Crypto exchange FTX has hired a former forex sales executive from HSBC, the U.K.’s largest bank, as it prepares to serve traditional financial institutions.

Jonathan Cheesman, most recently the head of forex sales to hedge funds and banks in London, has joined FTX as head of over-the-counter and institutional sales. In this role, Cheesman will be “a bridge between traditional finance and crypto natives,” he told The Block in an interview.

“I’m very happy to be a facilitator and a translator for people that are new to the crypto space in traditional finance,” he said.

Cheesman has been a crypto trader and investor since 2017. Before HSBC, he was a partner at the crypto venture firm Distributed Global, focussing on investor relations and strategy. Before Distributed Global, Cheesman spent 12 years at Goldman Sachs and Barclays working in forex sales roles.

When asked why he’s joining FTX now, Cheesman told The Block that it is “great timing” as crypto’s institutional adoption is just starting to pick up. “I’ll be able to leverage my relationships in the hedge fund community as well as servicing and learning from FTX’s crypto native community,” he said.

The hiring of Cheesman is one of the first steps in FTX’s bid to serve traditional financial institutions. FTX CEO Sam Bankman-Fried told The Block that the exchange is currently in contact with more than 30 traditional finance firms, including banks, payment processors, and hedge funds, to explore crypto offerings.

“We are proactively reaching out to a number of traditional finance firms to develop relationships, figuring out which products they want most, and building beta versions of those products,” he said.

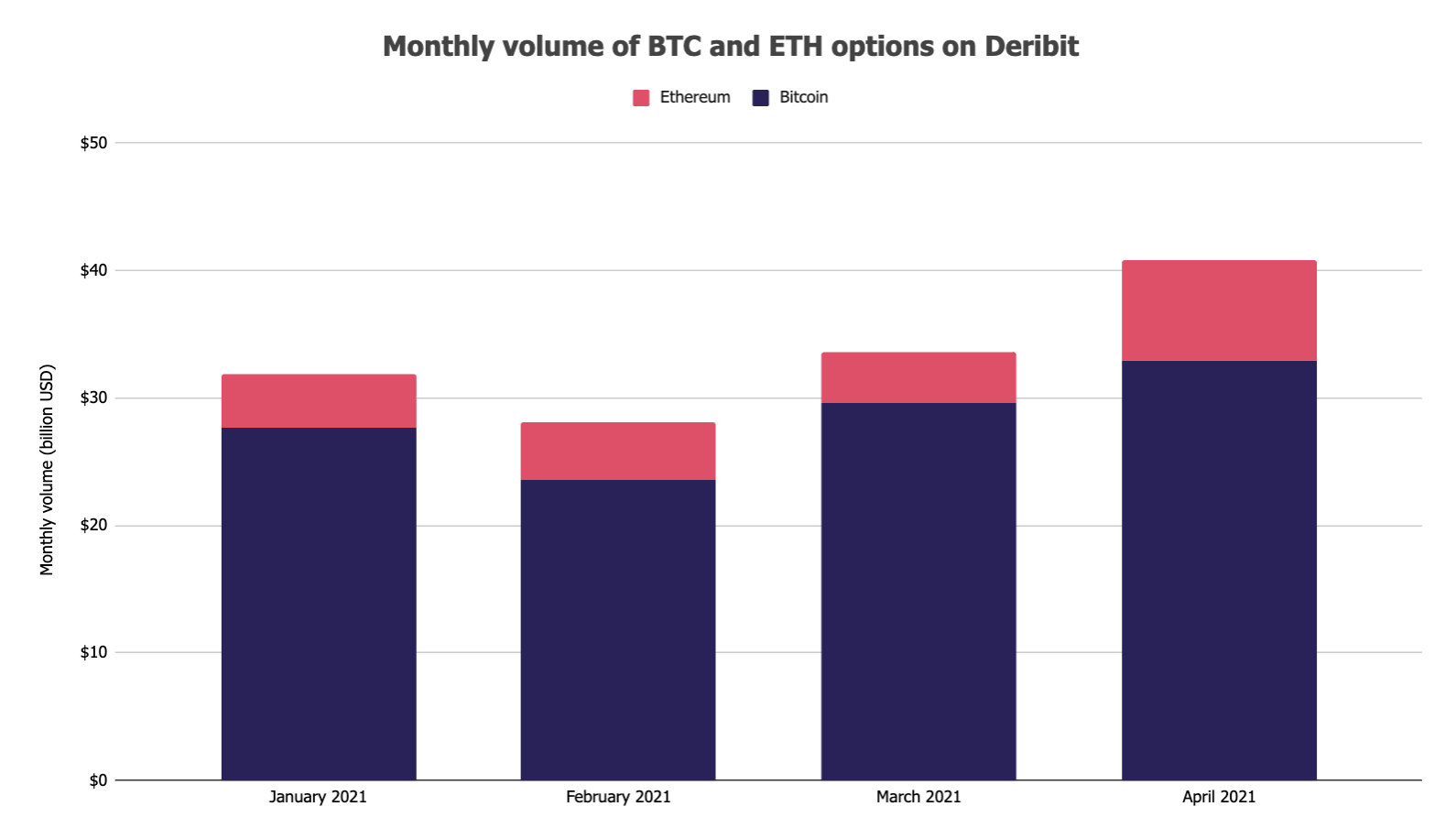

Bankman-Fried went on to say that many financial institutions over the past year have decided that they will dip their toes into the crypto space. While most of them haven’t yet done large volumes, FTX anticipates that there will be substantial increases this year.

“So, we want to be ready to support them,” said Bankman-Fried.

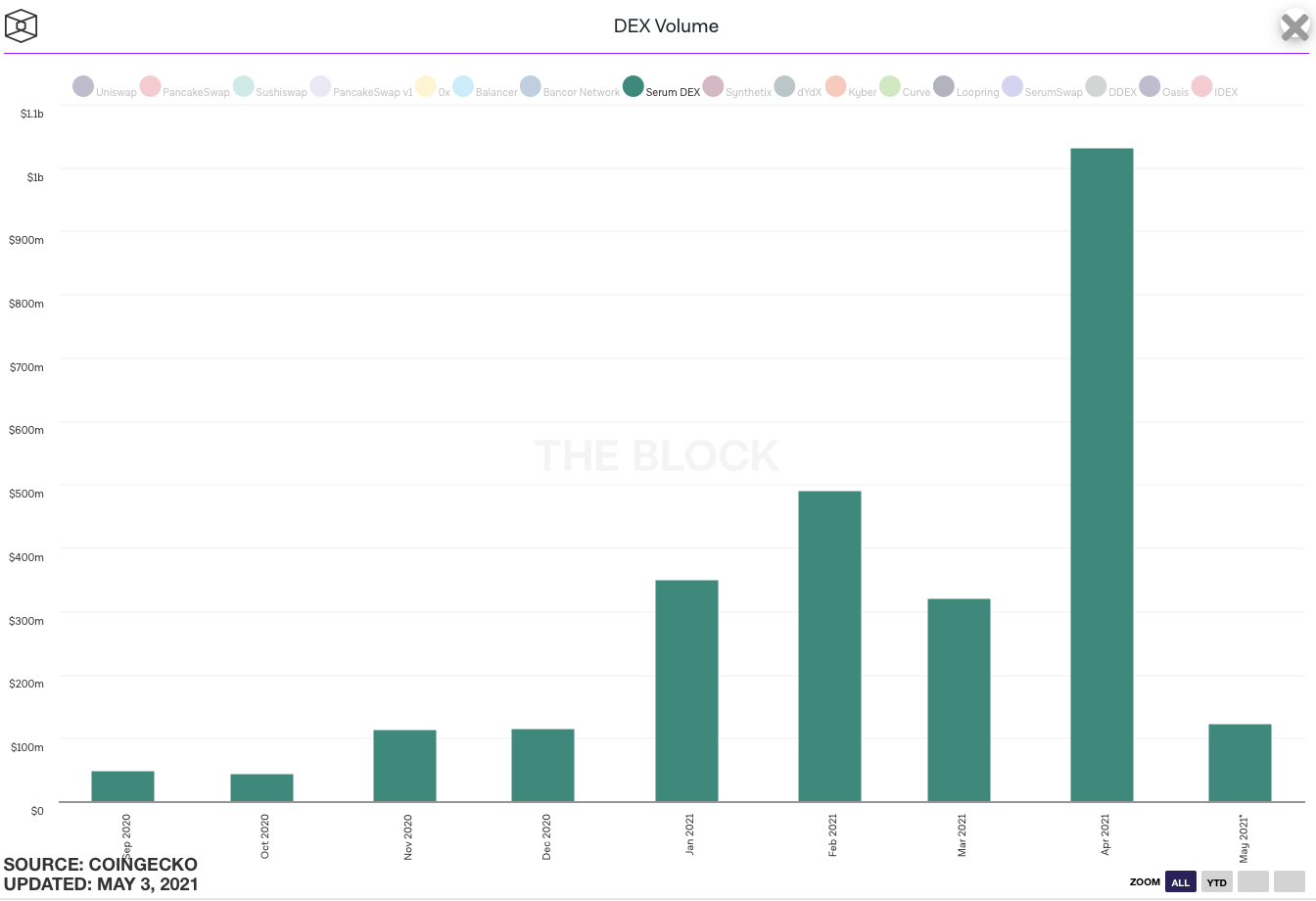

Cheesman told The Block that some of the products institutions are interested in include curve trades, custom baskets (such as DeFi index products), and total return products (main asset plus staking/ yield income). FTX’s core offerings include spot and derivatives trading, as well as products such as pre-IPO contracts and stock tokens.

Overall, FTX wants to be a “value add counterparty” for traditional finance institutions by helping them to find the best trades and potentially working with them on structuring products, said Cheesman.

To support its expansion plans, FTX is currently also raising a “big equity round” to support strategic partnerships, Cheesman told The Block. Bankman-Fried confirmed the round but declined to share details since the raise is ongoing.

FTX has grown significantly since the launch of its operations in 2019, and is currently the fourth-largest spot crypto exchange by trading volumes. FTX facilitated nearly $44 billion worth of spot trading volumes on its platform in April, according to The Block’s Data Dashboard.

In terms of derivatives trading, FTX is one of the largest exchanges in the space for both bitcoin futures and options. It is ranked fifth and sixth for bitcoin futures and options, respectively, by aggregated open interest, according to the Data Dashboard.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.