Aikon, a multi-chain onboarding platform, announced it has raised $10 million in a Series A round led by Morgan Creek Digital.

Morgan Creek’s CEO Mark Yusko and ventures partner W. Scott Stornetta will also join the company’s board, said Aikon in a release.

Other investors in the round include Avalanche ecosystem fund Blizzard, Up2 Opportunity Fund and Yugen Partners. Follow-on investments were made by Mighty Capital, Alpha Edison and Think+ Ventures.

The ORE network

Founded in 2017, Aikon aims to accelerate blockchain adoption with simple onboarding solutions for business and consumers. Aikon is built on the Open Rights Exchange (ORE) network and is powered by the ORE token.

The ORE network is a blockchain built for decentralized identities, assets and rights. The whitepaper for the network was released in 2018. Aikon’s founder Marc Blinder is part of the network’s core team.

Funds involved in the investment round have purchased ORE Tokens in order to take a stake in the ORE Network, according to the release.

Accelerating offerings

“We started the project in 2017 during which time the ICO craze was also happening and have seen the ups and downs of this industry. But one thing remains constant – our resolve to build useful things,” Marc Blinder, Aikon CEO and founder said in a statement. “In the last five years, we have built infrastructure solutions designed to last for decades to come and we are thrilled to have the funding from industry leaders to continue our mission.”

Aikon is adding compatibility for the Avalanche blockchain and is planning to release ORE Vault, a crypto and NFT multi-signature wallet for businesses, out of beta.

“Their embedded wallet registry, coupled with the ORE Token, creates a practical path toward truly universal self-sovereign identity,” said Stornetta in a statement. “It is personally very gratifying to support a team that is realizing the universality of vision we originally had for blockchains.”

The new funds will be used to accelerate Aikon’s offerings. The startup previously raised $2.6 million, according to data from Crunchbase.

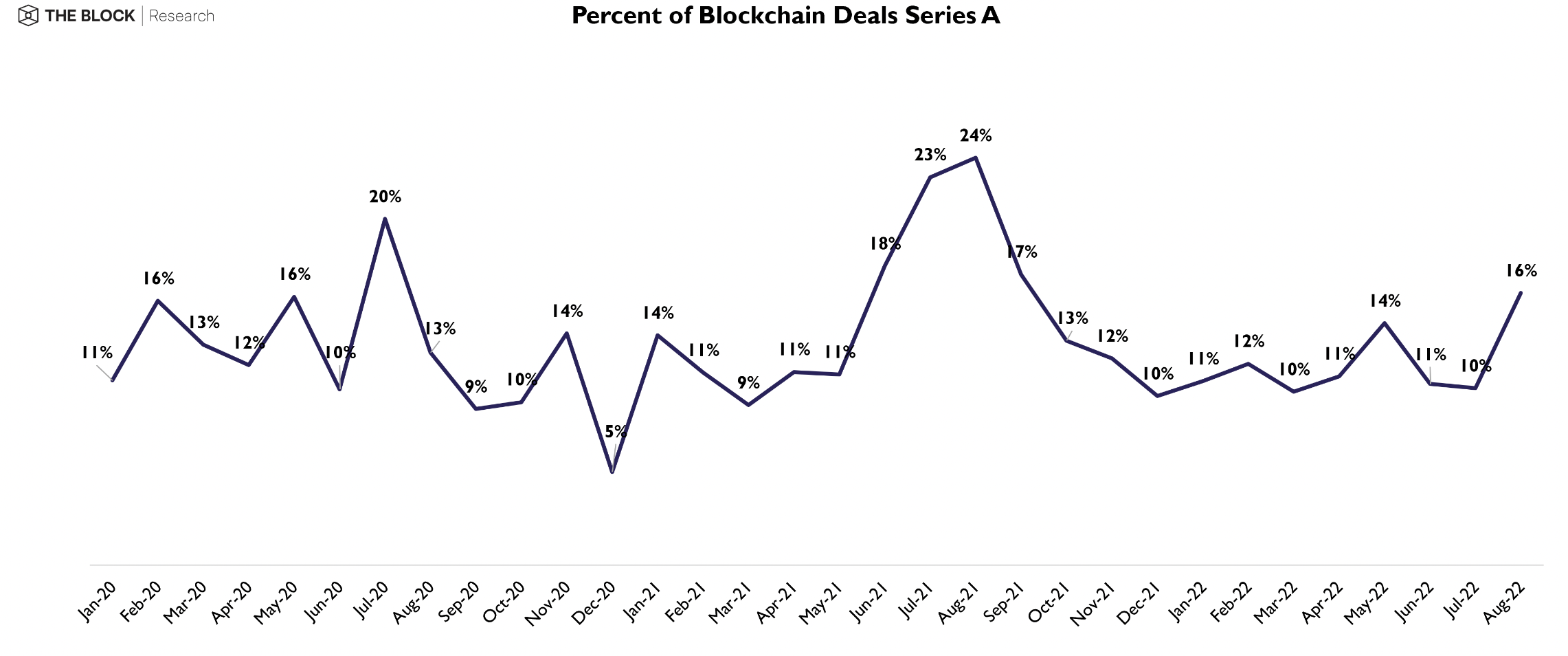

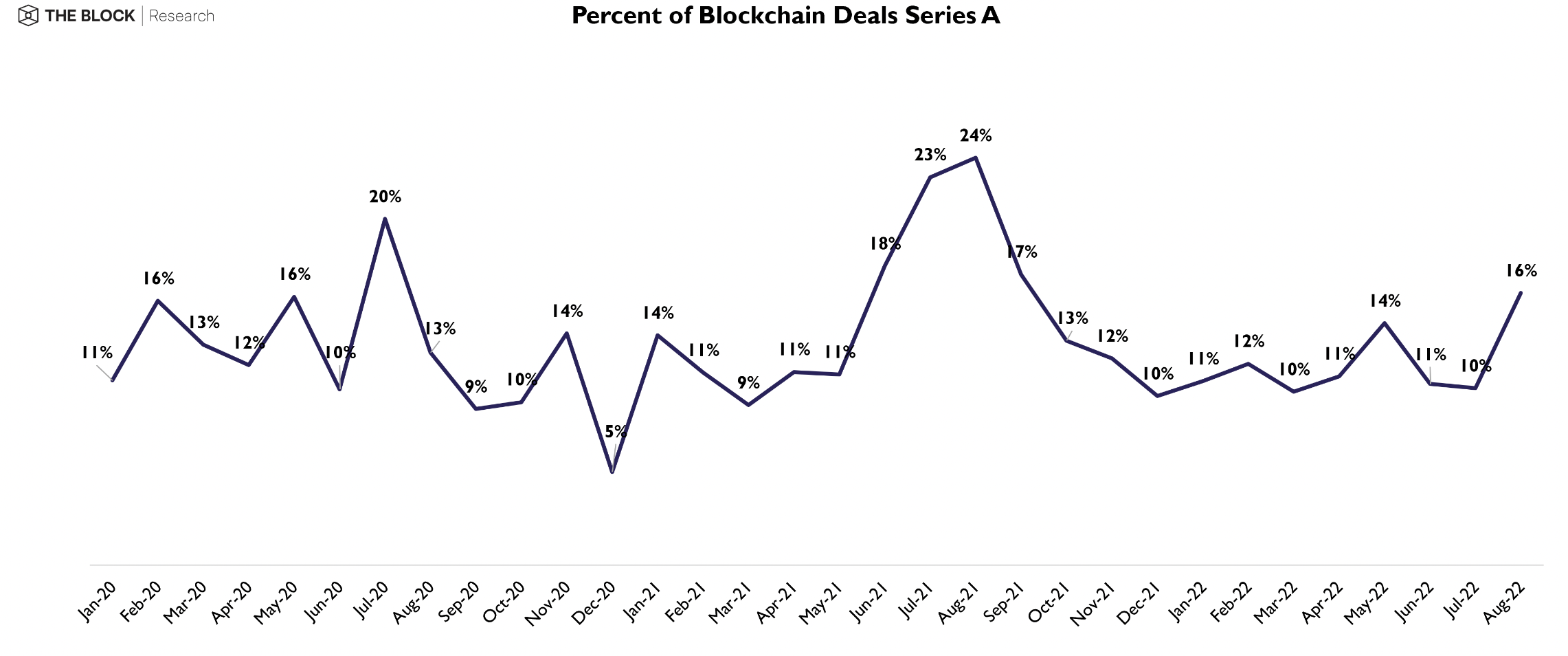

Percent of blockchain deals at Series A from The Block Research

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.