Nucleo, a company that aims to build on-chain privacy infrastructure for organizations, has raised $4 million in seed funding.

The round, led by the crypto arm of investment firm Bain Capital and 6th Man Ventures, also featured participation from others in the privacy infrastructure sector including Aztec Network, Aleo, and Espresso Systems, a news release said.

The company seeks to create a private multi-sig solution for organizations to transact on the Ethereum blockchain through zero-knowledge cryptography. Multi-sig, or multi-signature, is a digital signature arrangement used in crypto wallets that requires more than one user to authorize and send transactions.

“Organizations have been looking for a privacy solution like Nucleo to bring trust, auditability, and accountability to the blockchain,” said Bain Capital crypto partner Stefan Cohen.

Founders Matthew Wyatt and Luke Newman said they created the project last November amid the failure of the ConstitutionDAO — a ragtag effort to raise money to buy a copy of the U.S. Constitution that was ultimately won by Citadel founder Kenneth Griffin.

Money raised via DAOs is publicly accessible via on-chain data. The Nucleo founders said the ConstitutionDAO loss might have been prevented if infrastructure had been in place that ensured the privacy of its total funds. This could also allow web3 organizations to more easily transact with traditional businesses that require closed-door deals.

With the funding, the project plans to develop a service for organizations to tap into DeFi privately, add further blockchain network integrations and expand its team.

Still, the raise for the project comes amid continued pressure from regulators on crypto projects that look to enhance user privacy. Last week, CoinDesk reported that a proposed European Union anti-money laundering bill could implicate privacy coins that allow anonymous means of payment.

In other jurisdictions, regulators have also sought to clamp down on crypto-based privacy tools. For instance, in August, the U.S. Treasury sanctioned crypto mixer Tornado Cash — leading to the arrest of Tornado Cash developer Alexey Pertsev.

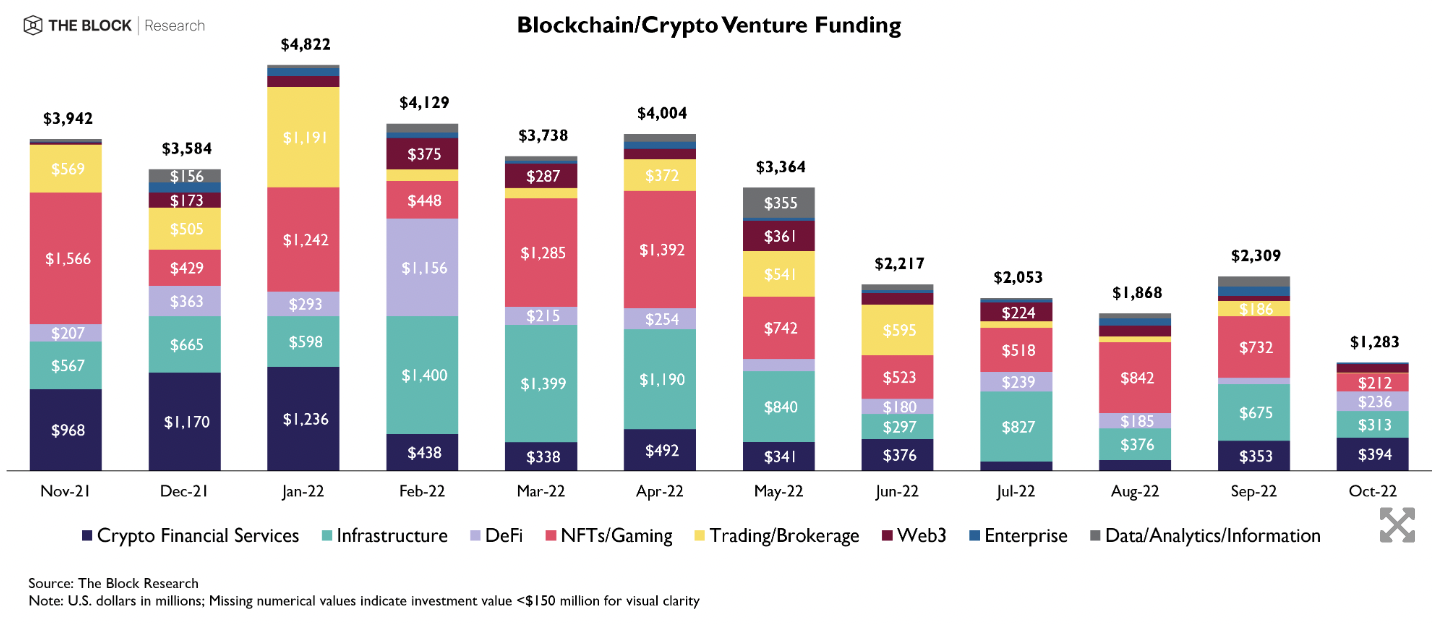

Companies building crypto infrastructure continue to be popular with crypto venture firms. According to The Block Research, infrastructure startups raised $313 million last month, second only to financial services.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Tom Matsuda