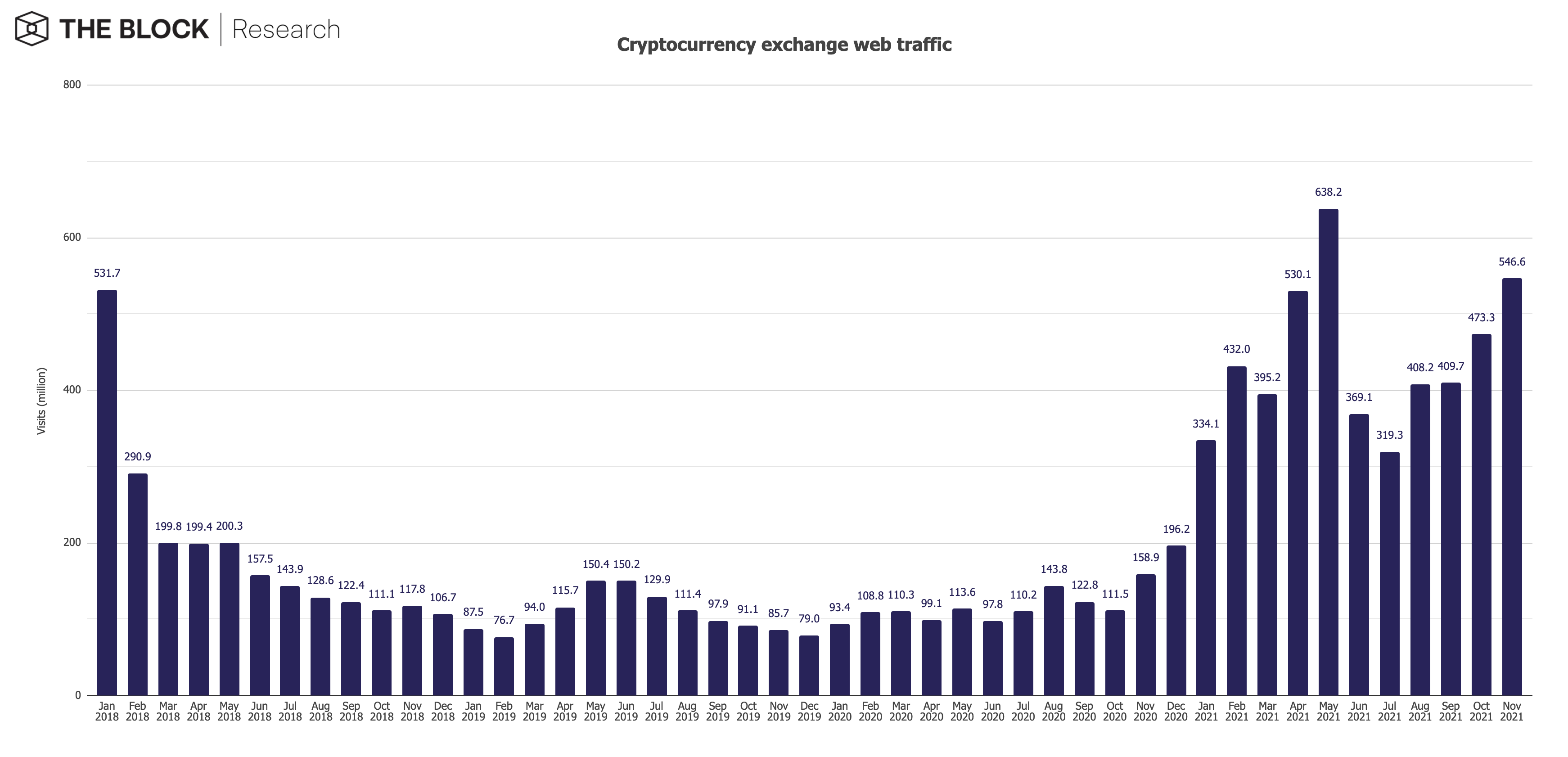

Crypto exchange websites saw internet traffic of 546.6 million visits in November, according to The Block Research.

The November website traffic figure is the second-highest in 2021 behind the 638.2 million visits recorded in May. December 2017 — the height of the crypto bull run from that year — is likely the monthly period with the largest cryptocurrency exchange website traffic.

Despite regulatory challenges across the globe, Binance still accounted for more than a third of total crypto exchange website traffic. Coinbase contributed almost a fifth of the total figure to place with KuCoin and Bybit in third and fourth, respectively.

According to The Block Research’s Lars Hoffmann on Twitter, retail client inflows from traders in the United States contributed to KuCoin and Bybit’s high placement in the rankings.

By reaching 546.6 million, November’s web traffic figure constituted a 15.5% month-over-month increase. Since experiencing consecutive volume declines in June and July, crypto exchange web traffic has been on the uptick.

This increase in web traffic has been in tandem with the crypto market recovery that occurred in Q3 following the May market dip that saw cryptocurrency prices fall by over 50%. Trading volume has also increased steadily during the same period.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Osato Avan-Nomayo