The Web3 Domain Alliance established itself as a new coalition this week to combat fraud and naming collisions as well as to promote technological advancement and user experience of the next generation of web3 domains.

Unstoppable Domains, Tezos Domains, Polkadot Name System, Hedera and Bonfida, which oversees the Solana naming service, are among the founding members, according to a press release.

Web3 domains such as .sol or .crypto can be used in place of lengthy wallet addresses for sending and receiving cryptocurrencies, as well as for website hosting and as a single sign-on method for many web3 apps. The domains are minted on the blockchain.

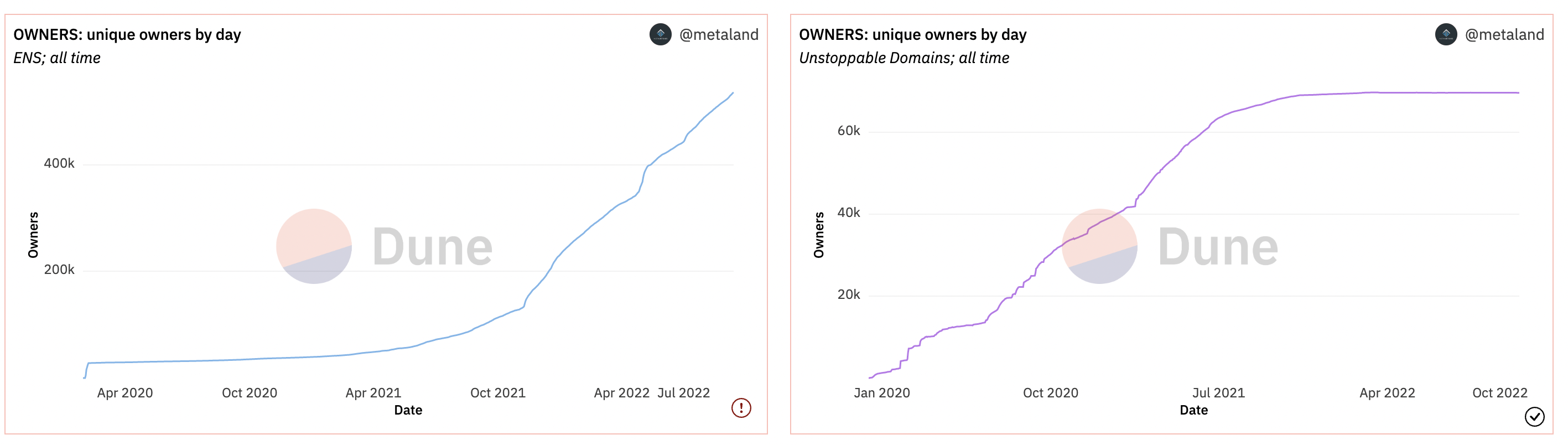

Demand is rising for web3 domains with unique ownership on two of the largest domain platforms, Unstoppable Domains and the Ethereum Name Service (ENS), reaching all-time highs, according to data from Dune Wizard Metaland on Dune Analytics.

Unstoppable Domains itself recently experienced a naming collision challenge with its .coin domain when it clashed with the. coin domain issued by blockchain platform Emercoin.

Ultimately, Unstoppable Domains decided to stop supporting the .coin domains and offered the owners credits worth three times what they paid.

A decentralized web brings new domain challenges

In the web2 world, domain names are organized and managed by the nonprofit Internet Corporation for Assigned Names and Numbers (ICANN). The group helps to implement domain industry standards.

“We’re still in the dial-up phase of web3,” Unstoppable Domains SVP Sandy Carter said in an interview with The Block at the Web Summit in Lisbon. Carter believes this stage of web3 is emulating the early internet and that standardization will be key to its maturity.

The organization plans to focus on aligning intellectual property rights of all web3 naming services and protecting consumers.

Why isn’t ENS in the coalition?

The cross-chain coalition includes naming systems across the Polygon, Ethereum, Solana, Tezos, Polkadot, Hedera, Bitcoin and Klayton blockchains.

Noticeably missing from the coalition is the Ethereum Name Service, which manages one of the most popular web3 domains .eth.

The alliance contacted ENS to see if it would join but the deal has not materialized, Carter said, adding that it is planning three phases of participants. The second phase will include wallets and browsers, and the third will include metaverse and gaming companies.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Kari McMahon and Lucy Harley-McKeown