Harpie, an on-chain firewall provider, announced it has raised $4.5 million seed round to protect users from crypto theft.

Leading the round is Dragonfly Capital, joined by Coinbase Ventures and OpenSea, according to a company release on Monday.

The startup aims to protect Ethereum wallet users by allowing them to setup a “trusted network” of apps and users they want to send tokens to. Any transaction that is outside this network will be identified as theft and blocked.

The startup is addressing an increasingly important issue in the crypto industry. Through July 2022, $1.9 billion worth of crypto had been stolen in hacks of services, compared to just under $1.2 billion at the same point in 2021, according to an August report from Chainalysis.

Scam revenue sits at $1.6 billion, 65% lower than where it was at the end of July in 2021. However, this decline is linked to the drop in prices amid the bear market, per the Chainalysis report.

A strategy for preventing attacks

Noah Chong and Daniel Chong co-founded Harpie to combat the rise in theft. Harpie’s documentation outlines that frontend attacks, phishing attacks, fake site scams and accidental transfers are some of the crypto thefts it can prevent.

The new funds from the raise will be used to increase the surface area of attacks it can prevent and expand operations to customers like group treasuries and institutional investors, per the release.

“With the majority of theft happening on Ethereum, it only makes sense to start here and expand to other chains as the need arises,” said Tom Schmidt, general partner at Dragonfly Capital, in the release. “The security offered by Harpie is a necessity for the future of crypto, and it could not have come at a better time.”

The startup’s business model works by taking a 7% fee on any asset that is recovered, according to Harpie’s whitepaper.

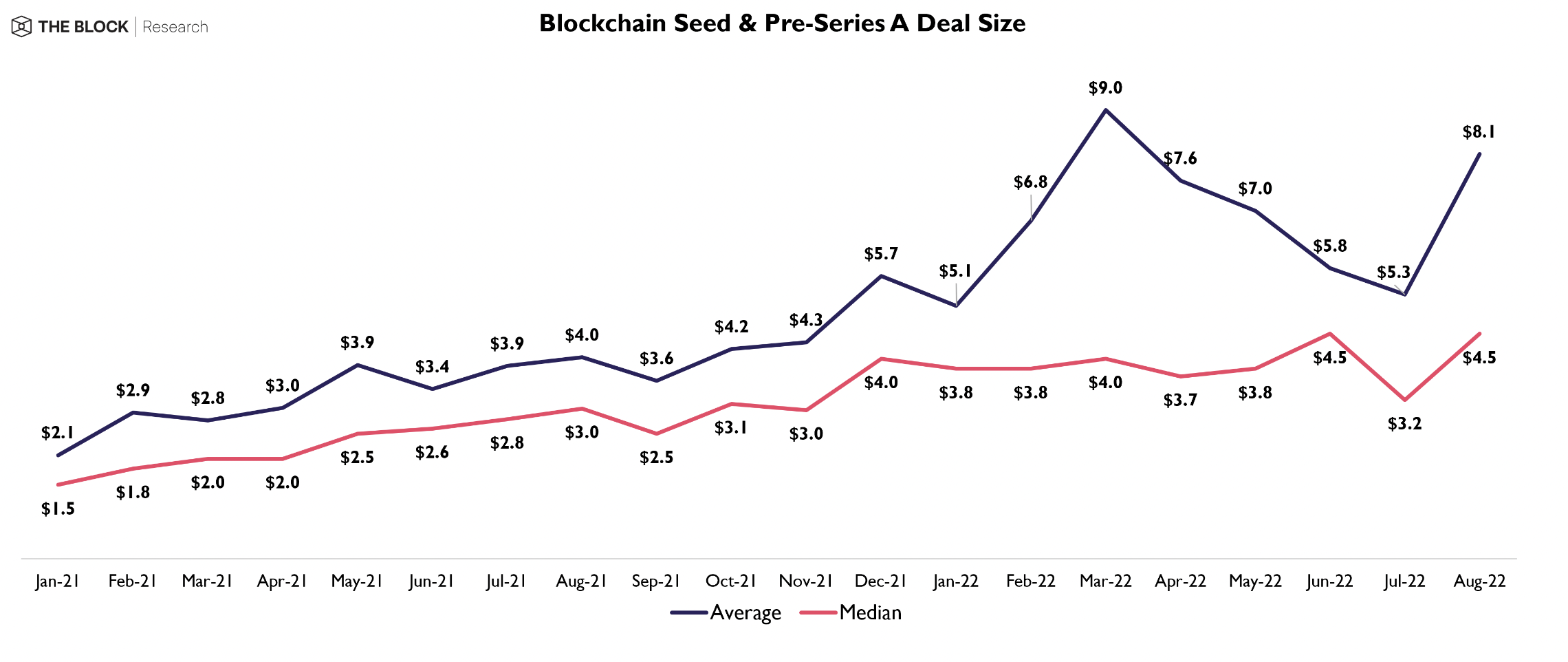

Harpie’s recent seed raise is in line with the median check size for a seed round, according to The Block Research’s August funding recap.

Blockchain seed and pre-Series A deal size

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Kari McMahon