Go to Source

Author: Nelson Wang

Go to Source

Author: Jeff Wilser

Go to Source

Author: Azeem Khan

Go to Source

Author: J.D. Lasica

Bitcoin mining stocks tracked by The Block were higher on Friday, with 16 gaining and two declining.

Bitcoin rose 7% to $26,774 by market close.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Catarina Moura

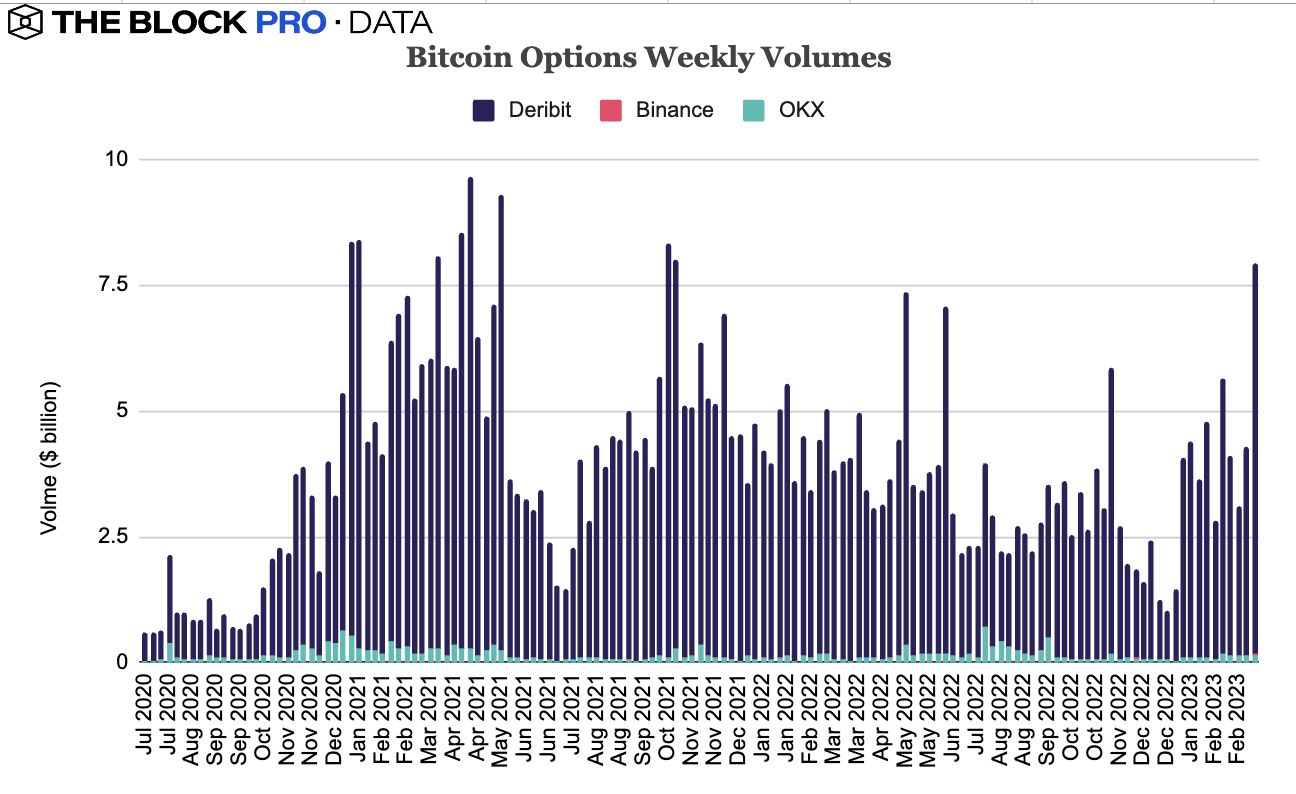

Bitcoin option volumes reached their highest point since October 2021 when the price of bitcoin reach a high of over $60,000 amid a crisis in banking.

The volume of bitcoin options trading was $7.94 billion this week, according to data from The Block, as traditional financial markets are seeing significant volatility.

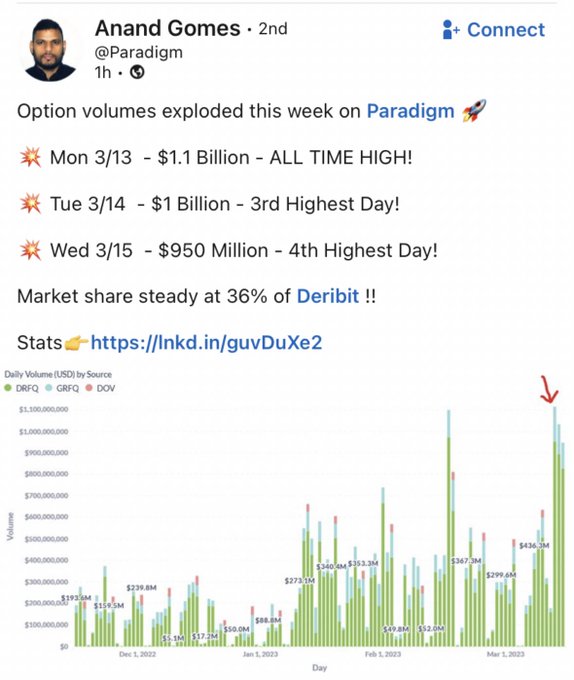

The market is “pricing in looser monetary conditions,” said Anand Gomes, co-founder at Paradigm, an institutional liquidity provider, because “the Fed can’t hike rates anymore.”

“[The Fed] raised rates and it broke the banking system,” Gomes said in an interview via Telegram, referring to the collapse of Silvergate, Silicon Valley Bank and troubles faced by Credit Suisse.

“[The Fed] raised rates and it broke the banking system,” Gomes said in an interview via Telegram, referring to the collapse of Silvergate, Silicon Valley Bank and troubles faced by Credit Suisse.

“Loose monetary policy means cheaper capital,” said Gomes, “and cheaper capital means we deploy it in higher yielding assets.” In response “macro sentiment has turned incredibly bullish.”

According to Laura Vidiella, vice president at LedgerPrime, the reason has more to do with volatility.

“High volatility and high trading volume are generally very correlated especially for liquid assets,” she said, which is why Paradigm had record volumes this week, doing over $1 billion in a single day.

Another reason for the rally, Vidiella said, is that investors are buying bitcoin as a way to get their funds out of banks with a high risk of failure. “This is a strong response to how people are hedging their exposure to fiat,” she said.

Vidiella thinks the reaction may spur some cooperation between crypto and regulators.

“Being stuck with financial regulation that doesn’t adjust or evolve with new advancements and innovation frightens me more than trying new developments and failing in the process,” she said.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Sam Venis

Go to Source

Author: Rosie Perper

Crypto exchange Coinbase is exploring launching an offshore platform to trade perpetual swaps tied to cryptocurrencies, according to two sources familiar with the firm’s aspirations to gate-crash a sector dominated by rival Binance.

The firm has briefed market-making and trading firms about the plans to roll out the platform in an offshore jurisdiction. Perpetual swaps — a type of future and a popular product in the crypto space – will be among the offerings. They provide a more capital-efficient way for traders to make bets on the underlying crypto market.

Coinbase didn’t immediately respond to an email seeking comment.

Bloomberg reported earlier that Coinbase Global is considering setting up a new trading platform overseas, without specifying what the new venue would trade.

Binance dominance

Crypto exchange behemoth Binance commands a plurality of market share in bitcoin futures, according to The Block’s data dashboard. At its peak, FTX was a large player in the market as well, with nearly 25% market share in early 2021.

Last year, Coinbase acquired of FairX, a CFTC-regulated derivatives exchange, and in 2021 applied for membership in the National Futures Association, the U.S. self-regulatory organization for such businesses.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Christiana Loureiro and Frank Chaparro

Bitcoin climbed to hover around $27,000 Friday morning as cryptocurrencies in general continued to rally. Traditional markets were trading lower.

The coin was trading at $26,560 as of 10 am ET on Friday. Ethereum was also up by 4.8% in the last 24 hours, trading at around $1,742.

Bitcoin had been closer to $22,000 prior to the Silvergate, SVB and Signature collapses. And while most cryptocurrencies generally had a positive week, bitcoin has been leading the rally.

Ben McMillan, founder and CIO at IDX Digital Assets, told The Block the move into bitcoin and the increase in its dominance is “100% a reflection of its value as a flight from risk asset”

The past week has shown how the coin’s “fundamental properties stand in stark relief to the shakiness of fractional reserve banking,” said Alex Thorn, Galaxy Digital’s head of firm-wide research.

He also pointed out that the correlation between bitcoin and the S&P 500 has decreased. “At the same time, bitcoin volatility continues to decline.”

Publicly traded crypto companies were also up on Friday. Galaxy gained 8.8%, Coinbase by 7.1% and MicroStrategy 7.6%.

In traditional markets, the Nasdaq fell 1% while the S&P 500 was down by 1.2%.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Catarina Moura and Adam Morgan McCarthy

Smart contacts are neither smart, nor are they contracts. That’s just techie jargon, according to Polgyon Labs’ new chief policy officer.

Rebecca Rettig thinks the wonky words and less-than-precise meaning are doing their part to hold the crypto and web3 industry back. And she wants to help change that.

What’s “really important is that people who understand the technology can speak about it precisely, clearly, without using a lot of complicated jargon to make sure that we can allow policymakers to understand what this technology really does,” she said in an interview with The Block.

A smart contract, as Rettig explained it, is simply software that lays out the “rules of the road” for transactions that are transparent and easily checked. The continued use of technical terms to describe new technology is confusing the general public and lawmakers alike, resulting in distrust and confusion instead of tapping into the possibilities of new technology, she said.

Rettig joined Polygon Labs from Aave Companies, where she was general counsel, at a time when policy and regulation is at the forefront of the crypto industry conversation. Agencies from the Securities and Exchange Commission to the Justice Department and the Commodity Futures Trading Commission brought cases against Sam Bankman-Fried following the discovery of rampant fraud at his companies and since then they have been on a roll.

Last month, the SEC sued Terraform Labs and in January fined Nexo and charged Genesis with offering unregistered securities.

It has become “politically attractive” to go after digital assets, Rettig said. Regulatory agencies which have enforcement power are exercising in the wake of FTX, but at some point, “Congress is still going to act and that will be the law of the land.”

Not her first go

Rettig’s been in the industry since 2017 and is “very passionate” about crypto, web3 and the changing paradigms from transactions going through intermediaries – including in arts and media – to decentralization. Though she’s been a lawyer in the space for a while, the focus mostly on policy will be a new challenge for her.

“I wanted to take it on for a few reasons,” she said. “The end of last year was obviously very difficult for the industry and I wasn’t willing to give up on the space. I also think that open, permissionless decentralized systems are very different from what we saw” previously.

“In order to ensure that there is proliferation of this technology and it’s protected and can grow, we need good regulatory guardrails,” she said. The lawyer is hopeful the U.S. will pass evergreen legislation that will permit the industry to flourish.

“I want 2023 to be the year of the use case,” Rettig said. There are “amazing applications” that people are building that need to be highlighted, like tracking food to get to developing countries. Household name brands are also incorporating blockchain into their long-term innovation plans, and those actions should be spotlighted.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Christiana Loureiro