Cryptocurrencies were trading in the red Thursday morning as investors across the market rushed for safety after Russia staged a military attack on Ukraine.

According to data from CoinGecko, bitcoin was trading down 7.9% over the last 24 hours, while ether was trading down more than 10% over the same period. Long-tail assets saw an even steeper sell-off, with Avalanche, Shiba Inu and Cardano falling by double-digit percentage points.

“Big risk off move across the board,” noted Chris Hermida of Manna Trading.

The price action in the crypto market again illustrates the degree to which liquid tokens have tracked global stocks — similar to the way it has amid the US Federal Reserve’s plan to hike interest rates. The news out of Ukraine is expected to add further pressure to a global economy gripped by mounting inflation and supply chain headaches. The Dow Jones Industrial Average was trading down more than 2.23% at the time of writing.

Indeed, this is the latest example of bitcoin failing to live up to its promise as a hedge against various forms of uncertainty. It’s 30-day correlation to gold—which has long been viewed as a safe haven asset in times of distressed markets— slipped from 0.28 on February 16 to 0.17 on February 22, while bitcoin’s correlation to the S&P 500 has ticked up.

“The correlation between crypto and stock markets has been pretty solid over the last few months on both inflation news and geopolitical issues,” noted Nigel Green, chief executive officer of deVere Group.

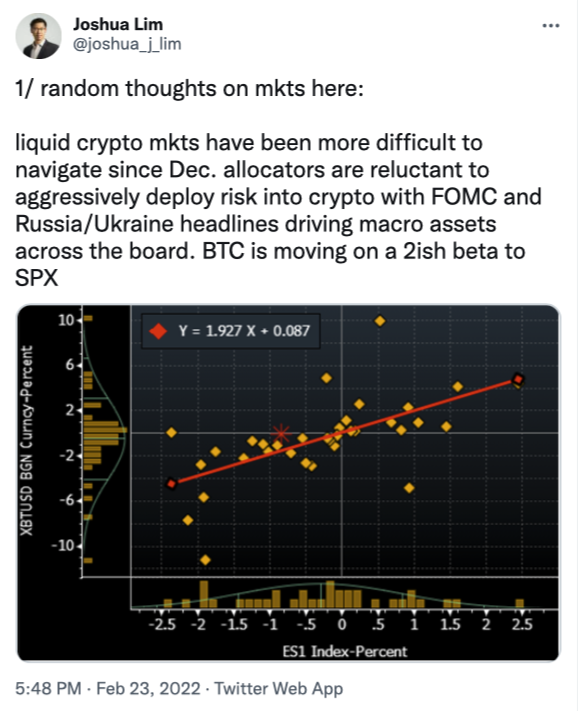

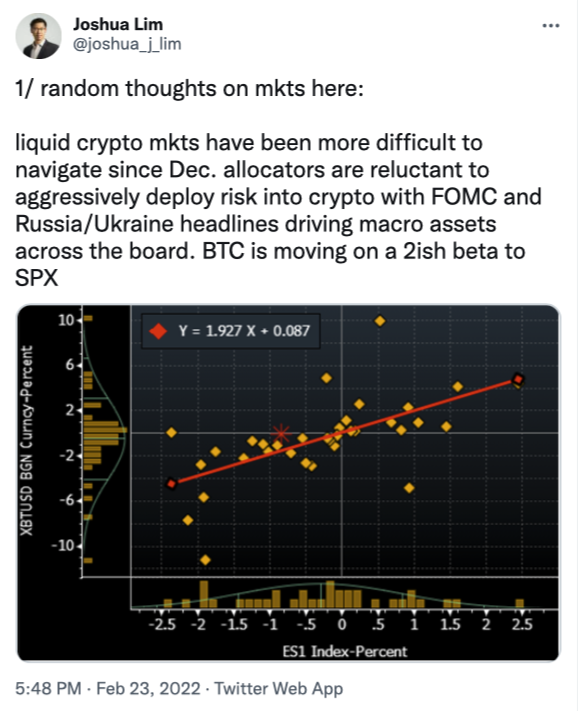

Joshua Lim of Genesis Trading said that investor wariness of the crypto market is behind that increase in correlation between bitcoin and US equities, with bitcoin moving “on a 2ish beta to the SPX.”

Still, gold — which has been enjoying a rally amid the intensifying tensions between Russia and Ukraine — pulled back Thursday morning. JPMorgan noted to clients that there is a risk that Russia could sell some of its gold reserves to fund its military operation.

In the short term, traders are keeping an eye on Ethereum, given the large number of on-chain liquidations that would be triggered at the $2,100-$2,200 level.

As explained by my colleague Osato Avan-Nomayo, “an automatic liquidation of $500 million in ether (ETH) could occur on-chain if its price falls below $2,100, causing a Maker vault holder’s position to become under-collateralized and putting further downward pressure on the second-biggest cryptocurrency.”

In general, market participants anticipate geo-political uncertainty and news out of the Fed to continue to weigh on the market.

“On the crypto front, surprised to see Bitcoin continue to maintain the $35K mark without dipping under $30K,” said Aya Kantorovich of crypto financial services firm FalconX in a message to The Block.

Kantorovich added: “All eyes on the Fed for whether March rate hikes will continue to stay in the books while we’re waiting for the 12:30 pm ET Biden address on Ukraine today.”

While macro events have pushed bitcoin to lows above $34,000, one executive pointed to a saving grace that could support the market from a severe drawdown: institutional capital sitting on the sidelines.

“Macro tourist money is the fastest to exit, as they free up capital in the most liquid instruments to meet margin calls,” said GSR co-founder Rich Rosenblum. “But, there are a lot of underinvested institutional pockets of capital looking to invest in crypto, waiting on the sidelines for a dip. So long as the situation doesn’t deteriorate, we should see bounces.”

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.