The Biden administration is contemplating how it wants to regulate stablecoin issuers, and people familiar with the matter say it’s considering encouraging firms to register as banks.

The Wall Street Journal reported the rumblings today, saying the administration is expected to recommend Congress draft legislation for a special-purpose charter for stablecoin issuers. This charter would be tailored to crypto business models, according to the Journal.

The news comes ahead of a forthcoming Treasury report on stablecoins. The highly-anticipated document is expected to highlight potential risks and set a framework for a federal approach to the stablecoin system. The report may also recommend that the Financial Stability Oversight Council (FSOC), the Treasury’s panel formed under Dodd-Frank for monitoring the financial system’s stability, take a closer look at stablecoins. However, sources told the Journal that this isn’t the administration’s “preferred approach.”

Stablecoins have remained top of mind for regulators in a variety of agencies as of late. The reports of the Biden administration’s plans to regulate issuers as banks come after both Acting Comptroller of the Currency Michael Hsu (OCC) and Securities and Exchange Commission (SEC) chair Gary Gensler each referred to stablecoin issuers as in the vain of the wildcat banks of the 1800s. Gensler also called stablecoins the “poker chips” at the casino-like platforms of the crypto “Wild West.”

Previous Comptroller and former Coinbase legal counsel Brian Brooks issued guidance clarifying that banks could custody stablecoin reserves and use stablecoins in payment settlements during his tenure at the OCC. That led many crypto firms, especially custody-focused enterprises, to apply for banking licenses. Some of those licenses are still pending due to Hsu’s review of crypto-related actions, but Anchorage got the green light prior to Brooks leaving office.

CEO and co-founder Nathan McCauley said the reported action coming from the Biden administration could create the necessary clarity for stablecoins.

“Dollar-denominated stablecoins represent an opportunity to further the strategic reach of the US,” he said. “The Biden administration is wise to embrace stablecoins in this way and look for ways to strengthen trust in the industry through regulation.”

Still, applying banking regulation to crypto firms hasn’t been easy due to the wealth of regulators with overlapping mandates on both the state and federal levels. For that reason, Hsu convened a “sprint team” of the three biggest players on the federal level: the OCC, the Federal Reserve and the Federal Deposit Insurance Corporation. Likewise, Gensler said securities regulation of the crypto space will likely require deeper collaboration between the SEC and his former place of work, the Commodity Futures Trading Commission.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

But even Zirlin admitted that interest can wane as quickly as it has built up:

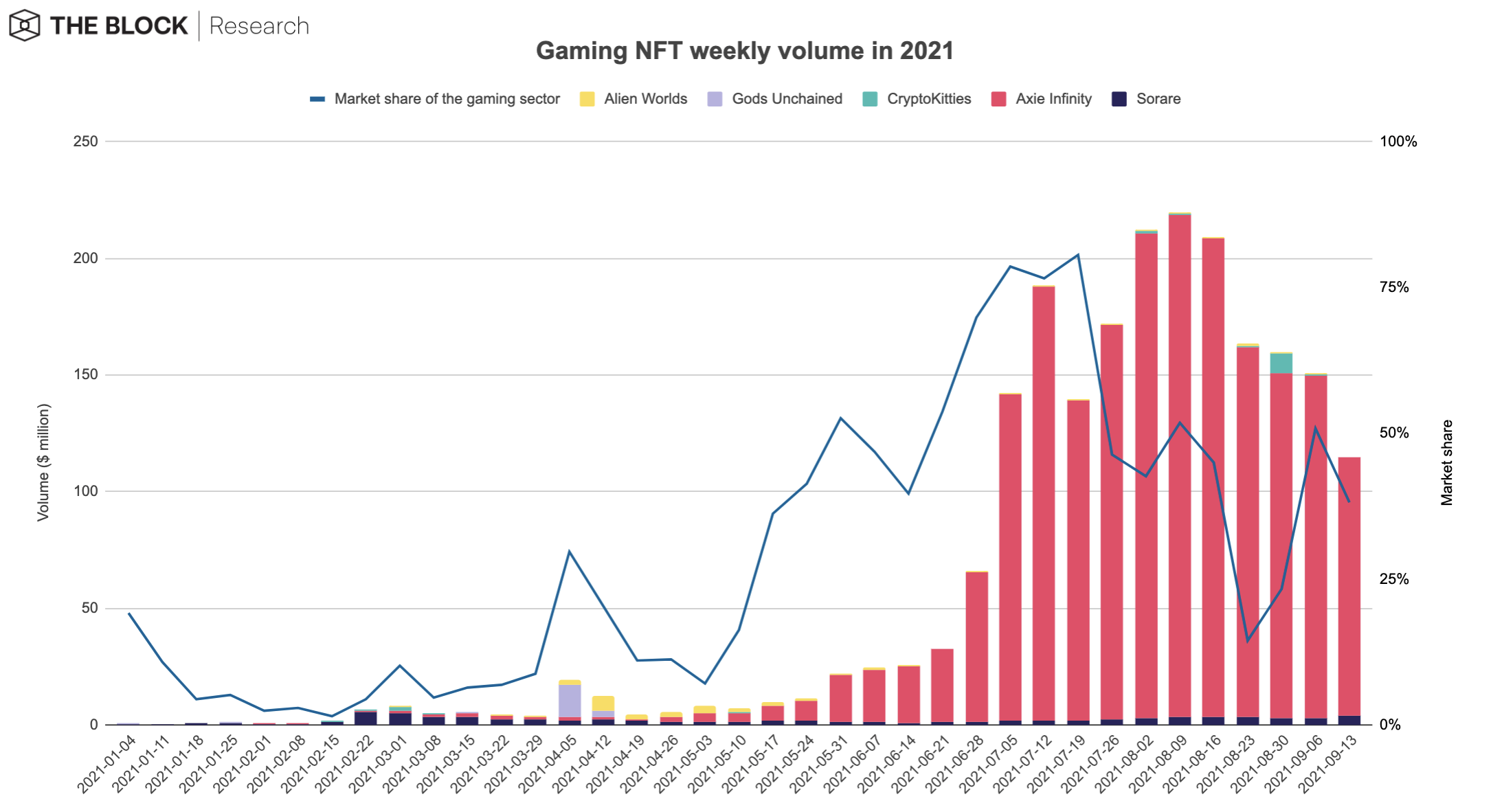

But even Zirlin admitted that interest can wane as quickly as it has built up: Axie Infinity, one of the most popular blockchain gaming startups, is bridging the nascent gaming world with the market for decentralized finance with the launch of a new decentralized exchange.

Axie Infinity, one of the most popular blockchain gaming startups, is bridging the nascent gaming world with the market for decentralized finance with the launch of a new decentralized exchange.