Go to Source

Author: Sebastian Sinclair

Go to Source

Author: Omkar Godbole

Go to Source

Author: Sebastian Sinclair

Tesla CEO Elon Musk has changed his Twitter bio to mention only Bitcoin.

The move is similar to Twitter CEO Jack Dorsey, who has since long been a bitcoin supporter.

The bitcoin mention by Musk means his more than 43 million followers could be keen to learn more about the world’s largest cryptocurrency.

This is a developing story and will be updated…

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

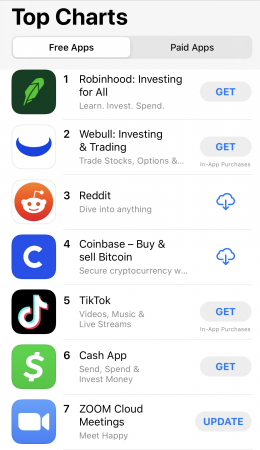

Coinbase has entered the top 10 ranking of free apps on Apple’s U.S. mobile store.

Live ranking of the free apps on Apple’s App Store in the U.S. shows Coinbase ranks the 4th as of Friday, following Robinhood, Webull and Reddit while ahead of TikTok, Cash App and Zoom.

The new ranking comes weeks after Coinbase advanced to the top 30 free apps on the U.S. App Store earlier this month.

Outside the U.S., Coinbase ranks the 15th and 131st on the U.K. and Singapore App Store.

Meanwhile, Binance’s mobile app has also entered the top 20 free apps ranking and now at the 3rd and 18th spot on Apple’s App Stores in the U.K. and the U.S., respectively, living ranking shows.

On the other hand, The Block’s data dashboard shows Coinbase’s ranking on the Google Play store in the U.S. has fallen from the top 19 to right now the 57th spot.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Wolfie Zhao

Visa dedicated a section to crypto during its Q1 2021 earnings call today. In his prepared remarks, CEO Alfred Kelly said Visa is poised to make crypto payments safer and more widely used through its partnership approach.

Kelly said Visa plans to work with wallets and exchanges to enable Visa users to purchase crypto-assets, and to allow users to cash out and make fiat purchases with their crypto.

During the call, Kelly described how the payments giant sees digital assets. At the moment, Visa sees two classes of digital assets, according to Kelly. Those that represent new assets, like bitcoin, Visa views as “digital gold,” and those that are fiat-backed, including stablecoins and central bank digital currencies. He called the second category “an emerging payments innovation that could have the potential to be used for global commerce.”

Kelly also teased the possibility of Visa enabling crypto as a payment itself, rather than converting crypto to fiat for payments.

“It goes without saying to the extent specific digital currency becomes a recognized means of exchange, there’s no reason why we cannot add it to our network, which already supports over 160 currencies today,” said Kelly.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

Quick Take

- Disclaimer: The Block Research team has, is, and will be experimenting with the various protocols, projects, and applications mentioned in this series. The projects mentioned in our reports are not recommendations from our team and should not be misconstrued as investment advice. Many projects that appear in this series are highly experimental and, as such, will come with risks. Readers should evaluate their own risk tolerance before experimenting with these projects.

- DeFi Digest is a weekly digest that summarizes recently launched projects and applications that our research team found interesting.

- This week’s digest looks at Zora, uVOL, Ruler Protocol, and Ribbon Finance

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Steven Zheng

Crypto startup The Graph has announced it is exploring providing support for additional layer-one blockchains, including Bitcoin, Polkadot and NEAR.

The potential integrations, which comes over a month after The Graph launched on mainnet, would add to the startup’s existing list of supported chains, including Ethereum, IPFS and POA. The Graph’s service enables the querying of data across many blockchains.

For instance, the Bitcoin integration would allow developers on layer-two Bitcoin projects to use some data they need from Ethereum or whatever other layer-ones that are integrated. The Graph’s integrations across that first layer will allow developers to use each integration’s best features to build their apps.

“After launching mainnet, we are looking to accelerate the upward trajectory of the Web3 ecosystem. That means ensuring that no matter which Layer 1 blockchain you are building on, you can build a subgraph and easily access data from across chains,” said Director at The Graph Foundation Eva Beylin. “We think this is a key part of unlocking that next wave of innovation on the decentralized internet.”

According to the startup, the new layer-one integrations are expected to take place in the next few months, depending on community interest and engagement.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Saniya More

Nearly six months after FTX acquired the crypto price tracking app Blockfolio in a $150 million deal, the platform is now ready to roll-out a crypto trading functionality.

Blockfolio got its start in the crypto market as a place where users could track the price of various cryptos and the performance of their holdings. The new functionality — which will be powered by FTX’s trading systems — will put the firm up against a long list of players that offer crypto trading, such as Coinbase and Robinhood.

Blockfolio believes its advantage over the competition will rest on its pricing model. The firm will be among the few platforms in crypto that offer zero-fee crypto trading (most charge around 50 basis points to make a trade). Blockfolio also has the benefit of having an established, loyal user base of more than 6 million.

“There is a wave of new users coming into the crypto space who need simple, easy tools to help them navigate what can be a daunting industry,” Jonathan Chu, head of product at Blockfolio, told The Block. “Since we’ve always tried to be the most user-friendly companion app for the crypto industry, bringing dead-simple, zero-fee trading into the app was a natural next step for Blockfolio.”

As for how the new feature will be monetized, the firm said it would offer superior prices to its competitors and capture a percentage of that price improvement.

The roll-out comes at a time when the market has been more focused on institutional activity in bitcoin. Since FTX’s acquisition of Blockfolio, headlines about large asset managers and hedge funders have dominated crypto-related headlines.

Still, Blockfolio sees retail activity on the rise. The firm points to bitcoin addresses hitting an all-time high earlier this month, and The Block’s own data shows Google searches for Ethereum hit an all-time high this month.

In some instances, the increase in retail activity has caused some platforms to buckle under the pressure. On Wednesday, Robinhood’s crypto platform reported issues, as previously reported by The Block. Earlier this month, Coinbase said it would overhaul its own infrastructure after an outage that affected its retail userbase.

Blockfolio says that offering a “clean user experience” will be a focus of the new function.

“Our plan with this launch is to listen to our users and iterate quickly together to improve the experience based on their feedback,” Chu said. “We’re lucky to have a really passionate user base — I’m pretty confident they’ll be vocal in letting us know what’s working and what isn’t!”

Retail mania

In some respects, the crypto market has been stuck in the shadow in U.S. equities in recent days. Stocks from GameStop to AMC have hit eye-popping values on the back of social media activity, triggering an array of responses from trading platforms, regulators and market observers.

FTX — which will offer some of its products through the Blockfolio app — has been working to capitalize on that fervor through the listings of various tokenized stocks as well as pre-IPO futures contracts in firms like Coinbase and Airbnb. Indeed, the firm said it would offer to its international users trading in three stocks that Robinhood has paused buys on: GameStop, AMC, and Nokia.

In the future, FTX could offer stock trading on both FTX.US and Blockfolio. The firm is in the process of acquiring a broker-dealer that would set the foundation for such an offering. Such an option is now available for international users outside of the U.S.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

MicroStrategy wants to acquire more bitcoin, according to the firm’s Q4 2020 results filing, and it’s exploring alternative avenues for doing so.

Michael Saylor, who was quoted in the Q4 results, remarked on the publicly-traded company’s bitcoin treasury strategy, which has seen it acquired tens of thousands of BTC to date.

Saylor noted:

“Regarding our bitcoin strategy, our pioneering decision to make bitcoin our primary treasury reserve asset has made MicroStrategy a thought leader in the cryptocurrency market and generated great interest in MicroStrategy as a corporation. Going forward, we continue to plan to hold our bitcoin and invest additional excess cash flows in bitcoin. Additionally, we will explore various approaches to acquire additional bitcoin as part of our overall corporate strategy.”

What those alternative means might constitute is unclear based on MicroStrategy’s statement.

Earlier this month, MicroStrategy announced that it had obtained $10 million in additional bitcoin for its treasury. To date, the firm holds 70,784 BTC — an amount worth roughly $2.3 billion at press time.

In November, executives from the firm remarked during a virtual investor day that it is exploring the development of bitcoin data products. At the time, MicroStrategy said that it was at the initial stages of building a team to pursue potential products in that area.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Michael McSweeney