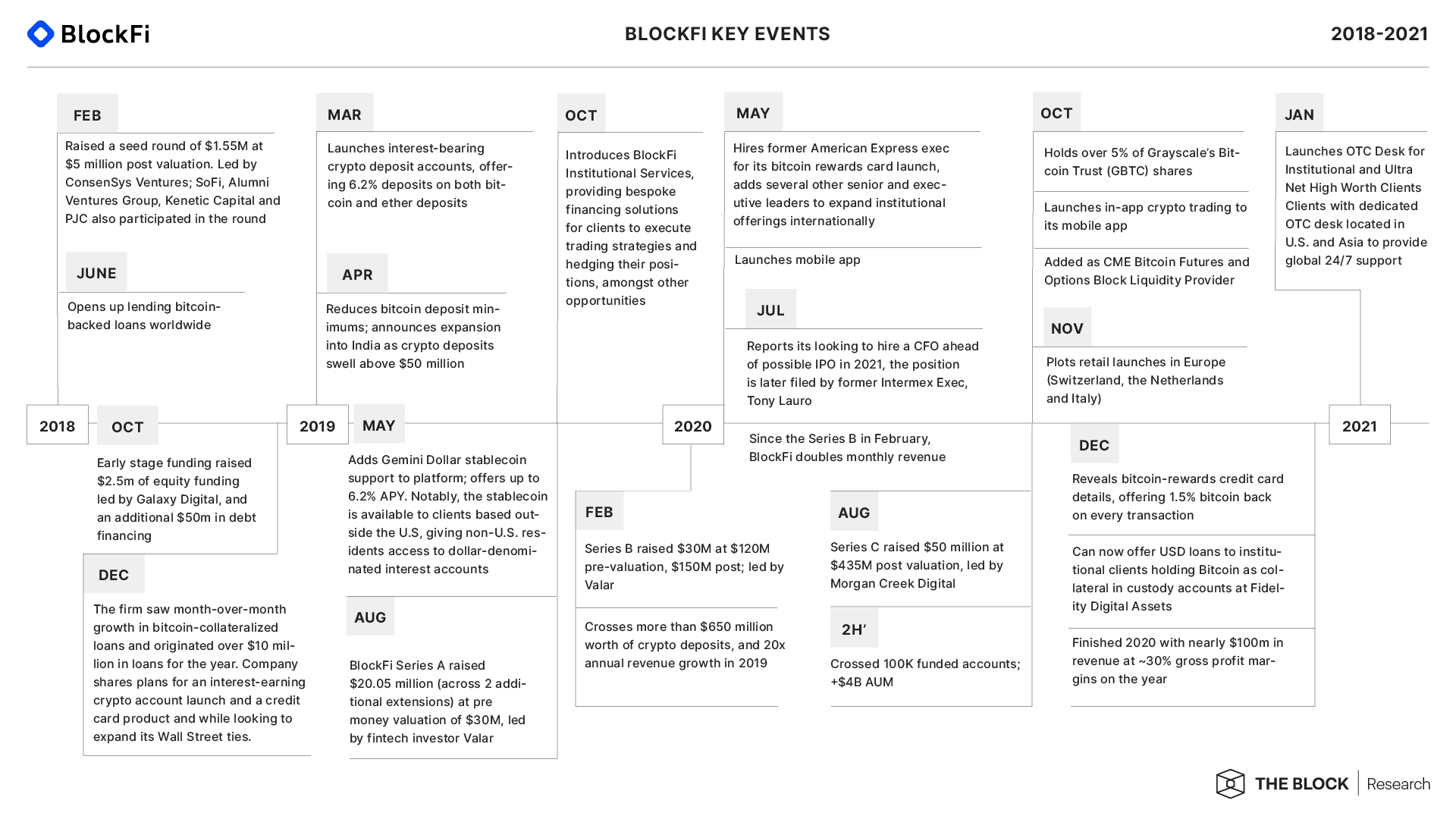

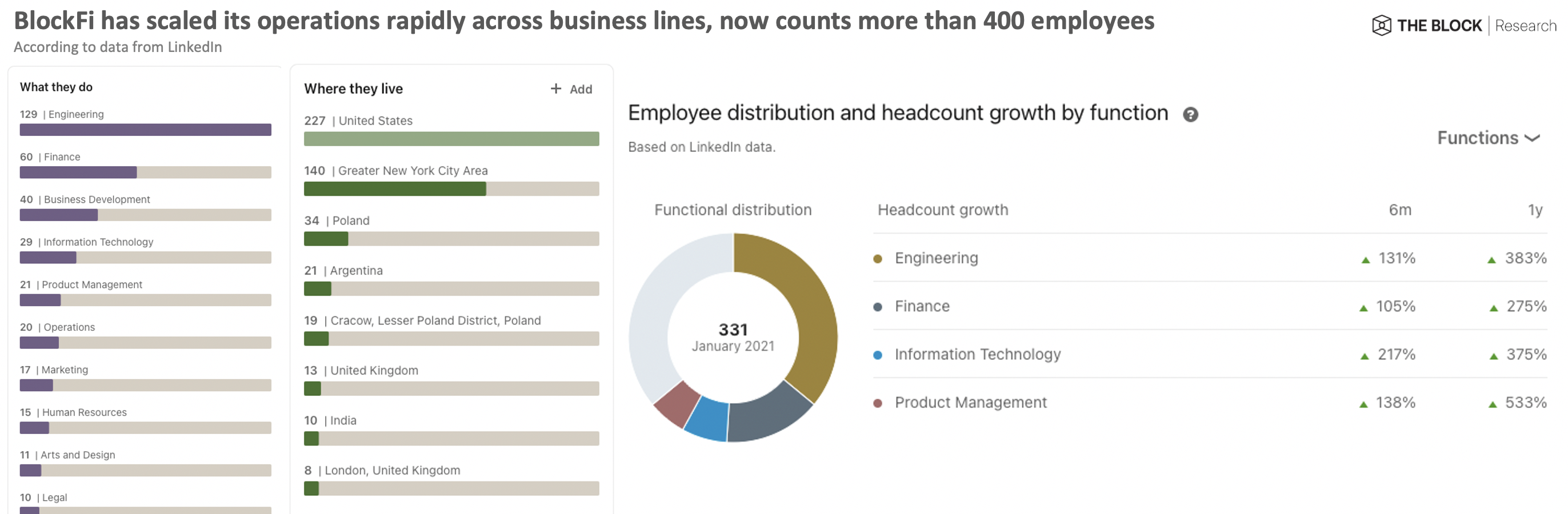

In less than three years’ time, BlockFi has scaled from a seed-stage company (with $10 million worth of loans originated YE 2018) to one of the largest employers in the space and one of the most well-funded digital asset financial services companies in the world. A key factor to this growth beyond execution comes from its rapid equity financing activity from private markets.

Since 2018, BlockFi has raised more than $100 million in equity financing across six deals (plus two additional Series A extensions and one Seed extension) and a separate $50 million in debt capital in mid-2018 to help finance its loan book early on.

Source: The Block Research, Pitchbook

BlockFi currently has more than 30 investors on its cap table, with the Series A, Series B, and Series C drawing significant participation. We’ve provided stock information, cap table history, and BlockFi ownership mix by investors vs. internal shareholders below. According to data from Pitchbook, internal shareholders own ~25% of BlockFi. Relative to other well funded and most valuable digital asset financial services companies, BlockFi currently has collectively raised significantly less than capital than its U.S. peers.

Source: The Block Research, Pitchbook, Company filings;

*Visual inspired by FT Partners Research | The Rise of Challenger Banks

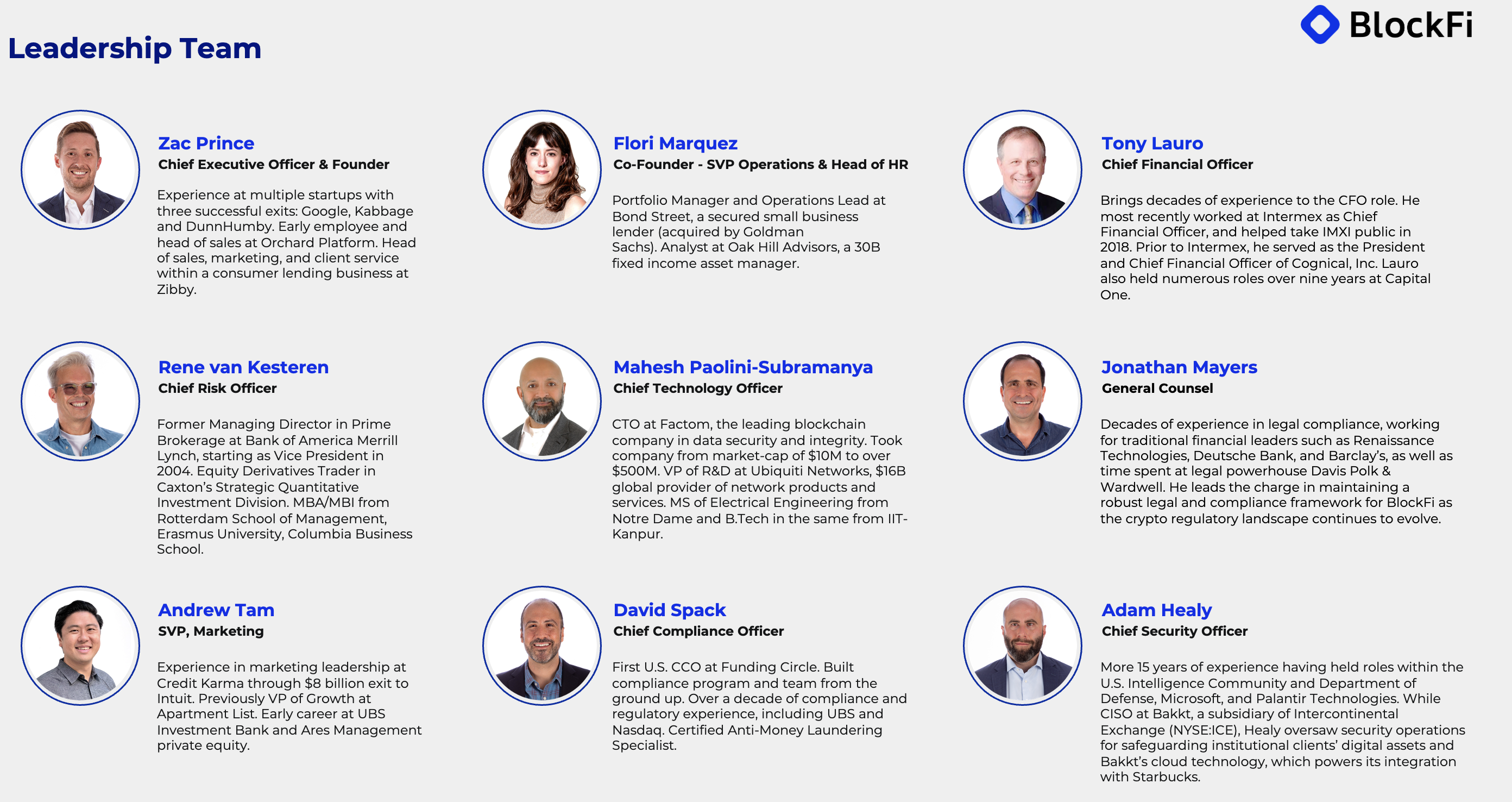

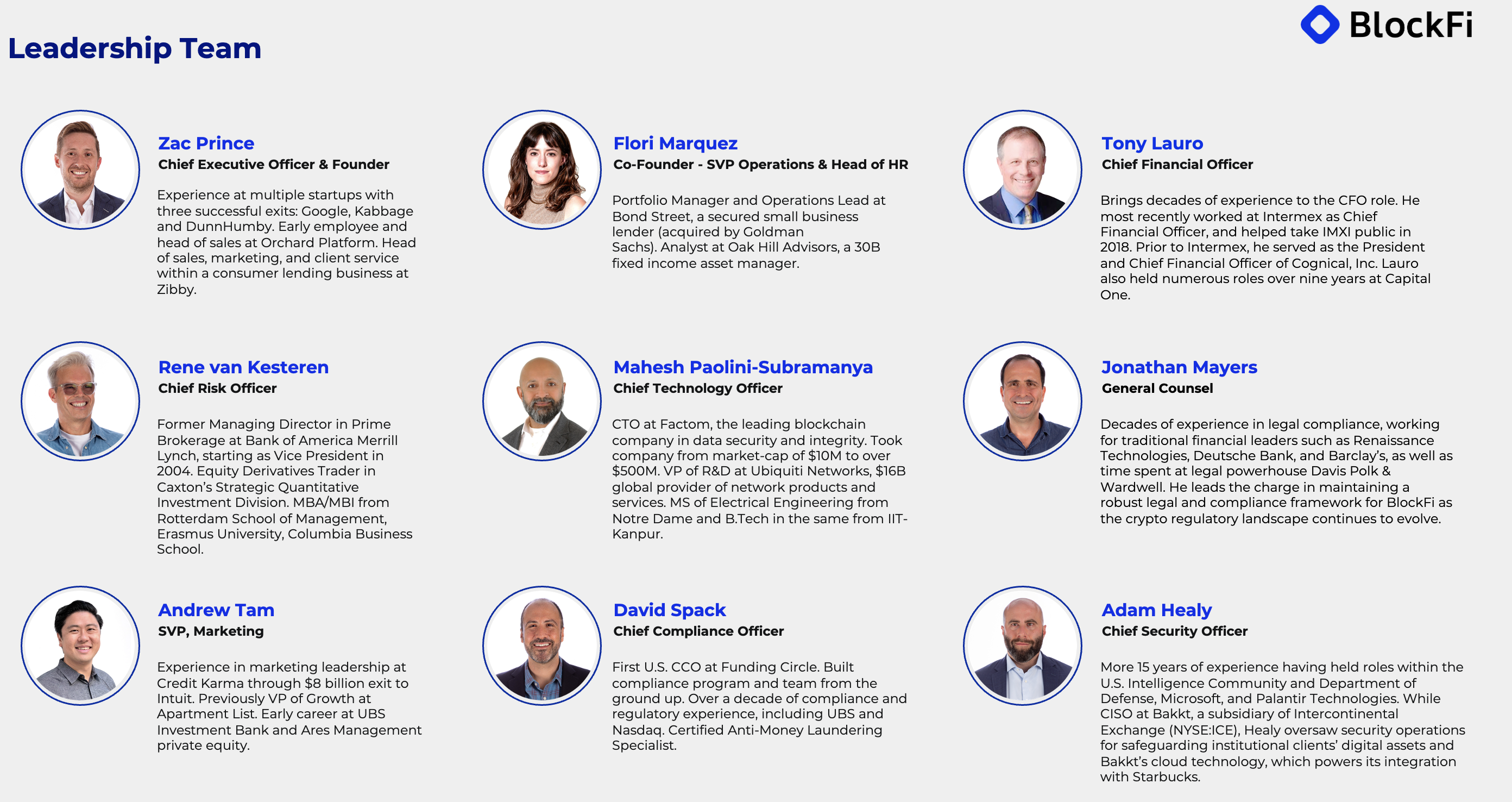

While BlockFi has yet to make any core acquisitions, it has taken the influx of capital to instead reinvest in itself and hire a number of executive and senior-level talent from financial institutions and large global corporate investment banks.

BlockFi’s leadership team counts executive and managing director level experience from American Express, Capital One, Bank of America Merrill Lynch, Credit Karma, Bakkt, among others.

Per LinkedIn, at the mid-to-senior level of the company, BlockFi has hired more than 15 former capital markets professionals (investment banking, sales, and trading, structuring and lending, etc.) to build out its institutional coverage and services offerings (see its announcement of Institutional Services here). Open jobs postings at BlockFi suggest that beyond compliance, legal, and engineering roles, institutional services remain a key focus of hiring talent in 2021.

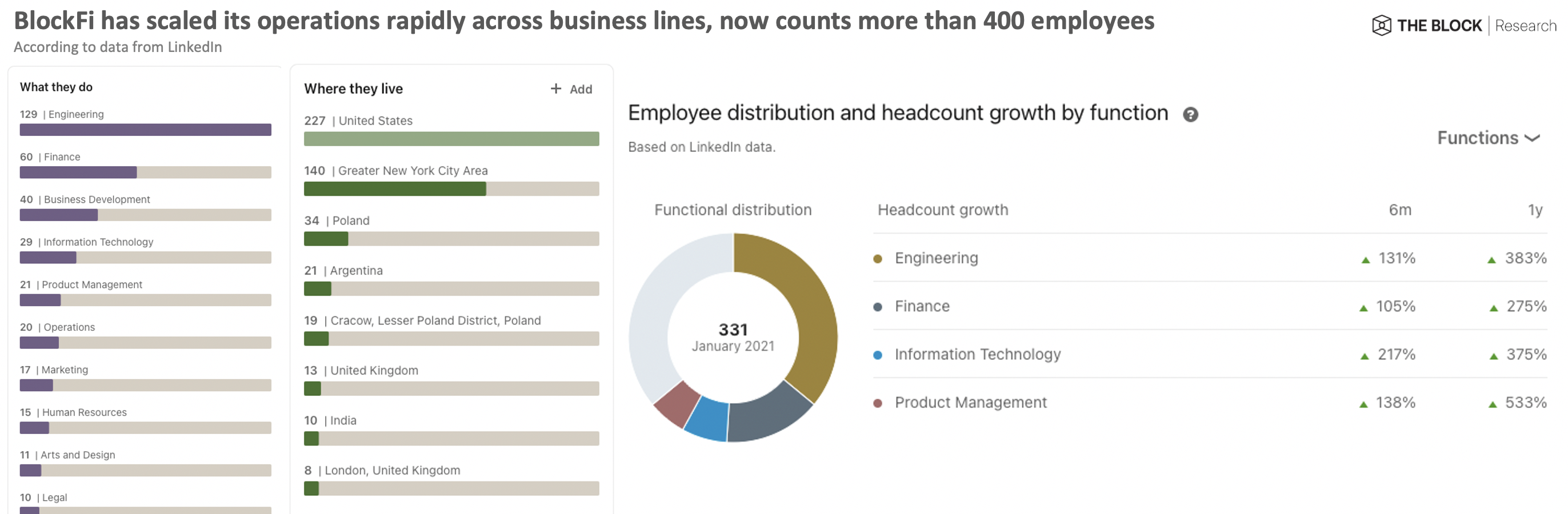

To date, BlockFi has scaled its operations rapidly across Engineering, Finance, IT, and Business Development functions, and now counts more than 400 employees across the world. In terms of its corporate board structure, BlockFi executives make up three of the nine board seats: Zac Prince (CEO), Mahesh Paolini-Subramanya (CTO), and Flori Marquez (Co-Founder, SVP Operations and Head of HR). Other board members include Christopher Ferraro (President and Board Member of Galaxy Digital), James Fitzgerald (Co-Founding Partner at Valar Ventures), Kavita Gupta (former Managing Partner at ConsenSys Ventures), Kevin Goldstein, Suk Shah (former CFO at HSBC) and Anthony Pompliano (Co-Founder & Partner at Morgan Creek Digital).

Strategy Overview

Retail

BlockFi is looking to take a playbook that was first popularized at scale by SoFi and has since become one of the core strategies for any new challenger-bank/neobank: grab deposit share with a product offering that unbundles a traditional banking function — in BlockFi’s case, bitcoin and digital asset interest savings accounts — and then roll-out new offerings that bundle the product suite together under the same franchise.

Since it first launched crypto interest-earning accounts nearly two years ago, BlockFi has moved to build a one-stop-shop for various retail crypto-financial offerings all under a regulatory compliant platform (the firm has 20 Money Transmitter Licenses, and offers loans in 47 U.S. states with 14 Lending Licenses). The company has found initial success to date in terms of creating a stickier retail deposit base.

Per company documents, 55% of retail clients have used more than one BlockFi product, and nearly a third have traded with BlockFi. This, in turn, has helped drive more than $8 billion in client balances across 125,000 funded accounts.

Source: The Block Research, BlockFi internal documents

However, product offerings are just one piece to the puzzle.

BlockFi has been able to draw in billions in client deposits off the back of attractive interest-bearing rates that can range as high as 8% on some stablecoins (and roughly 6% for BTC). The company can afford to pay up for these deposits at higher rates because, in many cases, it can actually lend out stablecoin and bitcoin deposits at even higher borrow rates (see figure below which shows that even on DeFi protocols, many stablecoin borrow rates sit above BlockFi’s cost of funds rate).

Source: BlockFi

Institutional

Structurally, crypto credit markets and a still-maturing market structure on top of a digital bearer asset class causes unique liquidity constraints around lending out the asset. Considering that the predominant demand in the market to borrow on the institutional side is to go short or play arbitrage opportunities between spot and futures bitcoin products, the lack of players soaking up this demand — combined with the near-instantaneous transfer of title when settling the asset — has led to a supply imbalance. This, in turn, naturally pushes lending rates up.

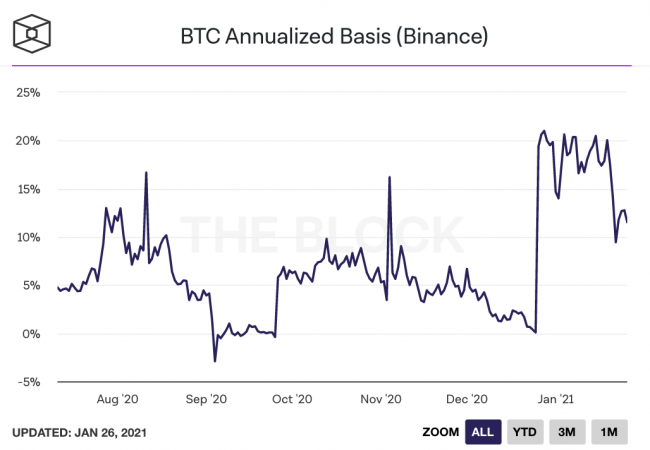

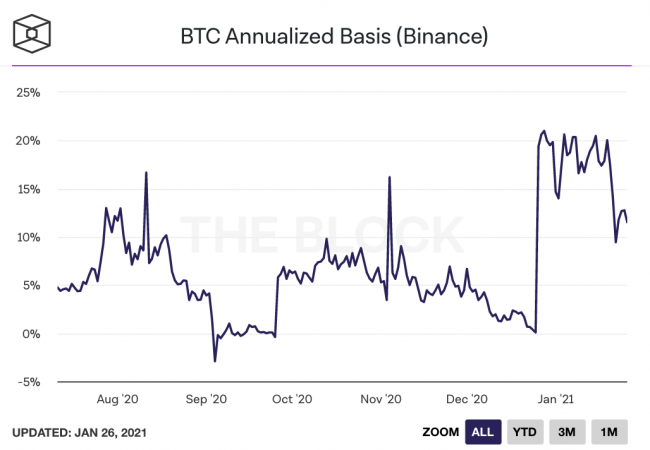

The reality is that there still exists outsized demand from institutional investors to borrow dollar or USDC (stablecoins) to buy bitcoin spot and capture basis arbitrage trades between spot and derivative exchanges. Indeed, there is enough demand that actually outstrips the total cash supply available to market-makers to take advantage of these opportunities themselves.

In response to this, we’ve seen institutional credit desks such as Genesis step into this role and provide USD-backed loans and other sources of credit to take advantage of these yield opportunities (See Genesis 4Q and 3Q 2020 Lending Reports for more information on these trades). Genesis continues to note in its Lending Reports that structural basis (currently around 15%) continues to persist due to a lack of cash inflows.

The market for these services and capital also continues to grow for Genesis. In 2020, the company originated more than $19 billion worth of loan originations ($7.6B in 4Q’20, up +7x since 4Q’19). BlockFi Institutional Services is looking to go after this market by offering capital, lending, and structured products to help clients take advantage of these trading opportunities.

Market Activity

BlockFi’s flywheel in servicing both retail and institutional markets — and being a key player in crypto credit markets — allows the company to be opportunistic in deploying capital into market-neutral and other attractive risk-reward opportunities. One example of an opportunity BlockFi is targeting is by owning Grayscale Trust products like the Grayscale Bitcoin Trust Product (GBTC). BlockFi currently owns ~24.2 million shares of GBTC (~$800 million in value at today’s prices) by subscribing to shares struck at the NAV of bitcoin (or cash) deposited into the trust. Given how these trusts can trade at significant premiums to NAV (average GBTC premium to NAV in 2020 was ~20%; see chart below), BlockFi can target this spread by holding locked shares through the 6-month lockup window and then sell unlocked shares at the market value (likely at a premium).

Varying degrees of market-neutral strategies around this trade are also available, depending on whether the investor has access to credit and other structured products.

Other opportunistic market activities include targeting similar basis trades between spot and futures markets on the CME Group. Notably, with CME Group set to release ETH futures in February, this could provide new investment opportunities for BlockFi in 2021.

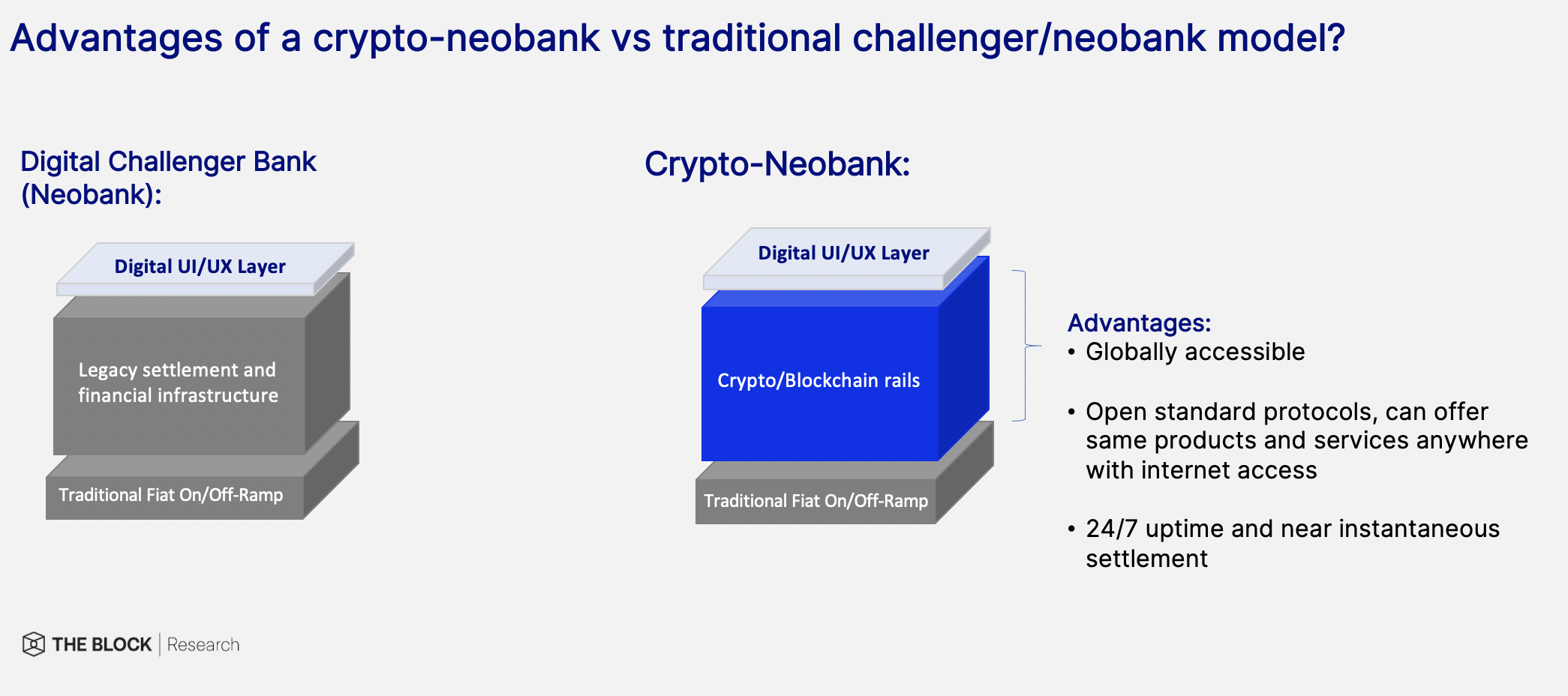

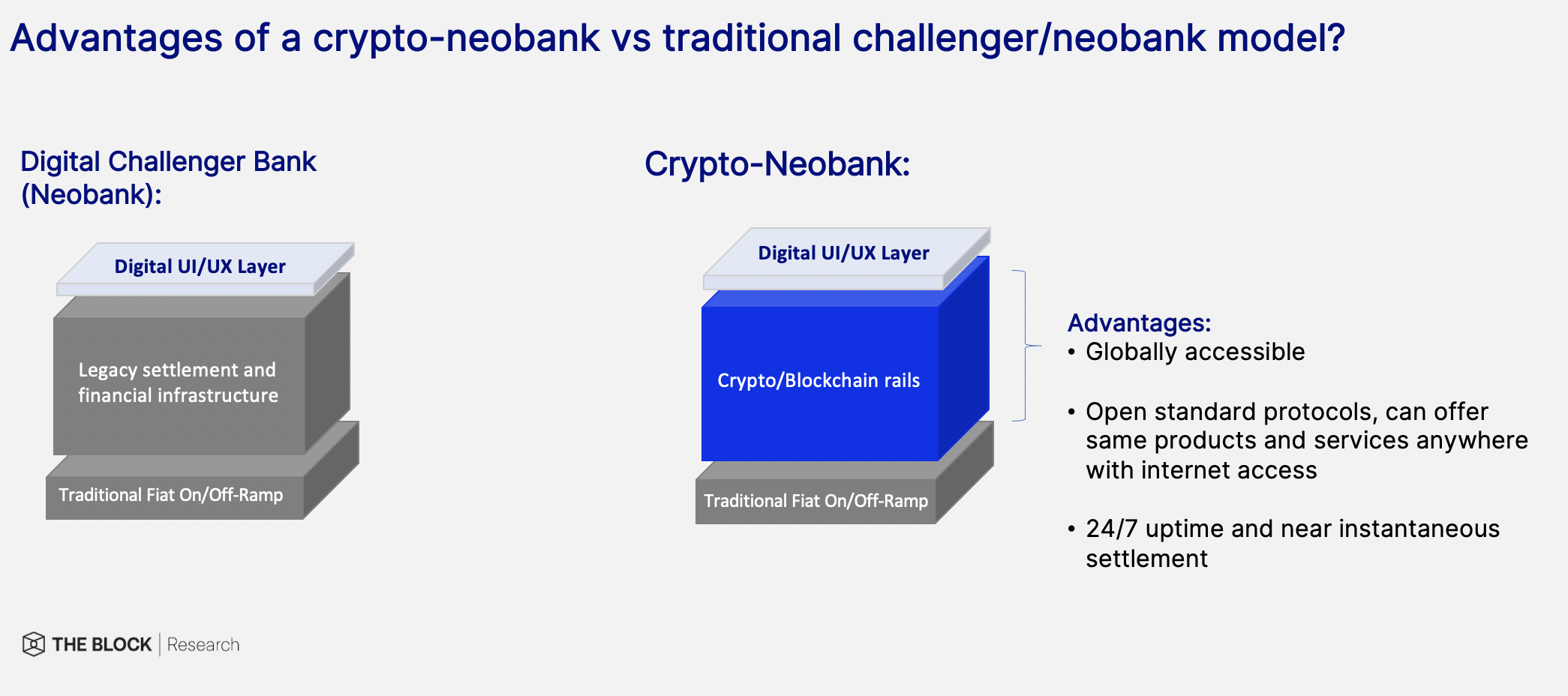

Advantages of building a crypto-neobank on top of new rails

One final unique aspect to BlockFi’s business worth highlighting is that BlockFi and other large digital asset financial service companies have proven that fintech offerings built around crypto, for both institutional and retail markets, can scale quickly and globally. One reason for this is that crypto-native neobanks and financial services offerings are being built on new infrastructure and rails that are openly accessible by nature. Companies building services on this new stack can offer products anywhere in the world that has internet. Notably, more than 40% of BlockFi’s traffic in December came from outside the U.S.

Considering this new stack offers global accessibility and near-instant 24/7 settlement, it also provides unique opportunities for new products that traditional neobanks can’t offer. An example is distributing credit card rewards through the bitcoin network, which provides a settlement medium that can transfer rewards anywhere in the world via an asset that is highly liquid and trades 24/7. Another example that has been proven out by BlockFi is the ability to offer collateralized credit to anyone globally that owns crypto or digital assets.

Source: BlockFi, The Block Research

Industry Outlook — Crypto Lending

The market for crypto lending may be small relative to other credit products, but the sector is still worth attention given its recent growth, pace of innovation, and ability to provide the lifeblood for companies in the broader ecosystem.

Crypto-secured loans require borrowers to offer cryptocurrency as collateral, oftentimes significantly overcollateralized, in exchange for another asset (usually USD or stablecoin). Loans can be originated centrally with a custodian/counterparty, or originated through a decentralized non-custodial lending protocol.

The core market and product offerings can be segmented as:

- Borrowing USD secured by crypto: Personal or Business loans originated by custodial lenders against crypto, with USD wired directly to bank accounts. Loans can be used for additional liquidity, and offer tax benefits on potential capital gains.

- Margin lending on exchanges: The ability to use leverage via derivatives or direct margin from the exchange itself.

- Lending crypto borrowing crypto: Origination volumes are largely demanded by fund trading, as the loans can be used to go short a position or run various other trading strategies where the fund would rather not own all the crypto. Genesis Capital is the major player in this bucket, but also plays within other segments (eg. USD – Crypto).

- Decentralized Lending Protocols (Non-custodial): Non-custodial lending protocols offer a similar collateralized loan as custodians, only in a decentralized way. The protocols leverage smart-contracts to minimize counterparty risk and reduce the cost to originate and borrow. While risks of smart contract risks are present, the risk of trusting your custodian to secure your deposit is shifted.

- Token-based platforms: A catch-all bucket for any lending platform or protocol that may push custody to a third-party provider and also comes with a token model attached to the hip. Large players here include Nexo and Celsius.

The lending opportunity impacts both lenders and borrowers. Lending on crypto (both centralized and decentralized) provides a unique opportunity for both lenders and borrowers that is hard to find with current lending products in the market.

For Lenders:

- Unique collateral characteristics that can be favorable to alternatives. Bitcoin, and other cryptocurrencies like Ether, offer unique collateral characteristics that make them favorable to lend against, assuming the loan is over-collateralized in order to mitigate underlying price volatility. Some of these characteristics include: 1) asset is received instantly (little to zero clearing friction), 2) efficient storage, 3) can be liquidated 24/7, and 4) is constantly marked-to-market. Contrast that to a more common secured auto loan where the collateral (the car) can face unexpected decline in value (not constantly marked-to-market, and doesn’t face upside appreciation), and can be tricky to repossess and store upon default.

- Entry for new lending growth. Considering the crypto lending market is still nascent, there aren’t a lot of players funding loans in the space. It’s not that big of a stretch, however, to imagine more traditional banks and credit funds starting to explore the market given that overcollateralization leads to relatively lower LTV (Loan to Value i.e., lower risk vs. other secured loans), while lower costs to underwrite/monitor the borrower and less competition lead to higher premiums. In the U.S., the OCC interpretive letters in 2020 which stated banks are allowed to custody and service crypto markets will be an area to watch for broader crypto credit market maturation.

For Borrowers:

- Potential to open up wider credit access to developing markets. For borrowers in countries with little access to low-cost credit or would prefer dollar-denominated debt, consumers that own BTC or ETH can receive significantly lower financing costs vs. competing products. There is a wide variety in interest rates being offered from both custodial and non-custodial crypto-secured lenders. Currently, lending protocols offer significantly lower costs to borrow (and true border-less access).

- Access to credit for crypto-native businesses and funds. Credit markets are the lifeblood of industries. For crypto-native business (exchanges, funds, service providers, BTC ATMs, etc.) access to credit that can be lent against the predominant asset on the balance sheet allows for greater capital management capabilities.

- Tax advantages. Ability to generate liquidity without realized capital gains on crypto holdings, allowing for tax arbitrage. Given the sharp increase in the underlying price of crypto-assets such as Bitcoin and Ether year-over-year, more borrowers will be able to leverage this advantage than ever before.

Competition

- Competition on rates, rather than duration and LTV. Loan terms (duration, collateral limits, etc.) are largely standardized across the space outside of the disparity of rates. The variance in the cost to borrow is dependent on the degree of directional exposure the underwriter is comfortable with, as well as jurisdiction and regulatory classifications. Over time, the expectation is for rates to continue to compress, eventually pricing similarly to a stock portfolio loan (LIBOR +2-3%).

- Non-custodial lending protocols vs. traditional custodial lenders. There are few notable advantages and disadvantages that lending protocols offer compared to traditional custodial lending. Some of the advantages of non-custodial lending allow for minimized counterparty risk, global 24/7 access to credit, and greater real-time transparency into outstanding loan books. Alternatively, lending protocols may not be suitable for all borrowers, as the UI/UX can introduce greater friction with limited product offerings, and the public nature of the data on-chain can weaken borrowing privacy (particularly an issue for institutional borrowers). While the narrative of crypto lending has recently focused more on the growth in utility of non-custodial lending protocols (Aave with nearly ~$600M in outstanding debt and money market protocol Compound at +$2B, as examples), custodial crypto-backed lending is an important trend to follow as well — and will able to compete against more efficient protocols by offering strong fiat rails, dollar funding direct to bank accounts, and the flexibility to iterate and diversify product offerings in a regulatory compliant way. This last point is key for servicing institutional investors in the West that require to know-their-customer and who they are lending/borrowing from.

Final Thoughts — Risks and Opportunities

Credit is a feature, not a bug.

It wasn’t that long ago when the crypto industry response to the launch of BlockFi’s interest-bearing deposit accounts was rather mixed. Why send a company bitcoin if one can custody it themselves? Of course, these deposits are still very much uninsured outside of small pockets of custodian insurance — which hardly covers a meaningful portion of the entire customer deposit base.

From that perspective, there remain clear risks to any credit-based business model, especially those involving an emergent asset class that currently doesn’t offer deposit insurance (no FDIC insurance in the U.S., for instance). Not lost on anyone is the fact that BlockFi is growing deposits in a market with an ethos of “not your keys, not your coin.” BlockFi will need to continue to build more robust internal controls (particularly in managing counterparty risk), similar to that of a traditional capital markets bank. As events like last May showed — when BlockFi suffered a data breach that exposed customer email and postal addresses for ~50% of its customers — BlockFi is very much susceptible to the same risks as any financial services company. Maintaining the trust of its users is paramount for continued success.

The market is still in the early days of figuring out how to rationally price and sell counterparty risk for this asset class. But to be fair, the pricing and selling of risk is what ultimately helps drive the net benefit of price discovery, deeper liquidity, and ultimately maturation of a market. All good things, to be sure.

The launch of a crypto-interest bearing account from a well-funded (initially +$52 million from the likes of Galaxy Digital, SoFi, Susquehanna, Fidelity, etc.) and U.S. regulated lender in the space has been a landmark shift not just for BlockFi, but for the broader crypto industry. While some revere the idea of “the institutions are coming!” early 2019 was still lacking core market structure pieces that need to be addressed before major fiduciaries could fully step into the crypto market. Robust lending and deposit-taking markets were one such piece. Fortunately, 2020 has emphatically demonstrated how this may no longer be the case.

Since the launch of BlockFi’s interest-earning account program in early 2019, the company has grown deposits to more than $8 billion across more than 125,000 accounts. But it’s not just BlockFi driving the maturation of crypto credit markets. The fact that Genesis originated more than $19 billion in cumulative loans in 2020 speaks to the opportunity and demand from institutional clients to borrow and lend crypto. What was arguably an even bigger story in 2020 for crypto credit markets has been the rise and comfortability of retail consumers to deposit more than $10 billion dollars worth of capital (stablecoins, crypto-assets, synthetic crypto assets, etc.) into both audited and unaudited smart contracts (also known as “DeFi”). What’s even more remarkable about this statistic is the fact that this value only crossed $1 billion for the first time at the start of 2020. The industry has come along way since the start of BlockFi’s interest-earning program.

What now may seem obvious in hindsight — in offering a “neobank” model for crypto — BlockFi deserves credit for executing at a high level and in bringing in talent to deliver regulated and trusted financial products for the digital asset ecosystem across the globe.

Looking ahead, the company is well-positioned to benefit and capture value from any potential secular growth tailwinds, even if and when more competitors build similar capabilities overtime.

Sources

Neobank: What Is It? The Balance. Sep 2020

The Scoop Podcast: Zac Prince. The Block. July 2019

Fidelity is backing a crypto lending startup that’s looking to launch a crypto credit card. The Block. Dec 2018

Crypto cash back: BlockFi looks to boost market with launch of high-interest accounts. The Block. Mar 2019

[Research] BlockFi exemplifies the value of bitcoin-focused fintech companies. The Block. July 2019

BlockFi confirms its valuation doubled in roughly 2 months. The Block. Dec 2019

BlockFi clinches $18.3M Series A led by Valar. The Block. Aug 2019

BlockFi hires former American Express exec as it gears up for bitcoin rewards card launch. The Block. May 2020

BlockFi is looking to hire a CFO ahead of possible IPO in 2021. The Block. July 2020

BlockFi raises $50 million, eyes potential SPAC. The Block. Aug 2020

BlockFi plots retail launches in Europe — but not the UK. The Block. Nov 2020

Genesis clocked in $8 billion in spot volumes, originated $7.6 billion in loans during Q4. The Block. Jan 2021

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.