Centralized exchanges still standing after the fall of FTX rushed to show proof of reserves. It’s a nice show, but it’s not enough, experts say.

Proof of reserves — or showing exactly what an exchange holds — is an attempt at the type of transparency that was, as recent bankruptcy filings showed, badly lacking at FTX. And so to reassure customers in the wake of the failed exchange’s collapse last week, exchanges including Binance, OKX and Crypto.com held up their proof amid social media choruses of “not your keys, not your crypto” and calls for greater clarity around the reserves of such exchanges.

On the face of it, the transparency is a welcome move. But proof of reserves is just a single snapshot and doesn’t show the full picture, experts say.

Assets are shown at a fixed point in time, which gives opportunities for manipulation, Bank of America wrote in a Nov. 17 note regarding proof of reserves.

What’s missing?

The exercise also has limited value because it’s just a single facet of many interconnected financial metrics, Wayne Trench, CEO of exchange OSL, said.

“They don’t reveal audited fiat reserves, client and company liabilities, company loans, or much of the other required information necessary to ascertain a firm’s financial health,” Trench noted.

OSL is owned by BC Technology Group, a public company based in Hong Kong that is subject to regulations and regular audits. While acknowledging that traditional structures aren’t bulletproof either, the company stressed that regular and transparent audits, the segregation of client assets in bankruptcy remote trusts, and being subjected to tier-one regulatory supervision and oversight currently provide significantly higher levels of investor protection.

CoinShares CFO Richard Nash echoed those sentiments and said sharing of proof of reserves is a beneficial practice.

“It is not, however, infallible,” Nash stressed. “It supports delivering trust and transparency, two concepts which have never been more relevant in the digital asset space than over the last two weeks.”

Nash noted that CoinShares is publicly listed on the Nasdaq First North Growth Market and that its proof of reserves “sits alongside our annual financial statement audit work.”

“What conclusions, if any, can be drawn about the financial health of the entity holding custodial assets when a proof-of-reserves is not a full balance sheet view,” Nash asked.

While exchanges were quick to hold up their proof of reserves, not one has shared proof of liabilities or outstanding debts.

Reserves, by the numbers

Binance, Crypto.com, OKX, Deribit, Kucoin, Bitfinex, and Huobi posted proof of reserves following the FTX’s collapse. The Block broke down the total value of reserves in dollars and each reserve asset, using data via Defi Llama.

Most reporting exchanges – except for Binance and Crypto.com – detailed a majority of clean reserves with clean total value locked (TVL) — with limited assets issued by the exchange. Kraken only posts reserves semi-annually and its last filing, dated June 30, has not been included as such.

Binance

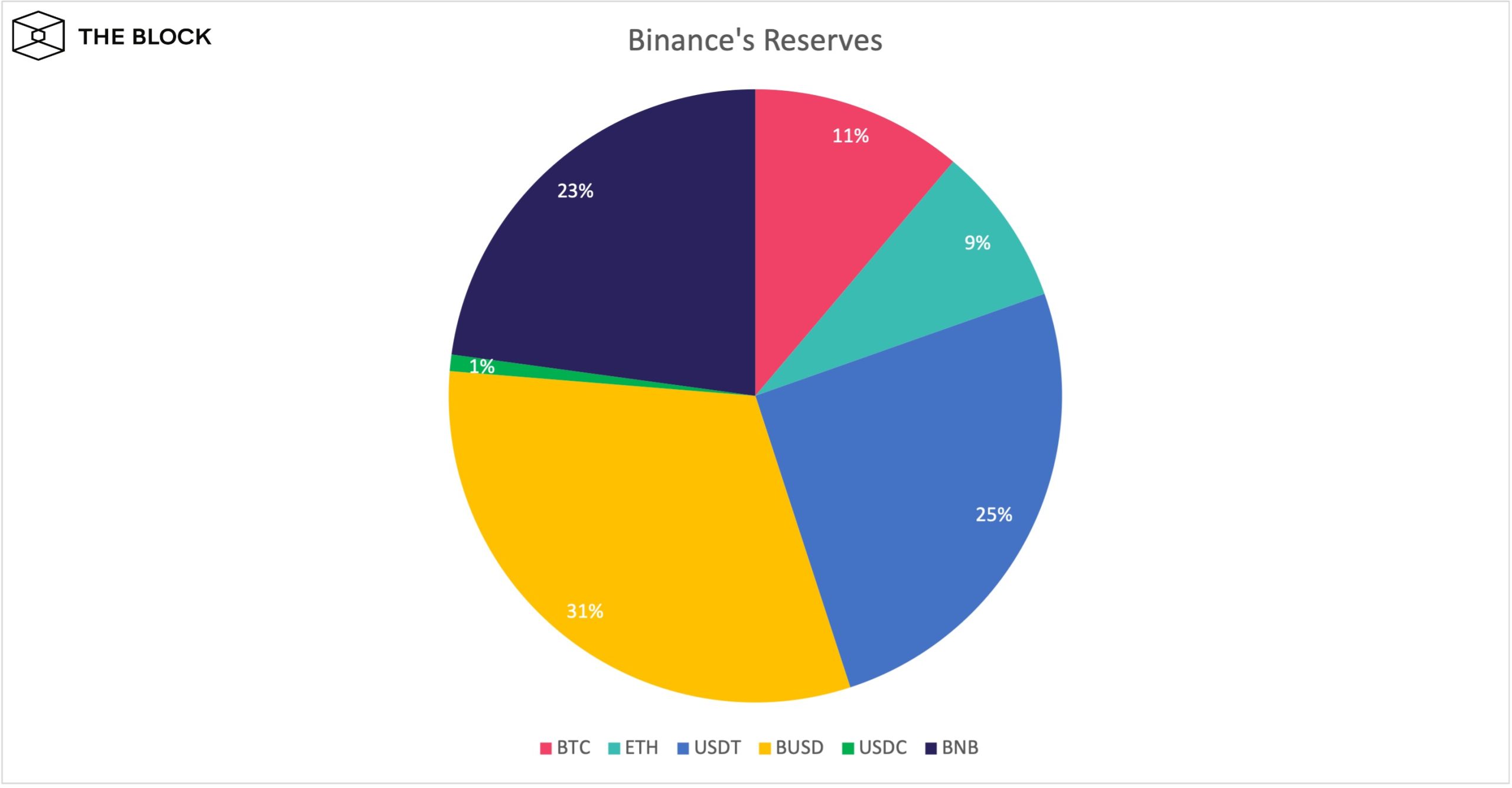

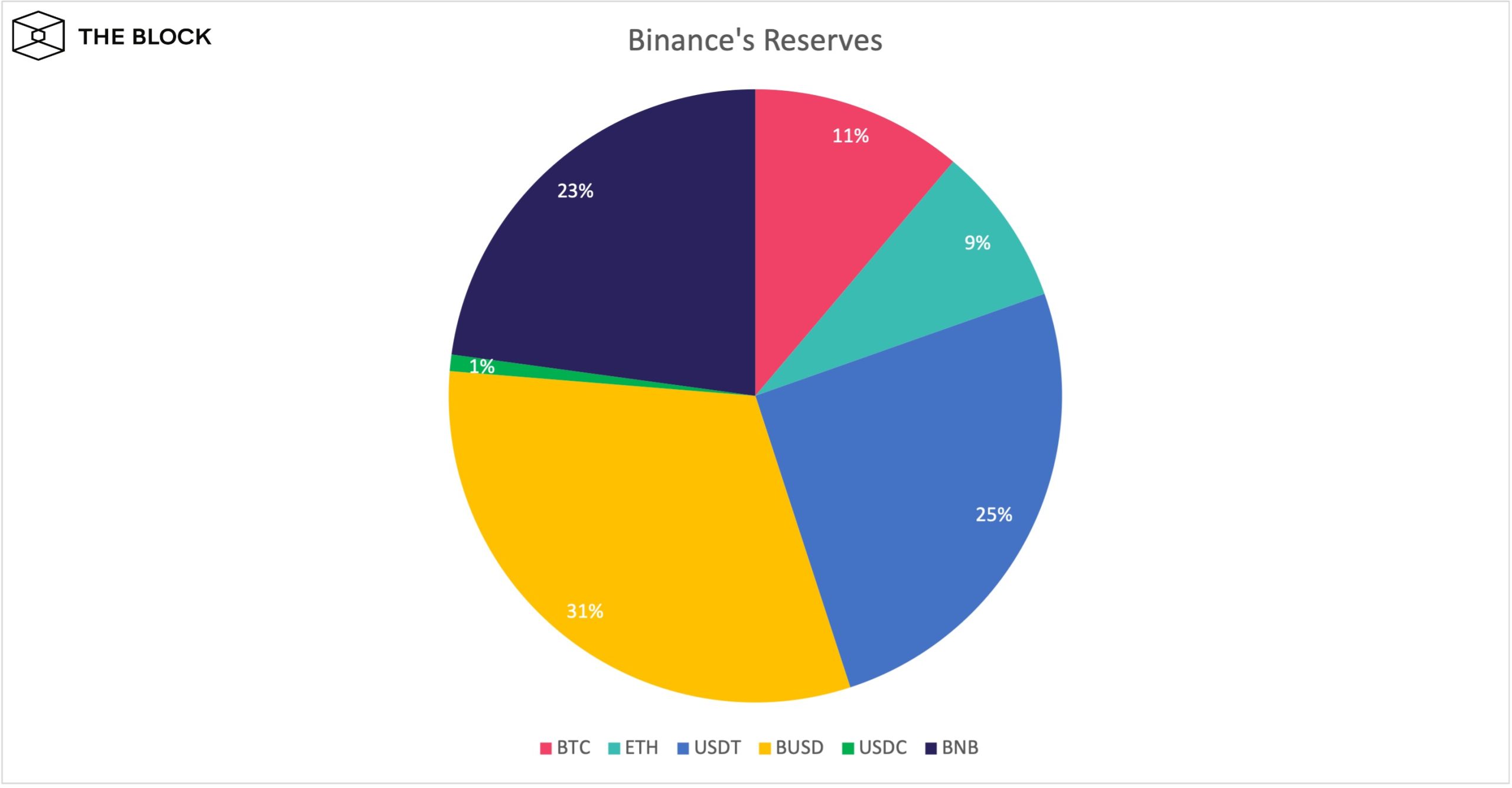

Binance reported the largest reserves of any exchange. According to data via Defi Llama, the exchange giant’s reserves clocked in at over $65 billion.

The exchange’s total reserves — as of Nov. 11 — include 475,000 BTC, 4.8 million ETH, 17.6 billion USDT, 21.7 billion BUSD, 601 million USDC, and 58 million BNB.

Binance holds a significant portion of its reserves in BUSD and BNB, worth around $35 billion. Most of its BNB holdings are on the Binance Smart Chain via its BEP20 token standard, though some 15 million BNB tokens held in reserve were issued via the Ethereum network.

The Binance stablecoin, BUSD, is issued by Paxos and not by the exchange itself.

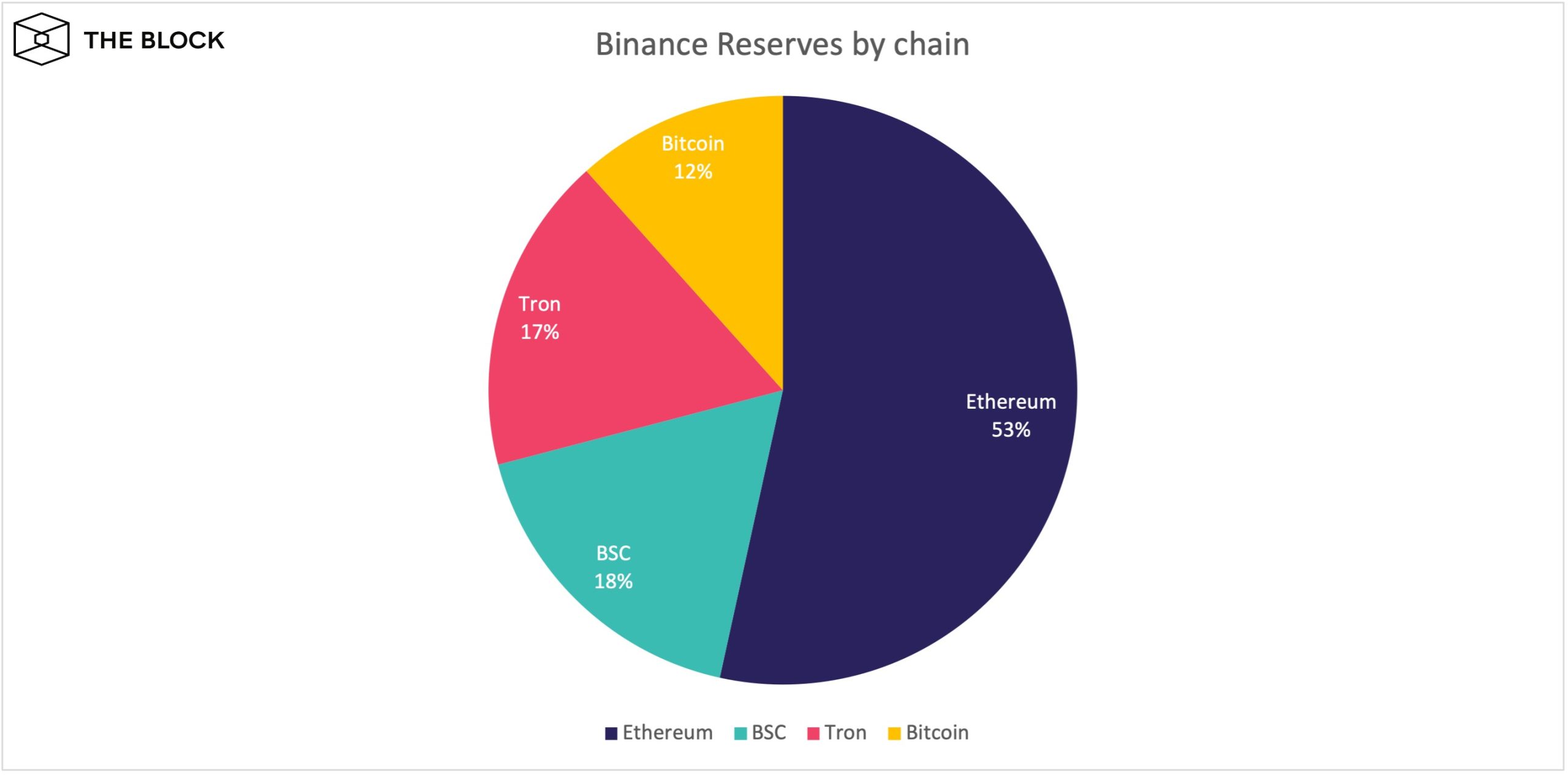

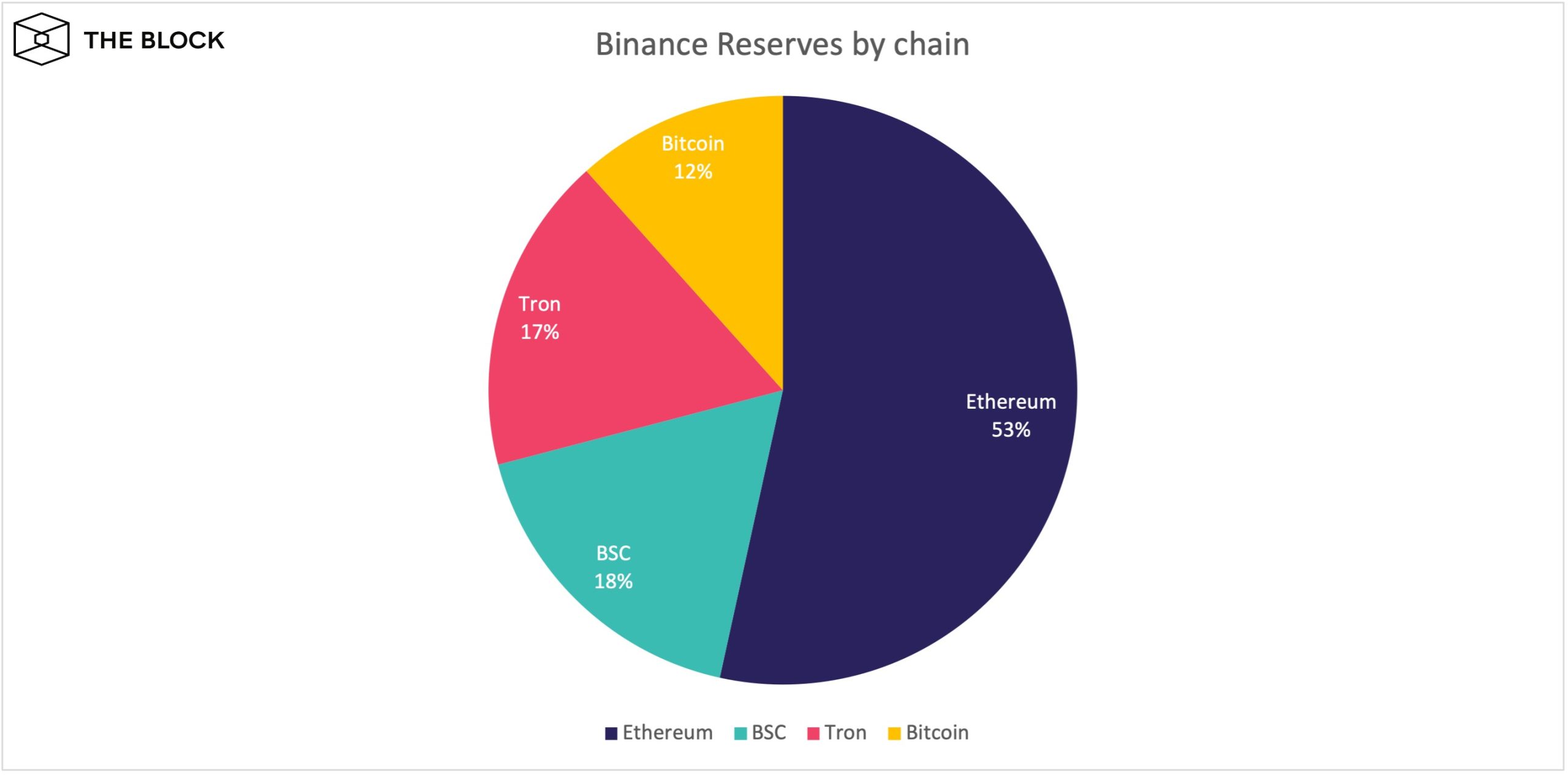

The exchange’s reserves are split across four blockchains: Bitcoin, Binance Smart Chain, Ethereum and Tron.

Binance’s reserves on the Ethereum blockchain are not limited to the chain’s native asset, ether. The exchange also holds stablecoins USDC, USDT, and BUSD on the chain.

The Ethereum blockchain was unaffected by recent market events. While digital asset prices have fallen sharply, the underlying network has continued to process transactions.

Crypto.com

Crypto.com’s $2.46 billion in reserves is comprised of 25% bitcoin, according to Defi Llama. Tether’s USDT and ether make up 5% and 18%, respectively.

The exchange raised eyebrows when its revealed 21% of its reserves were made up of Shiba Inu, a dog-themed memecoin susceptible to speculative price swings. The token traded higher in line with dogecoin when Elon Musk’s takeover of Twitter was completed. Shiba Inu is currently trading at $0.000009.

Crypto.com’s reserves are split across Bitcoin and Ethereum. Shiba Inu is a token on the Ethereum blockchain.

OKX

The majority of OKX’s reserves are held in stablecoins, with $2.43 billion USDT and $195 million USDC. According to Defi Llama, the Seychelles-based exchange also has 91,000 BTC reserves.

62% of OKX’s reserves are held on Ethereum, with 27% held in bitcoin. Tron and Arbitrum make up 5% and 3%, respectively.

Some chains, like Polygon, aren’t displayed; this blockchain represents a much smaller portion of the firm’s total reserves.

Bitfinex

Bitfinex reported reserves of $5.06 billion, $3.26 billion of which was in bitcoin. The exchange’s remaining reserves were $1.49 billion worth of ether, $88 million in USDT, and $55 million in USDC.

The majority of the exchange’s reserves are split across three chains: Bitcoin, Ethereum and Tron. The majority of its holdings are in bitcoin, with the remaining held mostly on Ethereum — through ether, stablecoins and other tokens on the network — with a small amount on Tron.

Huobi

Huobi reported reserves of over $3.11 billion, according to Defi Llama. The exchange’s reserves include 43,200 BTC, 274,000 ETH, 820 million USDT, and 9.7 billion TRX.

Broken down by the chain, most of Huobi’s reserves are held on Ethereum-native assets, comprising 43% of the total. Bitcoin and Tron account for 34% and 23%, respectively.

Huobi holds assets from other chains, including Algorand, Avalanche, Polygon, Litecoin, EOS, and Solana. These chains each comprise 1% or less of the exchange’s reserves.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.