Nasdaq has threatened to delist bitcoin miner Digihost for trading below $1 for 30 consecutive days, the latest mining company to slip into the danger zone for companies that hope to keep their spots on major U.S. stock exchanges.

“The Company’s business operations are not affected by the receipt of the Notification Letter and the Company fully intends to resolve the deficiency and regain compliance with the Nasdaq Listing Rules,” Digihost said in a document filed Friday with the U.S. Securities and Exchange Commission. The miner has 180 days to regain compliance with Nasdaq listing rules by trading for $1 or more for a period of at least 10 consecutive days. However, it may be eligible for an additional 180 compliance period, the filing said.

Thanks to multiple factors contributing to a downturn in the bitcoin mining industry, Digihost is only the latest company to see its stock listing put in jeopardy.

Two other public miners — Mawson Infrastructure Group and BIT Mining — also need better stock performance to keep their listings on Nasdaq and the New York Stock Exchange (NYSE), respectively.

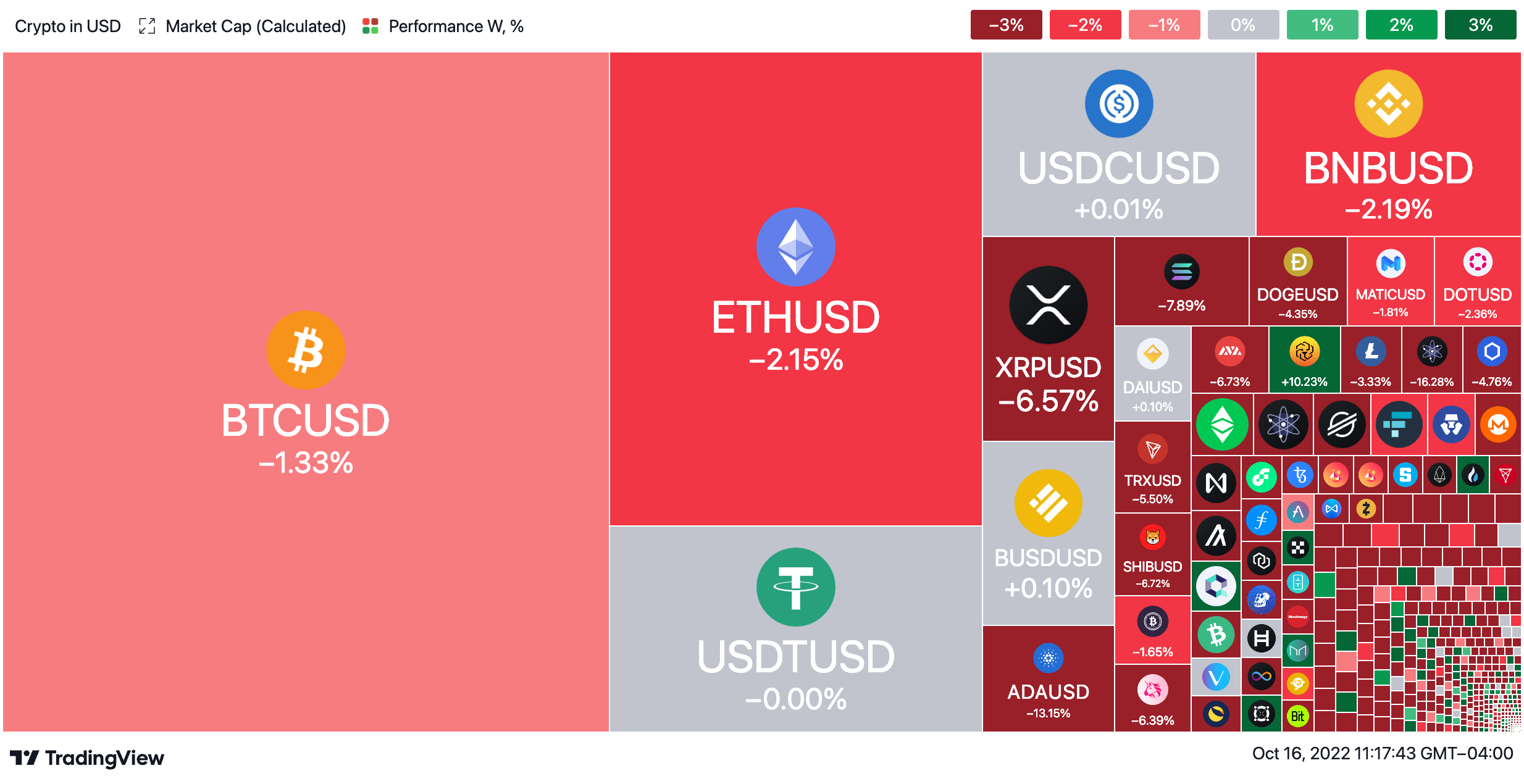

In the past week alone three other bitcoin mining stocks fell under the $1 threshold, while a handful of others are trading only slightly above that. Stock prices for companies tracked by The Block fell significantly over the past week of trading. That could put more in danger of delisting, if the stock price doesn’t recover to over $1 per share.

Bitcoin mining stocks tend to follow the coin’s price, which has plunged 70% since the all-time high of around $67,550 in November of last year and about 50% in the last six months. This decline, combined with rising power costs, has squeezed profits for bitcoin miners, which have also had to contend with mining difficulty jumping 13.55% last week to an all-time high.

Leadership for the Australia-based Mawson Infrastructure Group projected confidence in maintaining the company’s place on Nasdaq.

“Per the 8-K, if we trade above $1 for 10 days the issue is cured, or we can simply do a reverse split to cure, so we’re not worried about that,” Nick Hughes-Jones, chief commercial officer at the company, told The Block last month.

The company sold one of its facilities in Georgia to rival CleanSpark, stating that it would focus on its Pennsylvania and Texas sites, where it sees “the opportunity for compelling returns on capital,” said Mawson CEO James Manning.

BIT Mining also sought to reassure investors in August that its stock would recover.

“Despite the tumultuous market conditions, rest assured that the current stock price will have no impact on our company’s normal business operations and our ability to create value for our investors in the future,” said BIT Mining Chairman Bo Yu said in a statement at the time.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.