This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Andreas Nicolos

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Andreas Nicolos

The 98-year old publication Time Magazine now accepts bitcoin and other cryptocurrencies for digital subscription payments.

Announcing the news on Monday, Time said it has partnered with Crypto.com for the feature, which is currently only available in the U.S. and Canada. Global access is expected to be rolled out “in the next several months.”

Time will accept all cryptocurrencies currently supported by Crypto.com Pay, a Crypto.com spokesperson told The Block. These include bitcoin, ether, dogecoin, XRP and litecoin, as well as DeFi tokens Uniswap, Aave, Balancer, and Compound.

Subscribers who pay with Crypto.com’s native token CRO will get rewards of up to 10%, said Time.

Time will keep accepted cryptocurrencies from subscribers. “Cryptocurrency payments for digital subscriptions will be held as crypto,” a Time spokesperson told The Block. The publication has 2.3 million subscribers, according to its president Keith Grossman.

Time has taken several crypto initiatives in recent weeks. Last month, the publication auctioned off three of its covers as non-fungible tokens (NFTs) for $435,000. Time is also hiring a new chief financial officer who understands bitcoin and other cryptocurrencies.

The publication is also partnering with crypto asset manager Grayscale on a new video series on the crypto space. Time will receive payment in the form of bitcoin and then hold the funds on its balance sheet, according to Grayscale CEO Michael Sonnenshein.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Pluto Digital Assets, an investment firm focused on decentralized technologies, is planning a stock market flotation on the Aquis Stock Exchange in London.

The company was only incorporated in January but raised $40 million in March in a round led by Argo Blockchain, a crypto mining company that’s also listed in London. Pires Investments and Riverfort Global Opportunities also participated in the raise.

People familiar with the matter told The Block that Pluto is currently in discussions with Aquis about listing its shares on the exchange.

Peter Wall, CEO of Argo and a director of Pluto, confirmed that Pluto is “rocketing to its IPO on the London Aquis Exchange, with a target of late May 2021 for its admission.”

“There is a material lack of scalable crypto-oriented companies available on public stock markets in the UK. With the support of its strategic shareholder Argo Blockchain, Pluto is listing to address the gap between the massive growth in DeFi and the lack of equity investment capability available to UK stock exchange investors,” he added.

Argo holds a 25% stake in Pluto, according to an announcement in March.

Wall and his fellow executives at Argo – which has a market capitalization of $590 million – are making a habit of taking crypto investment vehicles public in London.

He is an adviser to NFT Investments, the non-fungible token investment firm which raised £35 million by listing on Aquis on April 13. Argo co-founders Jonathan Bixby and Mike Edwards also sit on the board of NFT Investments.

Argo’s Edwards set up Dispersion Holdings, a decentralized finance investment firm which on April 19 announced its intention to float on the Access segment of Aquis Stock Exchange Growth Market. The firm hopes to raise £10 million before expenses at a valuation of £25 million.

A person close to these companies said Pluto differed from NFT Investments and Dispersion in that it has already been in business for a few months, meaning it may take longer to complete checks and balances ahead of a listing. It is not yet clear, they added, how much money Pluto will look to raise or at what valuation.

Pluto would not be the first investment firm of its kind to come to market in London. KR1, a blockchain investment firm founded in 2016, also trades on Aquis. It currently has a market capitalization of £184 million – up significantly since the start of the year.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Ryan Weeks

Crypto exchange OKEx has now integrated Bitcoin’s Lightning Network after first announcing its plan to do so in February.

OKEx users can now use the Lightning Network, a Layer-2 scaling solution for bitcoin. The feature is currently live on OKEx’s desktop website, with mobile to be followed.

With the Lightning Network, the average cost of bitcoin transactions will come down to “less than 0.01 cents,” OKEx CEO Jay Hao told The Block in February. Whereas average transaction confirmation time will reduce to “1-3 seconds,” Hao said at the time.

While there seem to be cost and speed benefits with the Lightning Network, there are certain limitations. The network is primarily meant for smaller transactions. Hao told The Block in February that OKEx would set a limit of up to 0.05 BTC (currently worth around $2,830) on transactions.

It is not clear whether the transaction limit has changed since then. The Block has reached out to OKEx and will update this story should we hear back.

The Lightning Network was launched in 2018. A number of crypto exchanges currently support the network, including OKCoin, Bitfinex, and Bitstamp. Earlier this year, Kraken also announced its plan to integrate the network. Other U.S.-based exchanges, such as Coinbase and Gemini, do not currently support the network.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

City Comptroller candidate Reshma Patel unveiled crypto-specific aspects to her platform today, including a call for allocating a portion of the city’s pension funds to crypto.

The City Comptroller’s office may be under extra pressure this year to aid the financial recovery of the COVID-19 pandemic. In an interview with The Block, Patel said she decided to run this January because she’s concerned about the long-term financial health of the city.

“I want to make sure that we’re steered in the right direction as we come out of the economic fallout from the COVID-19 pandemic,” she said. “I start thinking about new ways we could do stuff, and one of those is we need more transparency and efficiency in our city government.”

The comptroller oversees how the city allocates its money, specifically by managing government contracts for projects and investing the city’s retirement funds. If Patel is elected, crypto and blockchain would have a role in the current recovery and future planning, with one to three percent of each of the city’s five retirement funds will be invested in cryptocurrency, per the candidate’s plan.

“Fears of inflation today, and through the future, are valid, and that is why some of the world’s most forward-thinking companies, like Tesla and Square, have invested a portion of their total cash reserve in bitcoin,” Patel’s plan states. “It is clear that cryptocurrencies have a future in finance and should have a future in the financial planning of New York City.”

She also plans to make investments in “blockchain-specific” funds. She plans to convene a task force to examine how the city can more directly invest in blockchain tech. This would serve a dual purpose according to Patel’s platform: “capture enhanced returns and support New York City-based fintech start-ups while learning more about how this cutting-edge technology can help New York City residents.”

That’s why in addition to allocating some funds to crypto, Patel also wants to use blockchain in the procurement system — the way the office awards and pays out government contracts for city projects.

Right now, Patel says the comptroller’s office has a 30-day deadline to settle on a contract, but other supporting agencies don’t have the same time restrictions. This can lead to a situation where the office doesn’t receive the necessary funds to execute a project for long swaths of time, which could force it to take out a loan to pay those providing services.

“Especially in a year like last year where we couldn’t do fundraisers and we had fewer funds, it was even harder situation for us to have to wait for the contract to be processed,” she said.

Using blockchain, she said, could create the transparency and speed needed for multi-agency collaboration. Patel said she’s seen these pain points first hand since working as a financial advisor to issuers of municipal bonds, meaning she spent ample time in the comptroller’s office, even training new staff there. The current system hurts the city, but it also limits a lot of small firms from doing business with the city since they can’t always afford to wait to begin work.

Patel sees this as a way to directly support start-ups, but she said she’s also looking at indirect ways. Though the comptroller’s main purview is investing the pension funds, it’s still a city office with influence. Patel said she plans to use that influence to make New York City a more attractive location for crypto start-ups. In her conversations with fledgling crypto firms, she said a continuous point of conversation became advocating for a second look at the BitLicense framework even though the work of the comptroller’s office is separate from the regulatory environment.

Current city comptroller Scott Stringer finishes his term this year and has been using the past few months to drum up support as a candidate for Mayor of the City of New York. Among his competitors are the crypto-friendly former presidential candidate Andrew Yang, who has said he would make the city a “hub for crypto” if elected. Yang has yet to outline a specific crypto agenda for the City.

Primaries for mayor and comptroller will take place on June 22.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

South Korea-based publicly traded video game development company Gamevil is set to acquire a 13% stake in local crypto exchange Coinone for 31 billion won (around $28 million).

Announcing the news on Monday, Gamevil said the acquisition, involving 87,474 shares of Coinone, is expected to complete on June 11.

With the investment, Gamevil looks to find new business opportunities in the crypto sector and increase corporate and shareholder value.

Coinone is the third-largest crypto exchange in South Korea by trading volumes, after UPbit and Bithumb. As for Gamevil, it is one of the largest gaming companies in the country, having a market capitalization of around 355 billion won (around $320 million).

Earlier this year, Gamevil rival Nexon was said to acquire Bithumb, but the company later denied such reports. Bithumb has been looking for a buyer since 2018.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Lars Hoffmann

The Bank of England and HM Treasury have jointly created a taskforce to explore a potential central bank digital currency (CBDC) in the U.K.

Announcing the news on Monday, the two government authorities said they have not yet decided whether to introduce a CBDC in the U.K. but will explore its use cases and risks.

They will also evaluate the design features of a CBDC and monitor international CBDC developments to ensure the U.K. “remains at the forefront of global innovation.”

If issued, a CBDC would co-exist with cash and banknotes rather than replacing them, said the authorities.

The taskforce will be co-chaired by Jon Cunliffe, Bank of England’s deputy governor for financial stability, and Katharine Braddick, HM Treasury’s director general of financial services. The central bank and the finance ministry will involve other U.K. authorities as appropriate, they said.

The Bank of England has also created a new CBDC unit, a CBDC engagement forum, and a CBDC technology forum.

The CBDC unit will lead the central bank’s internal and external coordination around potential digital currency. The engagement forum would focus on non-technical aspects of a CBDC, such as uses cases, roles of public and private sectors in a CBDC system, and data and privacy implications. The technology forum, on the other hand, will focus on understanding the technological challenges of designing, implementing, and operating a CBDC.

This is a breaking news story and will be updated…

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

A vice governor of the People’s Bank of China (PBoC) has said the country regards bitcoin and stalecoins as crypto assets – not currencies – and hence they are investment alternatives.

Li Bo, a recently appointed deputy governor of the Chinese central bank, said during the Bo’Ao Asia Forum event that until the PBoC figures out what kind of regulatory requirements it needs to prevent the speculative nature of such assets from creating any serious financial stability risk, it will keep its current stance on the asset class.

Li made the remark in English in a panel discussion on the overall topic of central bank digital currency on Sunday night China time. He was joined by Zhou Xiaochuan, the former governor of the PBoC, Agustín Carstens, the general manager of the Bank for International Settlements, as well as executives from Thailand’s central bank and SWIFT.

Li’s comment was in response to the question brought up by the moderator Arjun Kharpal, a senior correspondent at CNBC, on whether China will maintain a tough stance on crypto trading activities going forward.

“We regard bitcoin and stablecoins as crypto assets. Crypto assets, as Agustin just discussed, these are investment alternatives, they are not currency per se. The main goal we see for crypto assets, going forward, they are mainly investment alternatives,” he said, adding:

“As for investment alternatives, many countries, including China still, [are] looking into it and thinking about what kind of regulatory requirements – maybe minimal but we need to have some kind of regulatory requirement – to prevent the speculative nature of such assets [from creating] any serious financial stability risk. And before we have a clear idea what kind of regulation we need, I think we will keep our current regulation,” he added.

The Chinese central bank issued a ban in 2017 on initial coin offering activities and ordered domestic crypto exchanges to stop the fiat on- and off-ramp channel for investors.

The main thinking was that no centralized crypto exchanges should be allowed to be a banking custodian of the Chinese yuan on behalf of their customers. Since then, exchanges like Huobi and OKEx could only have crypto-to-crypto order books while offering over-the-counter desks as a fiat on-ramp method for users.

In addition, Li’s comment on stablecoins was also in line with other central bank executives that a strong regulation needs to be in place.

“For stablecoins, they are crypto assets, and if they want to be accepted widely as a payment solution, we need stronger regulations, stronger than bitcoin maybe, in the sense, something like a currency board,” he said. “Going forward, I think stablecoin, which may have the vision to become a widely accepted payment solution, has to be regulated like a bank or a quasi-bank.”

Elsewhere in his remark, Li said China is on track to widen the adoption of its central bank digital currency, known as the e-CNY or DC/EP.

He added that during the upcoming Winter Olympics in 2022, the e-CNY will not only be open to domestic users, but also foreign consumers and international guests. But Li said the internationalization of Renminbi is not meant for replacing the dollars.

“Our goal is absolutely not to replace the U.S. dollars or any other international currency. Our goal is to let the market to choose,” he said.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Wolfie Zhao

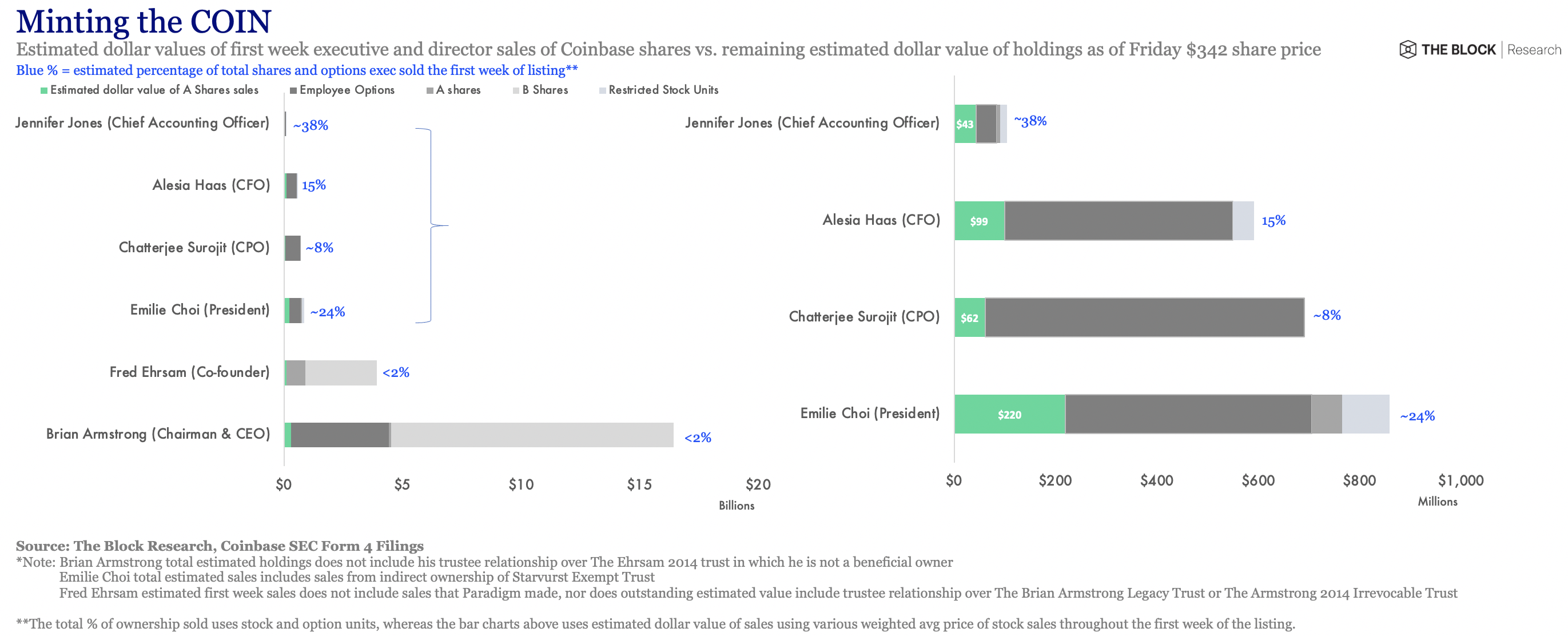

Coinbase sent shockwaves throughout the trading world after it tapped the public markets in a debut that’s been rivaled by some of the largest technology initial public offerings in history.

The exchange-operator’s fully diluted market capitalization hit more than $80 billion by the end of the first trading session, putting it up against several Wall Street titans such as Credit Suisse, Nasdaq, and Barclays. Still, the crypto world focused its attention not on Coinbase’s positive metrics, but how much its executives were selling its stock.

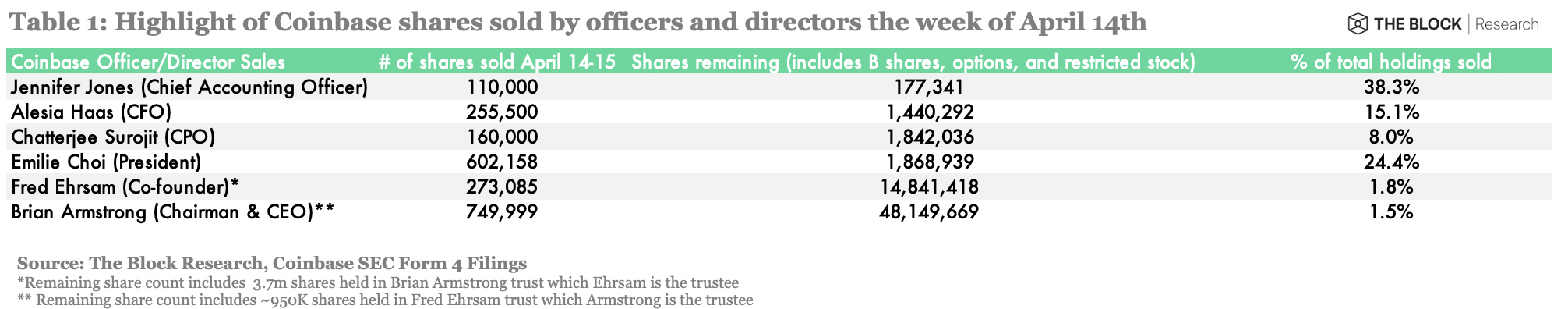

In a tweet that garnered several thousand retweets, one spectator noted that Coinbase’s management team sold-off the lion’s share of their equity. But data compiled by The Block from filings with the Securities and Exchange Commission suggests that the firm’s largest shareholders sold off just a fraction of their shares in the firm over the course of April 14 and 15.

So how much did Coinbase’s executive team sell during the first week of $COIN trading?

Chief executive Brian Armstrong, to start, sold less than 2% of his holdings. Meanwhile, CFO Alesia Haas—whom pundits erroneously said sold off 100% of their equity—only sold 15% of her total holdings – she still holds nearly $500 million in total holdings based on the price of $COIN at the close on Friday.

Chief operating officer Emilie Choi sold the second-most shares in percentage terms. The former LinkedIn M&A executive sold 24% of her shares during the first two trading sessions, offloading more than 50 shares close to the stock’s top above $420, according to SEC documents.

Jennifer Jones—the firm’s chief account officer—sold 38% of her total holdings, which is the most among executives in percentage terms.

It should not come as a surprise to the market that executives sold stocks. In a direct listing, there is no offering of shares like there is in a traditional initial public offering. As such, the sale of existing stocks by shareholders ensures there’s enough supply for a direct listing to execute.

Coinbase general counsel Paul Grewel noted this in a tweet Sunday night, commenting “To provide enough supply and invite new investors in, a company must sell a minimum of the total cap table for a successful listing. The largest shareholders are typically the investors and executives, so this means that they will often have the largest sales on listing day.”

The following chart shows exactly how many shares top Coinbase shareholders sold during the week of April 14. Unsurprisingly, Coinbase CEO Brian Armstrong sold the most shares (just under $300 million), but they represented a small fraction of his total ownership in the company. Choi sold slightly under $220 million in shares during the same period.

As for the performance of $COIN, the exchange ended the trading day on Friday at $342 a share, down a significant amount from where it was trading in the early hours after its market debut. Coinbase hit a low of $310 during the final hour of trade, reaching $328.28 at 4 p.m. ET. It ended that first session with a $85.7 billion fully diluted valuation.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro