For many advisors, allocating to bitcoin for their clients is a difficult thing to do. Advisors are faced with a difficult decision: They can use something like the Grayscale Bitcoin Trust (GBTC) to gain exposure, or they can help their clients set up a bitcoin/crypto account that is not under their management.

Outside of these two options, there really aren’t many other solutions that are easily accessible for advisors. This problem has caused quite a few debates in the advisory world – one that could quite easily be solved with the U.S. Securities and Exchange Commission (SEC) approving a bitcoin exchange-traded fund (ETF).

The first bitcoin ETF filing was made in 2013, and was quickly denied by the SEC. The last formal bitcoin ETF denial happened in 2018. There is now quite a list of bitcoin ETF applications waiting to be approved or rejected by the SEC. Most of them are “physical” bitcoin ETFs – funds that will hold actual BTC.

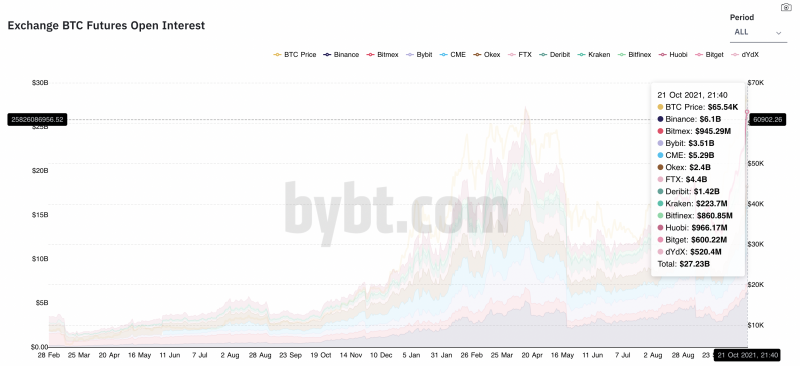

Interestingly, there are several bitcoin futures-based ETFs waiting to be approved, with the first-ever ETF approval being the ProShares Bitcoin Futures fund (BITO), which began trading this week. Another notable application is Cathie Wood’s Ark Investments’ (ARKA) futures-based ETF.

Beginning in the first part of 2021, with Gary Gensler now the chairman of the SEC, we’ve seen multiple bitcoin ETF filings. According to Nate Geraci, the host of the “ETF Prime” podcast and president of the ETF Store, a registered investment advisor, this was due to the fact that Gensler has been seen as being historically pro-crypto, having taught blockchain courses at MIT.

Futures-based ETF vs. ‘physical’ ETF

As of Oct. 19, the SEC approved a futures-based ETF and the first fund (BITO, by ProShares) began trading. The fund had an astounding nearly $1 billion of volume in the first day of trading. To put this in perspective, this is the highest first-day organic volume seen in ETF history.

Bitcoin futures held by a fund create interesting problems, however. For example, if the bitcoin futures curve is in “contango” (the out-months are trading at a higher price than the front-months), this is equivalent to selling low and buying high. When futures are held in an ETF, they must be rolled at the end of each month. This creates what is called a negative roll yield – creating a decay in terms of return.

What this really boils down to is that a futures-based ETF will have a difficult time tracking the spot bitcoin price, and it will be an expensive way for advisors to allocate to bitcoin for their clients. But it might be the easiest option for quite a while.

“One of the main benefits of a futures-based ETF is that the futures are cash settled. There’s no custody. So, if the SEC has any issues around custody with bitcoin itself, that won’t be a concern with a futures-based bitcoin ETF,” according to Nate Geraci.

A “physical” ETF, however, does not have the same problems as a futures-based solution. While crypto trading, custody and reporting is more expensive than traditional finance, a physical bitcoin ETF will not have the same drag as a futures-based ETF. We can certainly expect a physical bitcoin ETF to be more expensive than most ETFs on the market, but likely cheaper than a futures-based ETF.

We can also expect a physical bitcoin ETF to track the spot bitcoin price more accurately than a futures-based ETF. Companies like Grayscale, which currently offers the Grayscale Bitcoin Trust (GBTC), have filed to convert to the ETF structure. [Editor’s note: Grayscale is owned by Digital Currency Group, the parent company of CoinDesk.] GBTC currently trades at a -20% discount to the spot bitcoin price, a phenomenon that many ETF experts believe will go to 0% upon ETF conversion.

Nate Geraci, for example, believes that we will not see a physical bitcoin ETF approved until the second half of 2022 at the earliest – and I agree with him. This is unfortunate because there is obviously demand for a physical bitcoin ETF.

Other means of crypto exposure

Advisors might wonder what other solutions exist for achieving bitcoin exposure for their clients. There are a few firms that offer separately managed bitcoin and crypto accounts (SMAs), but implementing these strategies is not as simple or elegant as simply buying an ETF.

One major advantage that SMAs have over ETFs is the fact they are able to trade actual bitcoin and potentially earn yield on the position. They are also much nimbler and won’t be limited to one cryptocurrency. As a bitcoin investor since 2012, I personally believe direct ownership is the best way to purchase bitcoin (although often not the most convenient).

The bitcoin ETF marketplace is quickly evolving. Advisors will shortly have the ability to allocate to bitcoin for their clients in multiple different ways: helping clients set up crypto accounts with crypto exchanges, a futures-based ETF, or even an SMA. Advisors are responsible for determining and researching the best way to achieve this allocation. Fortunately, it seems that the number of opportunities to do so is quickly increasing.