Filip Dragoslavic has been involved in his share of Solana projects. A blockchain explorer, a digital wallet provider and a prize-winning decentralized fund management platform called Solrise. To say he’s a fan would be to state the obvious.

That was before one of his investors nudged him in the direction of a brand new blockchain, Aptos, that billed itself as cheaper and faster than the rest.

“We were actually dead set on staying just Solana,” Dragoslavic explained in a recent interview, citing the blockchain’s potential to go “mainstream.”

But Dragoslavic and his team – drawn by the simplicity of the chain’s technical documentation – hunkered down over a weekend and decided to test out this new chain. Two days later, what was recently unveiled as Rise Wallet was well on its way.

“We’ve seen that we could do 90% as a proof of concept build just over the weekend,” Dragoslavic said. “We had a fully functioning app as well … everything that we have in SolFlare, that we have been building for the last two years, now we have an app like over the weekend but just as a proof-of-concept.”

Dragoslavic’s team aren’t the only ones flirting with Aptos. Many Solana developers are window shopping on the blockchain and investors are throwing money at it. FTX, a16z and Multicoin Capital have all contributed to the $350 million Aptos has raised even as other projects saw their funding dry up as the bear market took hold.

Aptos sets itself apart in several ways. It is built on Move, a programming language that builds on Rust — which is used in the Solana blockchain — and implements novel methods of parallel execution, which is the ability to execute tasks at the same time, making transactions faster and cheaper.

The Move language also enables Aptos to use a resource model where assets can be subject to restrictions, meaning, for instance, that they cannot be copied or accidently destroyed, helping to avoid some of the common smart contract attacks that occur on existing blockchains.

“Developing on Solana, especially in the early days, was like a nine out of 10 complexity,” said Dragoslavic, describing his co-founder’s reaction to building on the chain. “Developing on Move in Aptos is like a four out of 10 complexity.”

Solana’s struggles

It wasn’t so long ago that Solana occupied Aptos’s position as the next big thing in blockchain. Last year, it raised $314.15 million in a private token sale and secured high praise publicly from investors. It was billed as the latest of the “Ethereum killers,” based on its faster speeds and lower costs compared to the more popular Layer 1 chain. Instead, it has struggled with frequent outages and frustrations from developers.

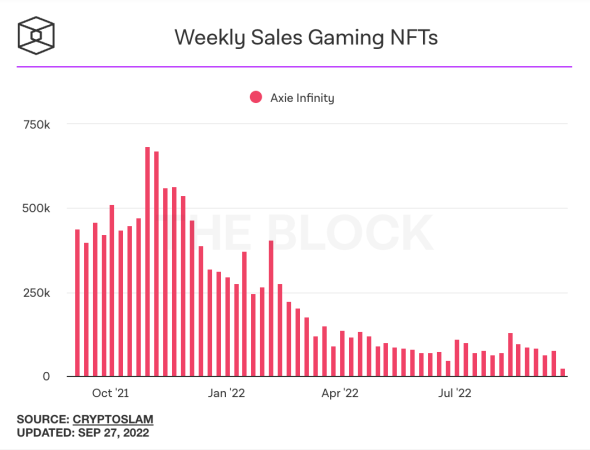

Venture funding for projects built on the Solana blockchain is now shifting toward non-fungible token (NFTs) and gaming use cases, instead of DeFi trading, according to data from The Block Research.

Solana funding from The Block Research

“I’m not sure it’s necessarily a move in terms of there’s less money going to DeFi than there used to be,” said Austin Federa, head of communications at the Solana foundation. “There’s definitely a much broader scope of projects that are receiving significant funding on the network.”

Developers tire of “eating glass”

Aptos was founded by Avery Ching and Mo Shaik, both of whom are refugees from Facebook’s Diem project. It’s only in the testnet stage but has over 100,000 members on its Discord and is supported by over 20,000 nodes, demonstrating its burgeoning developer community. Then there’s the blue-chip crypto backers that riddle its cap table.

But Aptos’s momentum is most visible in both the projects and developers, like Dragoslavic and his team, dipping their toes in the chain even as they continue to work with Solana.

The Solana blockchain explorer and indexing provider SolanaFM is hoping to take full advantage of this trend. The startup recently raised $4.5 million in seed funding and now plans to expand to Aptos alongside continuing to develop on Solana.

“If the Solana devs are moving towards Aptos, then its users probably move into Aptos as well,” said Fathur Rahman, co-founder and chief operating officer of SolanaFM in a recent interview. “And they get the same experience when they interact with DeFi, NFT or even the explorer because they already know how to interact with it in Solana.”

The tech stack is what’s driving many developers to Aptos, Fathur said. The developer experience on Solana can be challenging. Backers like FTX and Jump Crypto have supported Solana hackathons to help build out its developer community. Still, Solana’s own CEO Anatoly Yakovenko has equated building on Solana to “eating glass.”

The founders of NFT trading platform Souffl3 didn’t go that far, but they did call the experience isolating. They left Solana last month, betting on the Aptos ecosystem and rebuilding Souffl3 on the chain.

“Technically speaking, Move, which is used by Aptos, offers a programming experience that is noticeably less choppy and more intuitive than Rust,” said Alex Funke, Souffl3’s co-founder and chief technology officer. “As Move has a straightforward syntax and a comprehensive stdlib library, it requires far less code during development to accomplish the same goals as Rust.”

Edith Yeung, a venture investor at Race Capital and prominent Solana backer, notes that while some projects within her portfolio have considered jumping to Aptos for its technical benefits, there are other reasons.

Aptos announced announced a grant program in June. A spokeswoman for the blockchain said the money has gone to select teams that have shown dedication to the ecosystem over time and that have clear milestones in place to ensure long-term alignment with it.

“Developers sometimes will be like, ‘Awesome, you’re giving a free grant, let me build on it,’ and they will try it,” Race Capital’s Yeung said. “At the end of the day, it doesn’t matter if you are a NFT project or a DeFi project, if you do build something you want there to be enough users, right?”

Of the projects The Block spoke with, both Souffl3 and Rise Wallet confirmed they did not receive a grant. SolanaFM declined comment.

The layer 1 wars aren’t over yet

The Solana Foundation’s Federa said it isn’t surprising to see projects expand to Aptos as a multichain future is still top of mind for many projects and founders. Still, Solana is taking steps to make life easier on developers. Work from the Coral team has helped create an easier framework to develop on Solana. Improved documentation and community events are also playing a role in this shift.

Better still, Federa notes, is that the blockchain is designed in a way that can support onboarding multiple languages. Solana will be adding the Move programming language that makes Aptos so appealing in the next six to nine months.

While Aptos is certainly getting people’s attention, it’s still early days for the nascent Layer 1. Vance Spencer, an investor at crypto native VC firm Framework Ventures, said none of his portfolio companies were looking to jump ship. He’s yet to be convinced by the Aptos hype.

“Solana tried, Avalanche tried, Harmony, Fantom, all of these different chains,” Spencer said. “There’s a huge incentive for VCs to [say,] ‘We can build an Ethereum killer,’ but the reality is that they just have not worked.”

Its backers say Aptos wants to be a more generalist blockchain, aiming to enable enterprise scale transactions like NFT trading or micro-payments. Investors view these enterprise use cases as a way to onboard non-crypto native institutions into the space, according to Sharvin Baindur, chief of staff at Saison Capital

“The L1 wars are still not over,’’ Baindur said. “We are just keeping an eye on everything right now.”

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.