Decentralized finance platform Zerion just raised $12.3 million in a Series B and aims to disrupt the crypto wallet landscape. The round is led by Wintermute Ventures and other backers — including Mosaic, Coinbase Ventures, Alchemy and Placeholder.

Founded in 2019, the Zerion platform enables users to access and manage assets across decentralized finance protocols. Users can connect as many crypto wallets as they want to the platform, and its non-custodial design means users are in charge of their own funds.

The new funds from the Series B raise will be used to further develop the wallet — leveraging advanced data and intuitive design — said the company in a release.

Last year, Zerion raised $8.2 million in a Series A in an effort to turn its web3 wallet product into the primary interface for web3.

Crypto wallets aren’t ready for web3

Crypto wallets are now forming the basis for individuals’ identities within web3, Zerion co-founder and CEO Evgeny Yurtaev explained to The Block. Yet, existing wallets haven’t changed in terms of what they can do to help the user.

“A lot of people dismiss wallets [with the] wallets being purely financial and pretty limited in terms of what wallets are capable of doing,” he said. “But it’s becoming less and less about only trading the few coins that you have and becoming about fun, about NFTs. For some, its games, for some it’s music.”

Zerion looks to solve some of the key problems that users face with existing wallets, Yurtaev explained. This includes poor support for multiple wallets, limited security checks on transactions and limited transaction-history data.

“People have this natural limit to how many wallets they can manage,” Yurtaev told us. “Hence, the wallet application Zerion is building is basically the one helping manage all of your identities, all of your data and all of your financial assets.”

The wallet also differentiates itself in that it’s mobile-first, though the team is currently working on building out a desktop extension. “We started with mobile because we’ve seen the biggest UX pain points in mobile-first,” Yurtaev said. “The wallets that existed on mobile were pretty terrible.”

Raising a Series B in the bear market

The cap table for Zerion’s round features a mix of crypto-native investors and traditional players from the venture space.

“We have team members in 20 countries and we’re 40 people,” Yurtaev said. “For the cap table, we also wanted to try the different kinds of investors just to have a broader view on how things are moving.”

The funds will provide a runway for about two years, he added.

The round’s lead investor, Wintermute, also participated in the Series A. While no formal agreement is in place between the two companies, Yurtaev sees synergies forming between both companies’ long-term goals.

“I think Wintermute is like moving more and exploring at least more consumer-facing applications,” Yurtaev said. “And on our side, we are exploring the tokens and trading side of things because trading is still the biggest part of the transacting within Zerion.”

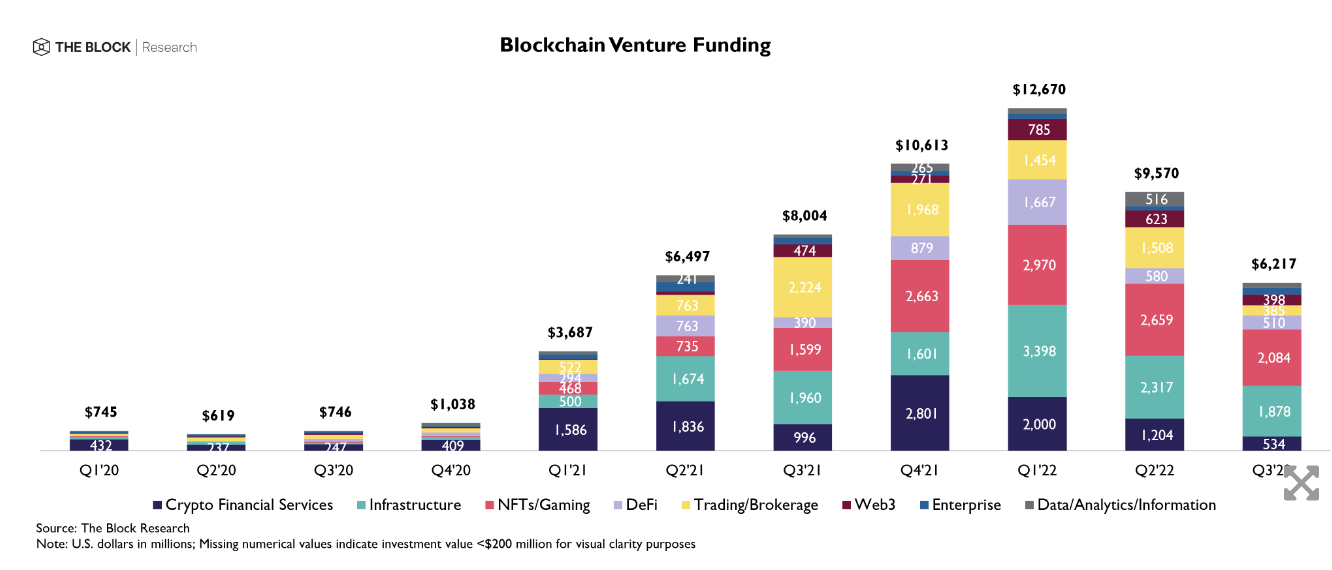

Generally, there has been a slowdown in VC activity in the crypto and blockchain at the mid-to-late stages, according to data from The Block Research. Mid-stage deals fell approximately 63%, from 30 deals in the second quarter to just 11 in the third quarter, according to The Block Research’s third quarter funding recap.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.