Private equity firm Thoma Bravo has led a $70 million Series B extension into TRM Labs, which provides risk management and compliance services for financial institutions, crypto companies and government agencies.

Known for its bets on software, Thoma Bravo previously told The Block about its $100 billion allocated towards digital assets and has made investments in FalconX, Figment and Anchorage.

Along with Thoma Bravo, the equity deal — which closed in October — sees institutional players, such as Goldman Sachs and the venture arms of PayPal, Amex and Citi Group. The company declined to share its new valuation with The Block but said it brought on Thoma Bravo for its track record of taking companies to IPO.

TRM’s core product line includes software that allows for the tracing of cryptocurrency transactions, risk assessment of other crypto businesses and transaction monitoring for anti-money laundering compliance.

“Demand has never been stronger for solutions that help protect crypto users, impede illicit actors, and support blockchain-based innovation,” said TRM CEO Esteban Castaño, “As the industry continues to mature, TRM is setting the standard for data, products, and training that equip enterprises and governments to combat fraud and financial crime, even as new threats emerge.”

Through this funding round, the company is looking to build out tools for helping law enforcement fight crypto-related financial crime. Citing its research that indicates over $3 billion was lost in crypto hacks this year, it’s looking to, in particular, target products for decentralized finance. Some of its own team are former law enforcement officers from Interpol, the IRS and the FBI, among others.

The company claims that it has seen its revenue grow by 490% year-over-year since launching in 2018.

As investors continue to fall back from the riskier bets they took during last year’s bear market, fraud and compliance firms continue to raise money from venture capital and private equity. In September, fraud detection platform Sardine raised $51.5 million in a Series B round from investors such as a16z, Visa and ConsenSys. This followed a $5.2 million seed round for web3 compliance company Satschel.

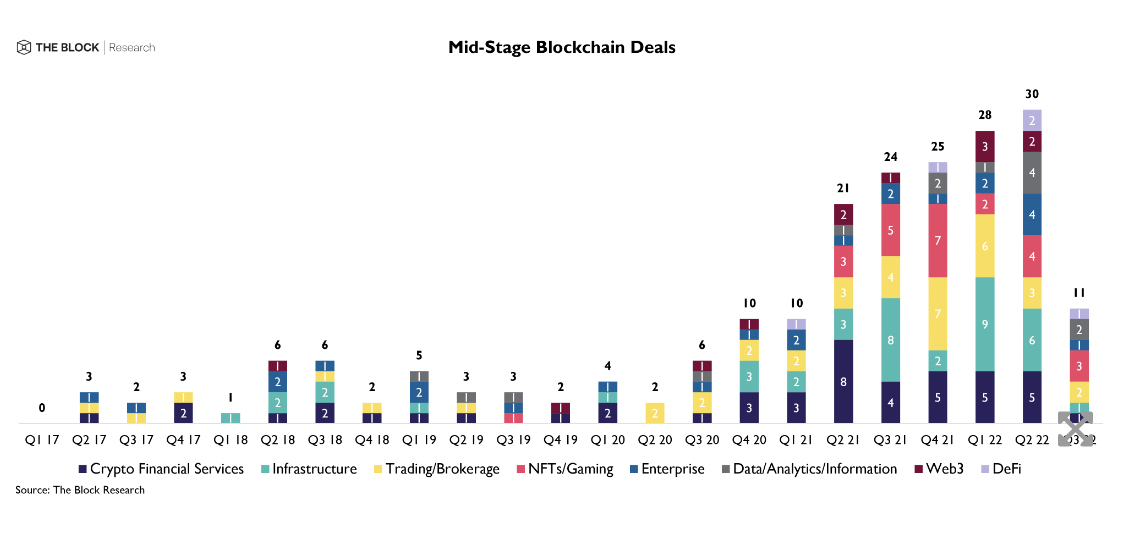

Midstage deals, such as the rounds raised by TRM and Sardine, are also increasingly a rare occurrence in the current market. According to The Block Research, mid-stage deals fell approximately 63% from 30 deals in Q2 to just 11 last quarter.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Tom Matsuda