High-profile FTX promoters like Tom Brady and Steph Curry could have a lawsuit on their hands.

Famed lawyer David Boies is talking to clients about a possible class action lawsuit against celebrity promoters of the now-bankrupt crypto exchange, according to a source with direct knowledge of the matter.

Boies’s firm, Boies Schiller Flexner LLP, has spoken with clients from a similar class action lawsuit against failed crypto lender Voyager, the source said. The Voyager case targets CEO Steve Ehrlich, the Dallas Mavericks basketball team and the team’s billionaire owner Mark Cuban. Voyager filed for bankruptcy protection in July.

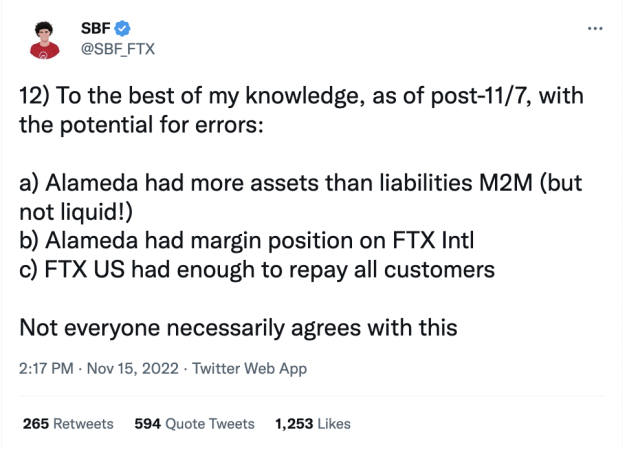

The possible suit comes days after FTX’s shocking collapse. FTX CEO Sam Bankman-Fried resigned his post when the exchange filed for bankruptcy protection in Delaware on Friday. At its peak, the company was valued at $32 billion, but crumbled after a run on its native utility token FTT.

Boies is a well-known trial lawyer who has represented the infamous medical company Theranos, Jeffrey Epstein’s victims and disgraced film producer Harvey Weinstein, among others. The Financial Times reported last week that Boies had been approached by FTX investors and customers about a potential lawsuit. He also helped argue the U.S. government’s case against Microsoft in a landmark anti-trust trial.

Celebrity defendants to be determined

Boies is co-lead counsel on the Voyager case with Adam Moskowitz, managing partner of The Moskowitz Law Firm. Moskowitz and a Boies spokesperson did not respond to a request for comment.

It’s not clear which FTX promoters the possible class action suit might target. Celebrity promoters of the exchange, including Tampa Bay Buccaneers quarterback Tom Brady and Golden State Warriors point guard Stephen Curry appeared in FTX ads and made equity deals with the exchange. Others associated with FTX include basketball star Shaquille O’Neal, TV star and “Seinfeld” co-creator Larry David, “Shark Tank” TV personality and businessman Kevin O’Leary and David Ortiz, who played baseball for the Boston Red Sox.

The Miami Heat basketball team is also linked to FTX. The team and Miami-Dade County ended their business relationship with the exchange last week, after the company inked a $135 million naming rights deal for FTX Arena last year.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.