Bitcoin miner Iris Energy considering possible mergers and acquisitions opportunities as the firm plots its growth plans.

Those also include other options such as “ongoing organic expansion,” the company said in a statement Friday.

Last month, it signed a deal with investment banking firm B. Riley for the option to sell up to $100 million in ordinary shares. “The Company continues to monitor funding markets and advance prospective capital opportunities,” it said.

There’s been plenty of talk of consolidation in the bitcoin mining industry lately, and companies like CleanSpark already have been leveraging market conditions to scoop up thousands of mining machines at discounted prices, as well as mining sites.

Iris Energy increased its average operating hash rate in September by 24% month-over-month to a total of 2.729 exahashes per second (EH/s). At the same time, it mined 325 BTC, an 8% increase.

The two weren’t proportional “due to an increase in the average difficulty-implied global hash rate during the period, which was also the primary driver behind the increase in the Company’s electricity costs per Bitcoin mined during the month,” the statement said.

Mining difficulty jumped 9.26% at the end of August, the largest increase since January. Current estimates point to another major hike coming next week.

Iris said that its development works across Canada, the USA and Asia-Pacific have the potential to support over 1 gigawatt of power capacity, beyond the 795 megawatts previously announced.

The company has three sites in Canada and one being developed in Texas, which is slated to reach 600 megawatts, after an initial build-out of 40 megawatts. All of them are “powered by 100% renewable energy,” according to the company.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

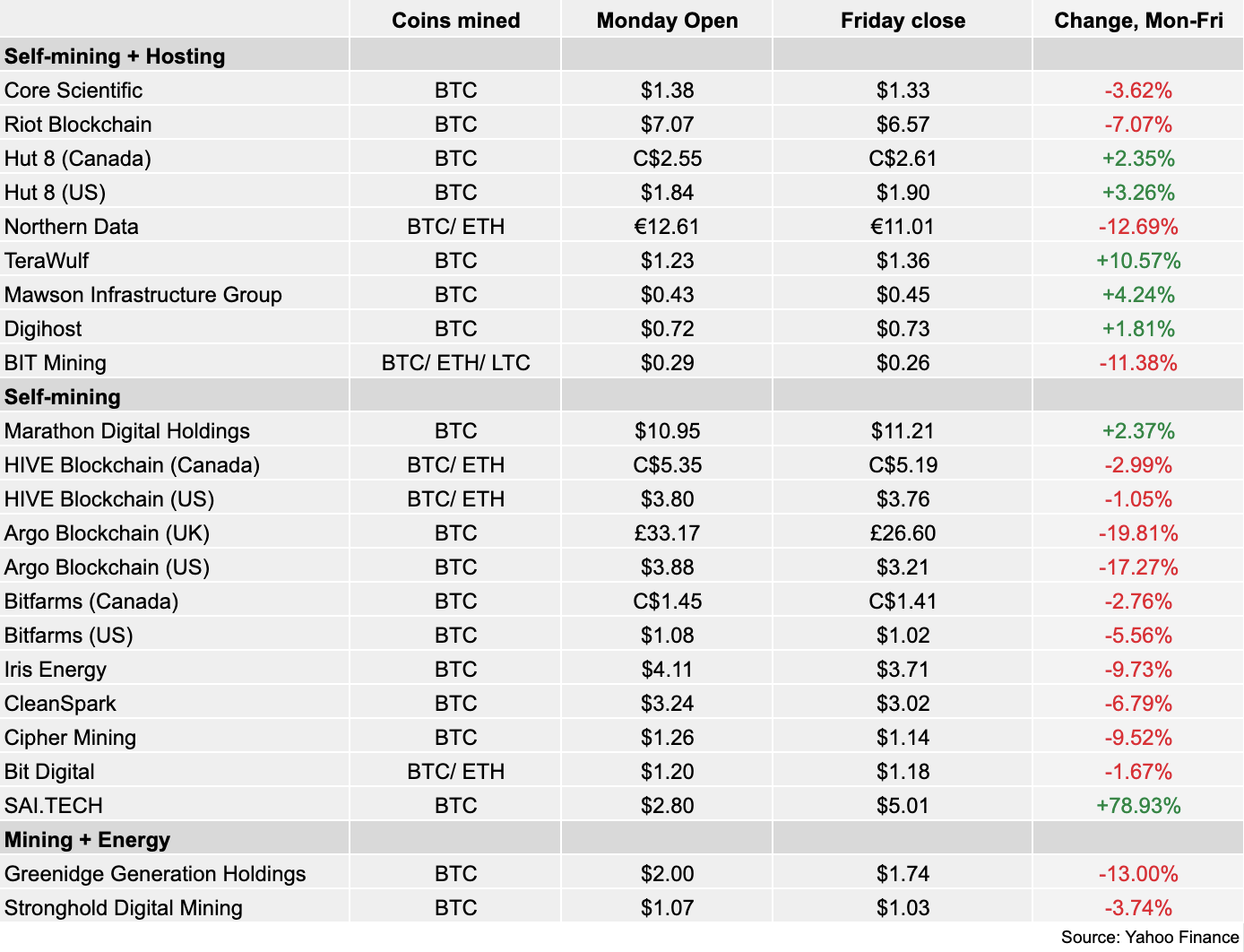

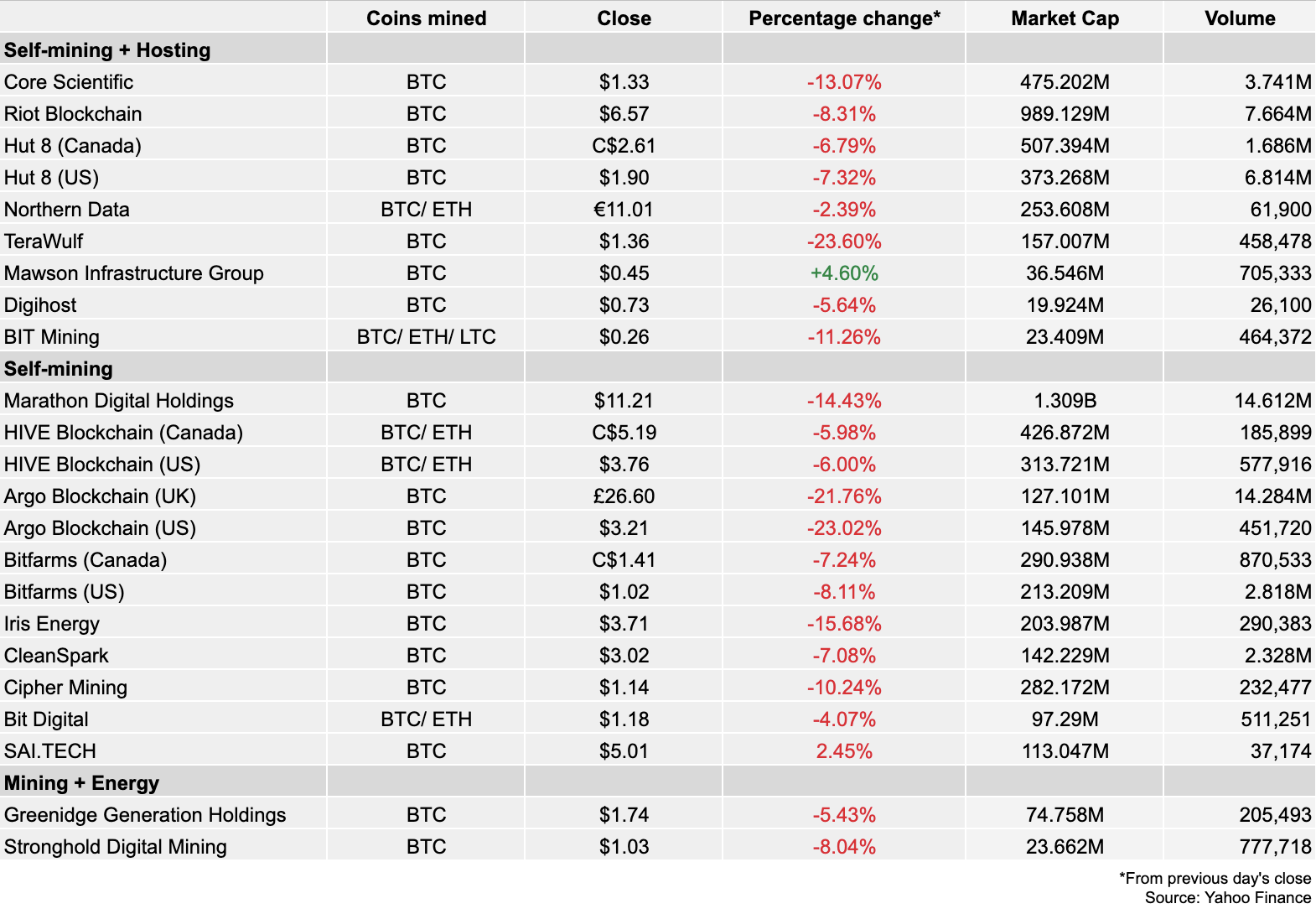

An overview of how miners fared over the week of trading:

An overview of how miners fared over the week of trading: