Go to Source

Author: John Rizzo

What a difference a year makes. Last year, when Bitcoin was over $40,000, a giant metal bull greeted visitors to the annual Bitcoin Magazine conference in Miami, proclaiming that the “future of finance” had arrived. A year later, and well into a fresh crypto winter, Pepe seems to have taken over.

In the first day of the three-day event, the mood was somewhat subdued as crowds trickled in to hear panel discussions such as “The Fed vs. The Financial System,” “Fighting the Anti-Crypto Army” and “Bitcoin & The Banking Crisis.” The mood was serious, yet hopeful. But the real star of the show was Pepe, whose omnipresence coincides with the memecoin that caused a frenzy when it hit the market in mid-April.

Off to the side of the large expo hall at the conference, an art gallery featured both physical and digital art, some of which could be purchased in an ongoing auction using bitcoin.

The show stopper is a massive, 21-panel mural that pays meme homage to Picasso’s Guernica, the famed 1937 oil painting that became a symbol of the Spanish Civil War. Dubbed Pepernica, the painting by artist Luis Simo is over 11 feet tall and 25 feet long. The current bid is 3.1 millions sats, or nearly $850.

Another work by Simo called “Las Pepinas” is an original oil painting that memes Diego Velázquez’s Las Meninas (The Ladies-in-Waiting).

Las Pepinas

Other Pepe-themed works at the show included Pepe-ized pop art “Plans for the Dollar” and “Oswald’s Diary.” The Indipepe series by artist JB is a memed derivative of Robert Indiana’s famous “LOVE” work that “seamlessly integrates the iconic Pepe the Frog into the annals of art history.”

To bid on the art, you have to deposit 1% of your bid as collateral, or 0.02 BTC for unlimited bids.

Pepe as Love

The gallery was not without digital art, and an “Ordinals Alley” displayed some of the earliest and most prominent Bitcoin Ordinals that have taken the sector by storm. Pepe was also there.

Pepe shoes

Art wasn’t the only thing for sale, with the event also featuring a peer-to-peer Bitcoin Bazaar where you could buy Bitcoin related items.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Nathan Crooks and Christiana Loureiro

Go to Source

Author: Amitoj Singh

With interest in tokenized assets on Bitcoin at an all-time high amid massive growth in both the trading volume of Ordinals and BRC-20 tokens market capitalization, a Tim Draper-backed NFT marketplace has announced its launch.

U.S.-based DIBA, an acronym for Digital Bitcoin Art and Assets, said it’s rolling out what it calls “the first Bitcoin NFT marketplace” to leverage RGB smart contracts. The RGB protocol is designed to provide “enhanced security, privacy, scalability, and reduced transaction fees” while making it easier to tokenize assets on Bitcoin, said DIBA’s founder and CEO Gideon Nweze.

“This marks a major milestone in the transition of the internet onto Bitcoin,” Nweze said. “This will revolutionize Bitcoin since it is highly compatible with existing Bitcoin infrastructure. You can think of DIBA as a gateway to what’s possible on Bitcoin.”

Nweze, although bullish on Bitcoin’s potential, hasn’t been thrilled by recent innovations like Ordinals and BRC-20 tokens, though they demonstrate “there is demand for such assets” on the popular blockchain, he said.

“BRC-20 is the dumbest technical experiment in crypto, and I have been around for some time,” said Nweze. “Ordinals and BRC-20 tokens are basically trying to force Ethereum on Bitcoin. In practice, it’s inefficient, clunky, and not as effective as it could be.”

DIBA’s launch includes promoting BitMask, a “Bitcoin-only” crypto wallet that can “hold music and art unique digital assets,” or UDAs, the company said in a statement. With the backing of Draper Associates, a venture capital firm, one of DIBA’s missions is “to bring Bitcoin utility to the masses through enabling the exchange of UDAs,” the company also said.

Another of Nweze’s main goals includes fostering a mass migration of tokenized assets like NFTs from Ethereum to Bitcoin. He also thinks the move could help avoid regulatory complications in the U.S.

“Bitcoin is the only asset considered not a security by the SEC, and smart contracts that inherit Bitcoin’s properties might be viewed favorably by the regulators,” he said.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: RT Watson

Go to Source

Author: Jesse Hamilton

Crypto exchange Coinbase is expanding its Coinbase One subscription product, which offers zero fees on each trade in return for a $29.99 monthly payment, to the UK, Germany and Ireland.

Coinbase One subscribers also receive 24/7 customer support, boosted staking rewards and introductory offers to crypto data services, the U.S.-based exchange said in a blog post. The company told TechCrunch it plans to launch the service in an additional 31 European countries in the coming months.

For Coinbase, a subscription product offers a predictable income stream over the lumpy revenue that comes from traders diving in and out of fickle crypto markets. The exchange’s subscription and services revenue more than doubled to $362 million in the first quarter of 2023 from the same period a year earlier.

“Through the bull market 18 months to two years ago, there was tons of growth, but we wanted customers to stay… That was the inspiration. How do we build a longer, deeper relationship with our customers and make it a win-win?” Phil McDonnell, Coinbase’s senior director of product management, told TechCrunch.

Coinbase’s international expansion

Coinbase has been attempting to reduce its reliance on its home market following a string of unwelcome moves by U.S. regulators, including a legal spat with the Securities and Exchange Commission. Earlier this month, the company announced plans for an international trading venue for perpetual futures contracts, run out of Bermuda, and this week it unveiled an expansion in Singapore.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Andrew Rummer

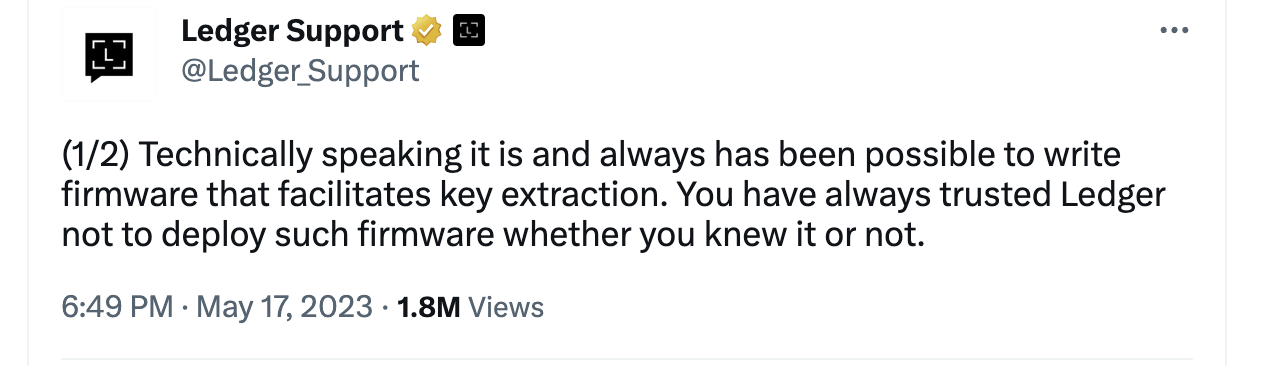

Executives at cryptocurrency hardware wallet maker Ledger struggled yesterday to explain to loyal users that its new Recover product may allow access that can unlock the device, but in a way that still remains secure. That resulting public relations mess continued today, as the company deleted a tweet that had said Ledger’s firmware “facilitates key extraction” — which is usually the opposite of what people want from a hard wallet.

Customers had clearly assumed that there was no way for their private keys — a 24-word seed phrase used as a password to unlock a wallet — to ever leave a Ledger hardware wallet.

But Ledger CTO Charles Guillemet said yesterday that with Recover, users can now permit the software running inside a Ledger wallet to allow private keys to leave the device in the form of encrypted “shards” that can be recombined to recreate the seed phrase. Ledger has said that the Recover tool is optional for users.

Some users “were a little bit surprised to understand that,” he said on the Bankless podcast. “The software running inside the secure element is something that can be changed, is something that has access to the secret.”

“The tradeoff, I think, is acceptable,” he said. This, Guillemet contended, is because Ledger Recover is aimed at people who want more security than that provided by an online exchange or an online wallet but are still too inexperienced to want to own an offline, hardware, cold wallet from which a password can never be recovered if lost.

Ledger customer support has a bad day on Twitter

Earlier in the day, before Guillemet’s podcast appearance, the Ledger customer support Twitter account pointed out to users in a since-deleted tweet that the software on Ledger wallets has always permitted “key extraction”:

That statement caused a sharp reaction among hardcore users, so the company later added a second tweet:

Now, the original tweet has been deleted. The support account said it did so because “we don’t want people to continue to be confused by this, and are replacing it with Tweet threads which address all frequently asked questions and concerns in the most understandable and accurate way possible.”

Recover isn’t a replacement for Ledger’s traditional product

Guillemet explained on the podcast that the Recover product was not intended as a replacement for Ledger’s traditional product, which maintains the keys on the device, can never be accessed remotely, and requires an owner to store their seed phrase with no backup if lost.

Rather, he said, “most crypto owners are using exchanges to custody their assets or are using software wallets. The reality is that self-custody seems a little bit complex, maybe is a little bit complex for newcomers, and people can be afraid of it. … When you are not tech savvy this thing can be frightening.”

“We need to find a way for newcomers in order to enable mass adoption,” Guillemet continued.

Guillemet went on to say that “in self-custody there are different shades of grey, different levels of trust.” At one end you have accounts on centralized exchanges where the customer’s wallet is in full custody of the exchange. In the middle you have online wallets accessible only with a seed phrase — they are more secure but they are still online “hot” wallets. And then at the other end are hardware, or “cold” wallets, disconnected from the internet.

It’s all about the shards

Ledger Recover splits a user’s seed phrase into three encrypted “shards” which are then shared with three different companies: Ledger, Coincover, and a third unnamed provider. Anyone who loses their seed phrase can recover it by proving their identity to two of the companies and combining two shards to recreate the third, thus regaining access to the wallet. The original seed phrases do not leave the wallet, only encrypted pieces of them.

It “gets one step closer to self-custody and self-sovereignty,” Guillemet said. “When you use this feature, I agree you are doing a small tradeoff where you are saying, ‘I am not completely self-sovereign, I am not the only one able to manage my backup’. But the tradeoff, I think, is acceptable because … you have to have at least two out of the three shards to be able to combine the secret. … So this is the tradeoff you have.”

Guillemet also added that the cryptographic element only operates inside the secure element of the wallet so that extraction of the seed never has to leave the device if users do not want to use the Recover feature. “This part is really, really important and it never changed.”

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Jim Edwards

Go to Source

Author: Eliza Gkritsi

Go to Source

Author: Lyllah Ledesma

Go to Source

Author: Danny Nelson