Crypto market maker Alameda Research has acquihired Ren — the DeFi project behind the development of tokenized bitcoin renBTC.

The news means Ren’s core development team, around 10 to 20 people, will join Alameda, Alameda CEO Sam Bankman-Fried told The Block.

“We expect them to keep producing good projects and not really miss a beat,” said Bankman-Fried.

Specifically, the Ren development team will add support for Solana in its RenVM protocol. RenVM is a cross-chain network that connects different blockchains with Ethereum and currently supports Bitcoin, Bitcoin Cash, and Zcash, among other blockchains.

“We anticipate that we will be able to begin bridging assets to/from Solana in Q2,” said Ren CEO Taiyang Zhang. “Doing so will have a profound impact on Serum, but also on the wider Solana ecosystem.”

Serum is FTX’s decentralized crypto exchange built on Solana, and FTX is a sister company of Alameda.

The Solana support will also help RenVM, said Zhang. “The upcoming support for Solana, and integration into Serum, will help bring even more volume and users to RenVM […] RenVM will see new and diverse assets, new users, and increased fee revenue for its node operators.”

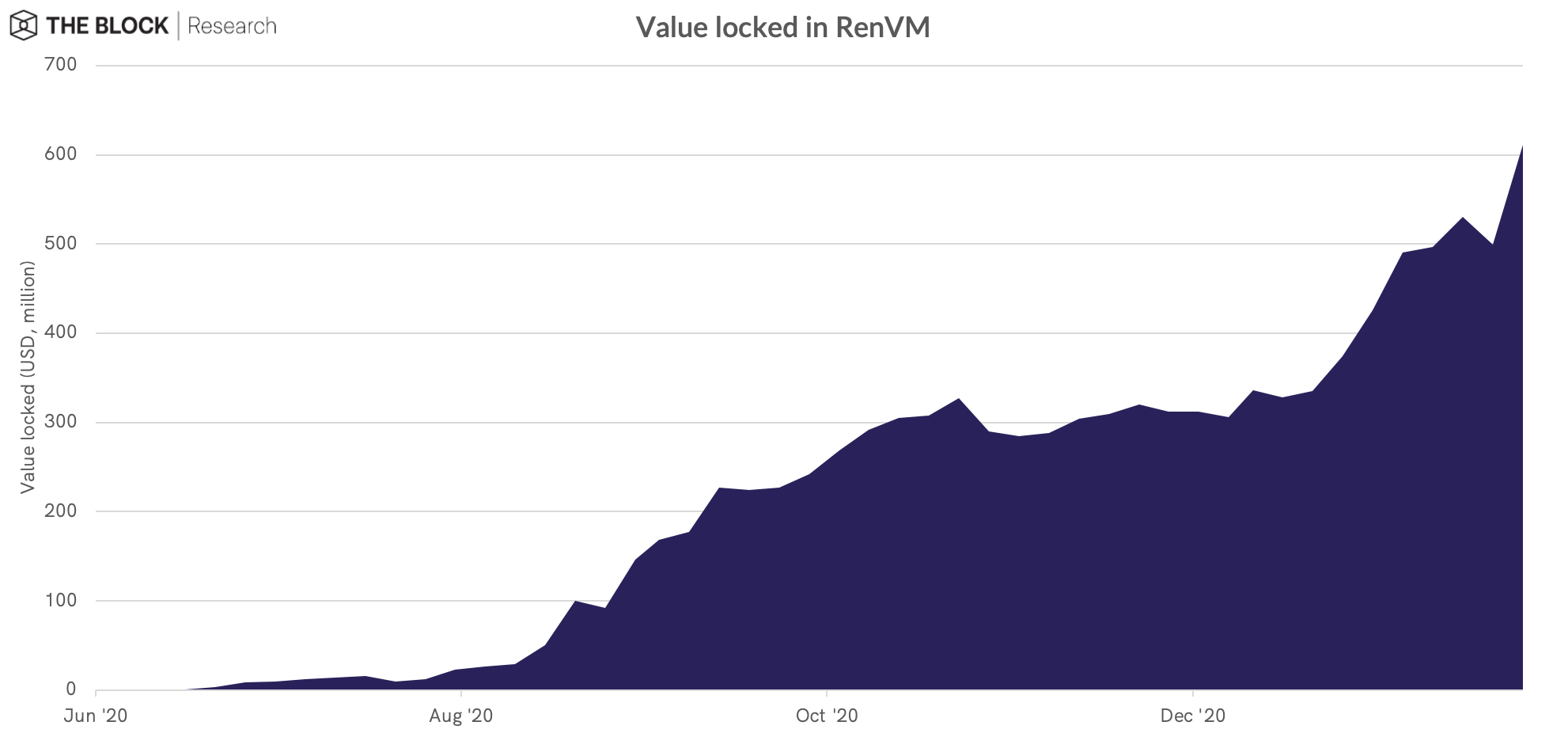

RenVM mainnet went live in May last year and currently has more than $600 million worth of user deposits, as The Block Research reported last week.

Source: Ren, The Block Research

Source: Ren, The Block Research

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri