Grayscale’s Bitcoin Cash and Litecoin products are trading at premiums of more than 1,000%

Grayscale’s Bitcoin Cash and Litecoin offerings are trading at a more than 1000% premium compared to underlying asset value, according to market performance data on its website.

The firm’s market data for Grayscale Bitcoin Cash (BCH) shows market price per share at $37.90, while BCH holdings per share remains at $3.19. That’s a 1,188% premium over the price of the asset.

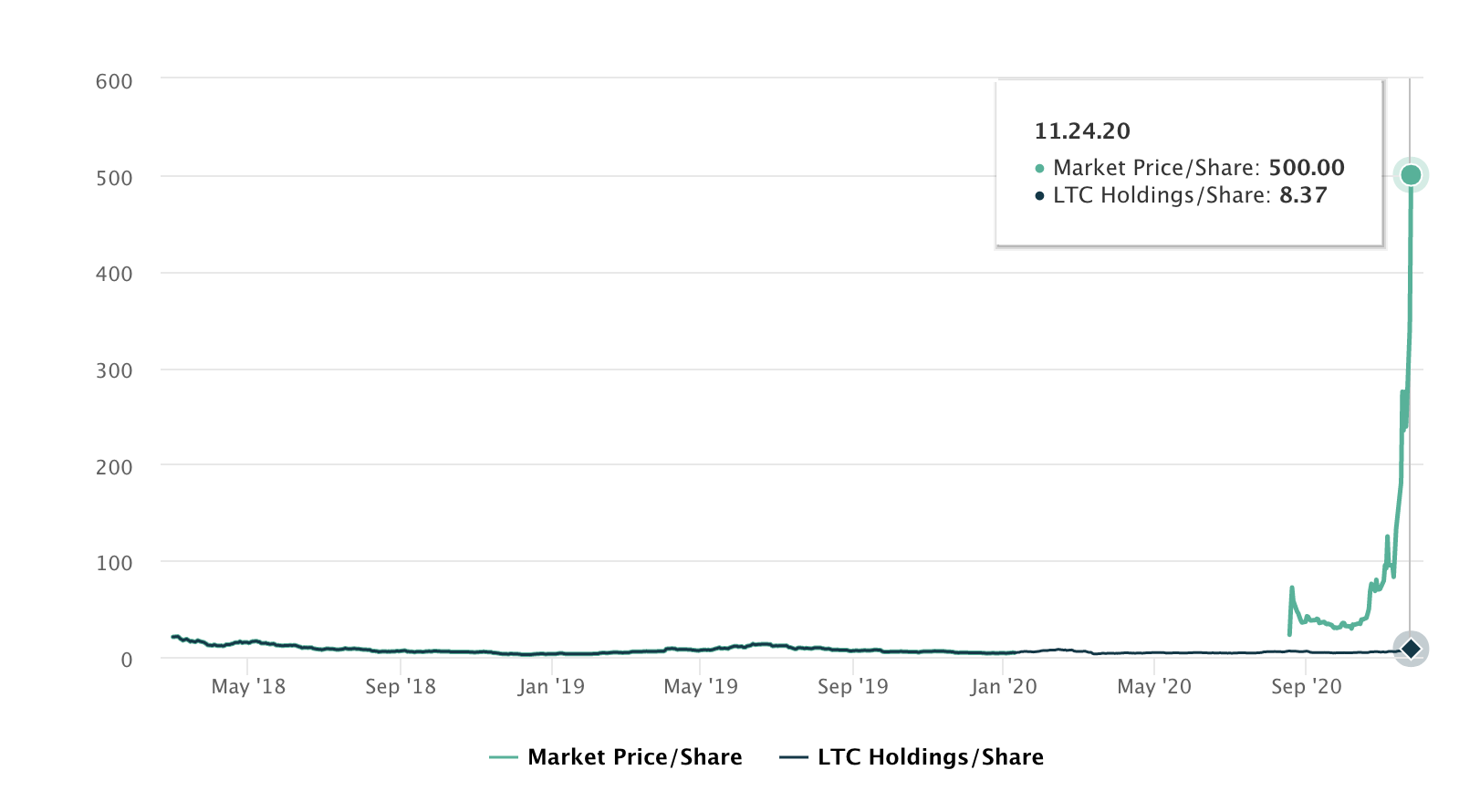

Grayscale’s Litecoin Trust (LTC) is performing similarly, with market price per share at $500, while LTC holdings per share sits at $8.37. That’s a 5,974% premium.

These products trade on over-the-counter markets rather than on an exchange. A difference in premium creates an opportunity for players to capture the spread between the premium and the net asset value (NAV), hedge funders told The Block earlier this year.

Weekly premiums of Grayscale’s Bitcoin (GBTC) and Ethereum (ETHE) offerings are sitting at 22.78% and 59.93%, respectively.

The ETHE premium has seen a steep drop off from its bull run earlier this year when it traded as high as 830% in June.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely