Democrats will keep control of the Senate after tight races in Arizona and Nevada were called for the party, but as vote counting continues in several races, control of the U.S. House of Representatives remains too close to call.

A run-off election in Georgia between incumbent Sen. Raphael Warnock, D-Ga., and Republican candidate Herschel Walker, a former football star, will occur on Dec. 6, after neither candidate received a majority of that state’s vote. But Democrat Sen. Catherine Cortez-Masto’s apparent win in Nevada, which was called by several media outlets including the Associated Press, means that the Georgia race will no longer determine control of the chamber.

Republicans remain favorites to gain control of the House, though the margin which they were expected to win by in polling leading up to the election has shrunk to the point where Democrats could still theoretically retain their narrow majority in the chamber. Should the House flip, committee chairs will shift to members of the majority party. A win in the House would give Republicans increased leverage to influence policy around stablecoins and regulation of crypto’s spot markets, as well as direct oversight power over regulators. But due to the split control of Congress, Senate rules, and continued Democratic control of the White House, any legislation will require bipartisan support to become law.

Crypto legislation is expected to have a better chance to become law than in most other issue areas, given the relatively fresh debate around the topic, which has yet to become a fully partisan issue.

Sens. Mark Kelly, D-Ariz., and Cortez Masto were projected to win their races on Saturday. Both had been top targeted seats for Republicans to pick up.

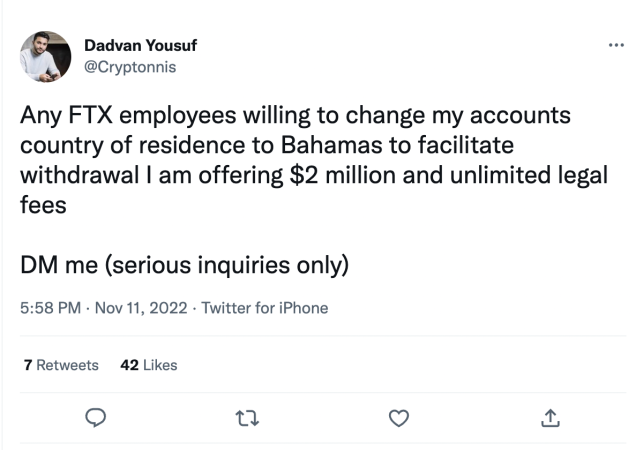

Senate Democrats will remain in control of committees in the chamber, while a GOP congressional takeover means that all House committees will shift from being led by Democrats to Republicans when the new Congress begins in January. Lawmakers on both sides of the aisle have signaled they want to pass new laws to regulate digital assets, particularly after this summer’s market crash and this week’s implosion of FTX, culminating in the exchange’s bankruptcy on Nov. 11.

“It is crucial that our financial watchdogs look into what led to FTX’s collapse so we can fully understand the misconduct and abuses that took place. I will continue to work with them to hold bad actors in crypto markets accountable,” Senate Banking Committee Chairman Sherrod Brown, D-Ohio, said in a statement. If the Nevada result holds then Brown, a financial regulatory hawk, will continue to hold his Banking Committee gavel, barring a broader, unexpected reshuffle in committee leadership.

If Republicans do win control of the House, Rep. Patrick McHenry, R-N.C., is on track to become the House Financial Services Committee chair next year. McHenry has signaled he will resume working on stablecoin bill legislation he negotiated with outgoing committee Chair Maxine Waters, D-Calif., if it does not pass before this Congress ends. Both McHenry and Waters in statements last week called for congressional action in relation to FTX’s implosion.

The new shift in leadership will affect which cryptocurrency bills advance from committee, and which legislation receives a full vote from the House and Senate. But President Joe Biden, a Democrat, will still sign any new bills into law.

That could include new legislation to grant regulators more direct oversight and rulemaking power over exchanges and digital asset markets, which a bipartisan coalition of senators support. Former FTX CEO Sam Bankman-Fried backed the bill, which became a point of contention between himself and other members of the digital asset industry.

The bill authors, Senate Agriculture Committee Chair Debbie Stabenow, D-Mich., and the committee’s top Republican, Sen. John Boozman, R-Ark., pledged to continue work on the legislation. The bill also has the backing of Commodity Futures Trading Commission Chair Rostin Benham, a former Stabenow aide. Earlier this year the Treasury Department and the heads of multiple regulatory agencies recommended that Congress pass a law to grant more direct oversight over crypto exchanges and markets.

“The recent collapse of a major cryptocurrency exchange reinforces the urgent need for greater federal oversight of this industry,” Stabenow said in a statement on Nov. 10. “Consumers continue to be harmed by the lack of transparency and accountability in this market. It is time for Congress to act.”

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.