This research piece is available exclusively to

members of The Block Research.

You can continue reading

this Research content on The Block Research.

Go to Source

Author: The Block Research

This research piece is available exclusively to

members of The Block Research.

You can continue reading

this Research content on The Block Research.

Go to Source

Author: The Block Research

This research piece is available exclusively to

members of The Block Research.

You can continue reading

this Research content on The Block Research.

Go to Source

Author: Greg Lim

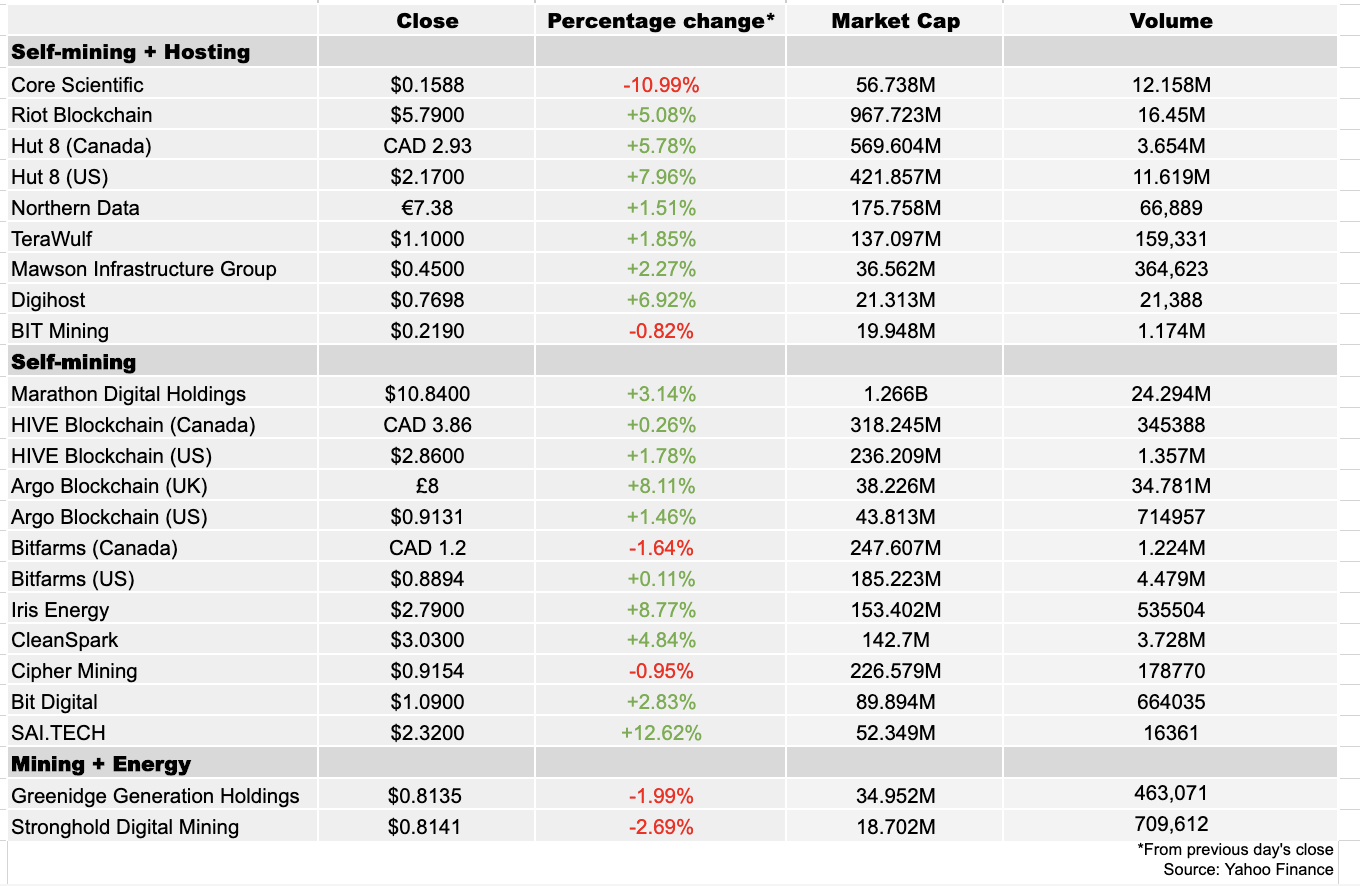

Most bitcoin mining stocks tracked by The Block were up on Friday as the crypto markets rose.

Bitcoin was trading at around $21,123 by market close, according to data from TradingView.

Core Scientific declined the most (-10.99%). Meanwhile, the stocks with the biggest gains were SAI.TECH (12.62%), Iris Energy (8.77%) and Argo Blockchain UK (8.11%).

Here’s how crypto mining companies performed on Friday, Nov. 4:

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Kristin Majcher

Tumultuous market conditions caused crypto trading platform Amber Group to reduce its valuation as the company pursues a new funding round.

Amber Group now seeks $100 million at the same $3 billion valuation it previously raised, Bloomberg first reported, citing anonymous sources. The company in February was valued at $3 billion as it raised $200 million, led by wealth fund Temasek, and joined by Sequoia China, Pantera Capital, Tiger Global Management, True Arrow Partners and Coinbase Ventures.

Amber attempted to raise again at a much higher valuation between $5 billion-$8 billion, but given a general slump in the crypto market, those funds never materialized.

The adjustments for Amber extend beyond fundraising efforts. Amber recently cut as many as 10% of its staff citing the bear market.

Cautious even with a 25% climb in revenue, the company’s head of business development, Annabelle Huang, previously told The Block that the company will be prudent while bearish conditions persist.

Markets slumped after a peak just over $3 trillion in November 2021, data from The Block Research show.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Jeremy Nation

When Twitter debuted its Tweet Tiles NFT pilot program last week, the roster of partners included a who’s who of NFT marketplaces: Magic Eden, Rarible, Dapper Labs and Jump.trade. OpenSea, considered by many the dominant platform, was noticeably absent.

The new feature — initially available only to a small test group — allows people to advertise NFTs for sale. Posted NFTs that are listed on marketplaces with partnerships with Twitter also include a click-through button to help interested parties seamlessly purchase the digital asset.

Although OpenSea and Twitter discussed working together on the social media company’s new program, the two sides could not agree on terms, according to a person familiar with the matter. That impasse between OpenSea and Elon Musk’s newly acquired company has paved the way for Magic Eden to emerge as perhaps the most significant marketplace partnering with Twitter. A few months ago, Magic Eden overtook OpenSea to become the largest marketplace by number of monthly transactions.

For more than a year, OpenSea has been the most dominant NFT marketplace by total dollar volume. The company has been valued north of $13 billion. Twitter and OpenSea have worked together before on integrating digital assets into the Twitter experience, including the current option that allows users to utilize NFTs as a hexagonal profile picture.

OpenSea declined to comment. Twitter did not immediately respond to requests to comment.

Twitter’s NFT experimentation represents one more example of established social media platforms — web2 companies — flirting with web3 and the buying and selling of crypto assets amid modest user growth. Recently Facebook, Instagram, Reddit and Twitter all implemented new digital-asset initiatives geared toward boosting engagement and revenue. Twitter has more than 200 million “monetizable” users.

Logan Holling, Magic Eden’s strategic partnerships lead, said that the high volumes his company is handling should benefit Twitter’s new NFT strategy. “By way of more transactions you have more opportunities for people to tweet these Tweet Tiles,” he told The Block.

When compared to Magic Eden, Twitter’s other three marketplace partners are much smaller. Dapper Labs is best known for creating NBA Top Shot and CryptoKitties, while Rarible is primarily a market aggregator. Jump.trade focuses on sports-related NFTs.

Twitter’s partnership with Magic Eden is also perhaps meaningful for another reason: The marketplace is the largest dealer of NFTs pinned to the Solana blockchain. OpenSea facilitates primarily Ethereum-blockchain transactions.

“For a long time Solana NFTs felt like this little brother to Ethereum,” said Tiffany Huang, Magic Eden’s head of content and marketing. “This is really good news for us, but also Solana.”

Although the large majority of the most valuable NFT collections traded, like Bored Apes Yacht Club and Cryptopunks, are all on Ethereum, more transactions are currently being completed on Solana.

“People transact more on Solana because the chain allows them to do so,” said Huang, adding that there are fewer fees when buying and selling on Solana.

In general, trading NFTs on the Solana blockchain is faster and cheaper. However, many argue Ethereum is a more reliable blockchain.

Given OpenSea’s popularity and Twitter’s past dealings with the marketplace, it’s quite possible the two companies eventually find a way to work together on Tweet Tiles. “So much of crypto culture already lives on Twitter,” said Chris Sirise, founding partner of Saison Capital. “So, it makes sense for the platform to work with all high-volume marketplaces at some point to get sufficient coverage of the best projects across the different chains.”

Twitter is perhaps the busiest platform when it comes to discussing all things crypto, including NFTs. With Tweet Tiles, the platform may be taking a significant step toward further embracing crypto influencers and enthusiasts, while also introducing its more mainstream users to the habit of collecting and trading NFTs.

For a while, major companies have been pursuing NFT strategies, which include selling digital collectibles; this includes diverse brands like Gucci, Warner Bros. and the NFL.

Reddit and Instagram have also both recently implemented their own NFT initiatives capable of attracting mainstream consumers.

Social media platforms, starved for ways to grow, don’t want to miss out on the action.

“With Instagram offering creator NFTs, Reddit successfully engaging their community with an NFT drop, the commercialization of non-fungible tokens indicates that social platforms are adding NFTs in their growth strategy to match user demand,” said Maxine Ryan, architect of Pulsr, an NFT discovery platform.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: RT Watson and Lucy Harley-McKeown

Buenos Aires-based neobank Uala has started rolling out crypto trading in Argentina, with the feature already available to selected users.

Customers can buy and sell bitcoin and ether on the fintech’s app, and the feature will continue rolling out to those who sign up on a waiting list. Uala has more than 4.5 million users in Argentina and also offers its app in Colombia and Mexico.

“For a long time our users have asked us for the possibility of investing in crypto in addition to pesos through the Uala app,” Uala Vice President of Wealth Management Andres Rodriguez Ledermann said in a statement. “We will continue working for financial education and access to different alternatives for investment in a simple and digital way.”

With annual inflation getting closer to 100% in Argentina, local residents have been turning to alternative currencies like stablecoins and crypto-based credit cards for purchases to more efficiently save. Uala’s announcement is significant in part because banks in Argentina have not had an easy time opening up crypto trading to clients.

In May, Argentina’s central bank (BCRA) blocked financial institutions from offering crypto operations, just days after major private bank Banco Galicia and all-digital Brubank said they would offer crypto trading.

Uala said it will offer the crypto trading feature in its app by requiring users to create an account with Uanex, a company within Uala’s ecosystem.

The fintech unicorn most recently raised $350 million through a Series D round in Aug. 2021 led by Tencent and SoftBank Latin America Ventures. The round brought the startup’s valuation to $2.45 billion, Bloomberg reported.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Kristin Majcher

Crypto wallet Zerion is gearing up to launch an in-browser web extension as it prepares to take on industry leader MetaMask. The web extension is now in a closed beta and is expected to go live by the end of November.

The web extension supports multiple seed phrases and has gone through audits with three security companies, according to an announcement at Breakpoint in Lisbon, Portugal.

Zerion takes a fundamentally different approach to its wallet user experience. It lets users see their token balances across multiple blockchains in one place. This is different from MetaMask, which shows token balances on each blockchain at a time, which means users have to switch between networks to see all their tokens.

The wallet also shows NFTs within the extension, similar to the Phantom wallet on the Solana blockchain. It takes NFTs on multiple blockchains and presents them in one place, in the same way as normal tokens.

When it comes to making transactions on different blockchains, the wallet automatically switches networks on behalf of the user. For security reasons, it lets users know what networks they are using. This is intended to make using cross-chain applications much easier.

The crypto industry has grown across more blockchains over the last few years. Many blockchains now have their own set of applications and scaling layers. With this, users are holding their tokens in different applications on different layers on different blockchains, making it tricky to keep track of all their funds. That’s the problem Zerion — and rivals like Zapper and DeBank — are trying to solve.

Zerion started as a portfolio tracker before launching a non-custodial wallet app on mobile devices. The extension will look like the mobile app and function in the same way.

The app supports more than 10 blockchain networks, including Ethereum-compatible blockchains like Avalanche and Polygon; Ethereum scaling solutions, like Abritrum and Optimism; as well as Solana. Trading is not yet enabled on Solana.

Zerion has integrated other crypto projects into the mobile app. It has integrated the Lens network, which was launched by DeFi app Aave — letting users send tokens to Lens addresses (similar to using the Ethereum Name Service). Lens is an experimental decentralized social graph used to create social networks. Zerion also uses the 1inch API to let users make swaps using various decentralized exchanges.

Looking ahead, Zerion is planning to add a browser for decentralized applications into its mobile app. This will let users browse applications, create transactions and sign them within the app. Zerion is also introducing a multi-chain transaction history, letting users see what transactions they have made, across all chains, in one place.

Zerion raised $12 million in a Series B fundraise in October. The application has more than 200,000 users and has seen more than $1.5 billion in trading volume for token swaps, it said at the time. The company is now based in Lisbon.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Tim Copeland

The Web3 Foundation that funds development of Polkadot said the blockchain’s token should no longer be considered a security subject to regulation by the U.S. Securities and Exchange Commission.

“The Polkadot blockchain’s native digital asset (DOT) has morphed and is no longer a security,” Chief Legal Officer Daniel Schoenberger said in a blog post. “It is software.”

Schoenberger said the foundation has been working with the SEC for three years as it sought a path that could permit a digital asset initially offered as a security to be re-evaluated at a later date. The transition would resemble other simple agreements for future tokens, or SAFTS, a legal structure that sells investment contracts for future tokens as a security while distancing the tokens themselves from that sale.

This regulatory shelter became a pressing concern following the SEC’s landmark DAO Report in July 2017, which said an ICO could be a securities offering and thus require registration. The crypto industry’s subsequent dealings with the SEC have been somewhat contentious, with industry players deriding its “come in and talk to us” message.

“The stakes were high, and the margin for error was slim,” Schoenberger said, citing a “spirit of open communication and dialogue” with the SEC. “Whatever it took in order for DOT, the native token of the Polkadot blockchain to be — or to become — a non-security, we were willing to do it.”

Doubts remain as to whether the current SEC believes SAFTS can truly decentralize at all. The SEC did not respond to requests for comment.

In October 2017 and March 2019, the Web3 Foundation reported sales of Polkadot SAFTs under Reg. D, which reserves sales for accredited investors. The Polkadot network did not reach its final launch until last December.

The current market cap for DOT is just under $8 billion.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Kollen Post

This research piece is available exclusively to

members of The Block Research.

You can continue reading

this Research content on The Block Research.

Go to Source

Author: Greg Lim

The European Parliament’s delay on a final vote over comprehensive framework for regulating crypto assets could delay other crypto legislation in the EU pipeline.

The Markets in Crypto Assets legislation is expected to lay the foundation for definitions and scope of the EU’s regulatory ecosystem on crypto. That legislation was expected to pass this month, but has been delayed for procedural reasons, likely until February.

The delay is expected to also postpone other upcoming legislation, including the Transfer of Funds Regulation, which requires transactions in crypto to include information on the sender and receiver of funds according to Financial Action Task Force standards, and the Anti-Money Laundering Regulation, which harmonizes AML provisions across the EU and establishes a new overseeing authority.

“Any such delay would cause further uncertainty for the industry, as MiCA’s text is intertwined not only with the TFR but also with other regulations currently in the works, most notably the Anti-Money Laundering Regulation,” Marina Markezic, co-founder of a European crypto advocacy group, said in a statement sent to The Block.

The vote on MiCA in the European Parliament plenary is deferred due to the laborious work required to translate the lengthy report into the 24 official EU languages. This process allows MEPs to vote on the legislation in their own language.

Once MiCA passes through Parliament, it also needs to go through a vote in the European Council before it can enter into the EU’s Official Journal. From the moment of publication, MiCA gives regulators 12-18 months to write the technical standards that targeted entities will need to comply with once the clock is up.

The TFR and AMLR frameworks were planned by policymakers to be more or less synced with MiCA in their application. The European institutions finalized their negotiations on TFR at the same time as MiCA in June.

AMLR, on the other hand, is still being drafted, and anticipated to enter so-called “trilogue” negotiations among the European Parliament, Commission and Council in early 2023.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Inbar Preiss